Amit Anil

- May 15, 2020

- 2 min read

WHK: Risk Mitigation In The Digital Age

The new WhiteHawk (ASX:WHK) Research Report is now out!

New Proprietary Technology Platform

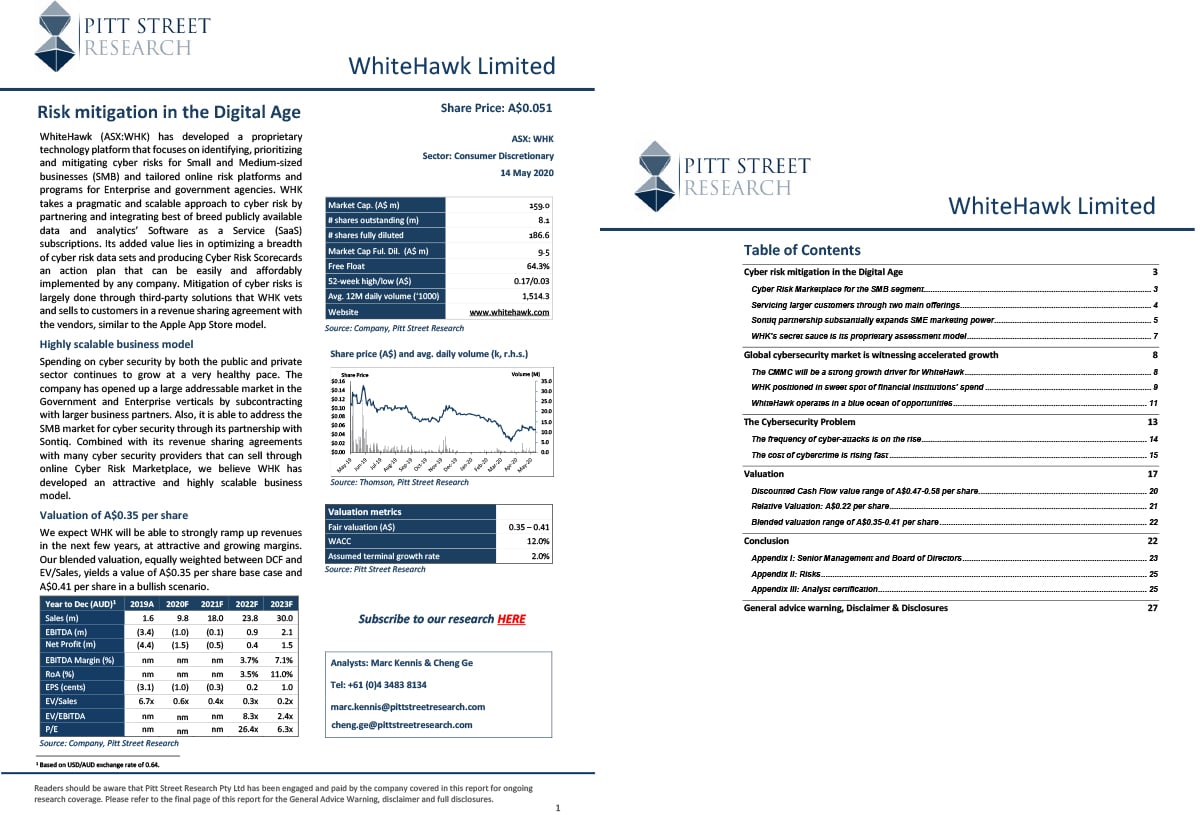

Whitehawk has developed a proprietary technology platform that focuses on identifying, prioritising and mitigating cyber risks for Small and Medium-sized businesses (SMB) and tailored online risk platforms and programs for Enterprise and government agencies. WHK takes a pragmatic and scalable approach to cyber risk by partnering and integrating best of breed publicly available data and analytics’ Software as a Service (SaaS) subscriptions.

Its added value lies in optimising a breadth of cyber risk data sets and producing Cyber Risk Scorecards an action plan that can be easily and affordably implemented by any company. Mitigation of cyber risks is largely done through third-party solutions that WHK vets and sells to customers in a revenue sharing agreement with the vendors, similar to the Apple App Store model.

Highly Scalable Business Model

Spending on cyber security by both the public and private sector continues to grow at a very healthy pace. The company has opened up a large addressable market in the Government and Enterprise verticals by subcontracting with larger business partners. Also, it is able to address the SMB market for cyber security through its partnership with Sontiq.

Combined with its revenue sharing agreements with many cyber security providers that can sell through online Cyber Risk Marketplace, we believe WHK has developed an attractive and highly scalable business model.

Valuation of A$0.34 per share

WHK is expected to strongly ramp up revenues in the next few years, at attractive and growing margins. The blended valuation, equally weighted between DCF and EV/Sales, yields a value of A$0.34 per share base case and A$0.41 per share in a bullish scenario.

“This report has been commissioned and paid for by WhiteHawk Ltd (Company) and has been prepared by Barclay Pearce Brand Partner Pitt Street Research, an Authorised Representative of BR Securities Australia Pty Ltd. The report solely reflects the views of Pitt Street Research.

Any opinions, forecasts, recommendations or forward-looking statements in the report reflect the judgement and assumptions of Pitt Street Research at the date of publication of the report. The Company does not endorse the findings or contents of the report, including any price target, earnings forecast or other statement about the Company’s prospects, and will not be responsible for any loss or damage arising in any way from errors, omissions or misstatements in the report or the use of, or reliance on, the report in any way.”

Share Link