Jack Colreavy

- May 7, 2021

- 3 min read

Will Government Debt Be The Source Of Future Inflation?

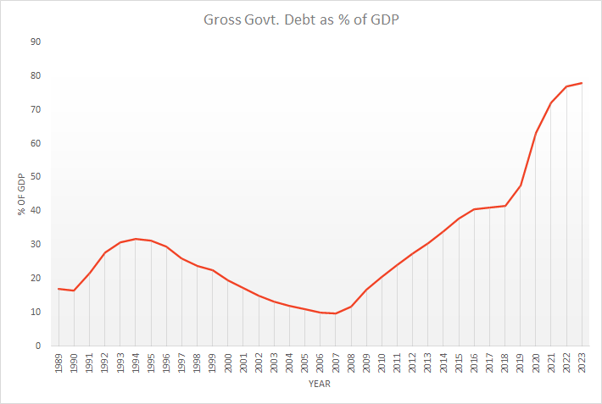

In 2007, Australia’s gross government debt was a meagre 9.7% as a percentage of our national GDP. Then a “once in a century” financial crisis rocked the global economy and the Australian government responded with a major fiscal stimulus in order to avoid a recession.

In two years, gross government debt rose to 16.7% of GDP and while this is extremely low in comparison to other countries, it still represents a 72% increase in debt.

But the rise in debt doesn’t end there; through persistent budget deficits over the next decade, Australia’s gross debt rose at an average of almost 10% to 47.5% of GDP by 2019.

2020 was meant to be the year where this trend reversed with the Federal government promising the first budget surplus since 2007. Instead, a “once in a century” pandemic rocked the global economy and the Australian government responded with a major fiscal stimulus. The International Monetary Fund (IMF) forecast a 52% increase in Australian gross national debt to 72.1% of GDP in 2021, which will be the biggest percentage increase in all the developed nations.

What's Australia's debt right now?

Australia’s debt breached $1 trillion AUD in 2020 and currently sits at ~$1.3 trillion. The website www.australiandebtclock.com.au provides a great visual representation of these debt levels. Currently, the debt increases ~$5,500 every second which equates to ~$475 million every day, resulting in an annual increase of roughly $170 billion per annum.

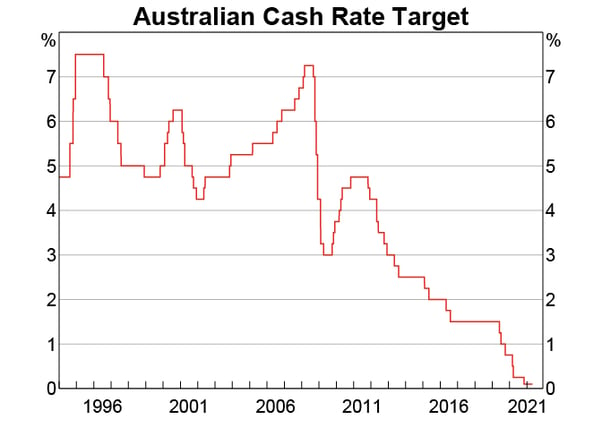

This exploding government debt is effectively being financed by the Reserve Bank of Australia (RBA) through artificially low-interest rates and Quantitative Easing (QE). The current RBA cash rate is at a record low 0.10% with the RBA also committed to keeping the 3-year treasury bond rate at 0.10%. This is achieved through the QE program that sees the RBA purchase 3-year treasuries in the secondary market whenever the yield deviates from the target. The initial budget for purchases was announced as A$100 billion but it has since been extended to A$200 billion. The market widely anticipates another A$100 billion extension to the program in 2021.

This exploding government debt is effectively being financed by the Reserve Bank of Australia (RBA) through artificially low-interest rates and Quantitative Easing (QE). The current RBA cash rate is at a record low 0.10% with the RBA also committed to keeping the 3-year treasury bond rate at 0.10%. This is achieved through the QE program that sees the RBA purchase 3-year treasuries in the secondary market whenever the yield deviates from the target. The initial budget for purchases was announced as A$100 billion but it has since been extended to A$200 billion. The market widely anticipates another A$100 billion extension to the program in 2021.

A moral hazard presents itself by politicians having access to a virtually unlimited supply of cheap money; it doesn’t really incentivise them to curb spending and risk losing power. In addressing the debt, the government has three options on how to repay the burden:

- Debt repayments through income a.k.a. more taxes or less spending;

- Refinance the debt with more debt, or;

- Default on the debt and negotiate new terms.

The Fiscal Theory of the Price Level

A loophole for repayment lies in the fact that the debt will be paid in nominal and not real terms, meaning that a portion of the debt will be inflated away over time. How much inflation occurs is up to the government, according to the “Fiscal Theory of the Price Level” (FTPL), which proposes the idea that the primary determinant of the price level (inflation) is fiscal policy through systemic structural deficits.

Whether FTPL holds up or not, it appears that budget deficits and low-interest rates are here for the foreseeable future and time will tell if inflation “officially” stirs from its slumber and starts to rear its ugly head at global economies.

1-Min Podcast Episode 8: Will Government Debt Be The Source Of Future Inflation?

Stay ahead of the game and be in the know!

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

Share Link