James Whelan

- Nov 28, 2023

- 7 min read

Turkey day done, retail is strong and Millenials are still painful - Market Map with James Whelan

New job, new firm but the same Free Whelan. I thank you for your continued support. Speaking of support, on the 28th of November I'll be speaking at the Ensombl All Licensee Professional Development Day. Link available here and I look forward to seeing you there.

Good afternoon,

Another great Turkey Day behind me and possibly the best one I've ever hosted. Good friends and good wine. Couldn't ask for a better way to spend a Sunday.

Here's a shot of the turkey. Apricot Jam Glaze.

Source: James Whelan

Full focus on now with us as joint lead with Ords on a rights issue and shortfall for listed pharma Wellnex. For any details let me know.

We've been tracking the US consumer this week and the post-Thanksgiving Black Friday sales will tell us everything we need to know about how strong the US consumer is, or thinks it is.

Source: Reuters

and

Source: Barron's

Source: Barron's

With a 7.5% year on year increase in online sales as well.

Things seem pretty good in the US and the more we see the more we confirm that a soft landing is the most likely outcome.

Bullish.

I broke up the week with a short note on copper which had started to show signs of recovery. China announced more support for their struggling property sector and there's been some supply issues also it's back in vogue. I spoke about it on the podcast as well and there's some charts and ideas off the back of it.

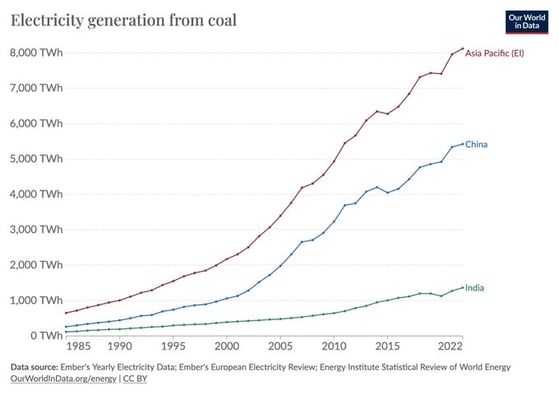

While we're on the subject of renewables requiring a whole heap of "stuff" we saw this from the Financial Times.

Source: Financial Times

Remember what a massive deal COP26 in Glasgow was a few years ago?

Apparently developed nations are now tetchy that not enough has been done on coal use reduction.

The fact is...

The developing world still goes through it and is growing usage. When this changes, and it will, it will be massive.

Source: CREA

China is still power-hungry. The only fact is that eventually that generation needs to be via other means. For now though it is only the developed economies leading the way away from coal.

Demographic Investing

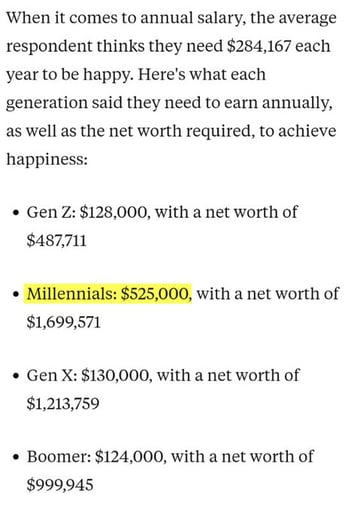

As I refine out the asset management offering iIm becoming more and more aware of what current and potential clients believe they need for retirement. It's quite a bit according to this survey posted by Ensemble Capital.

Source: Business Insider

Note that millennials are right in the firing line when it comes to spending anxiety. Housing, school for kids, big purchases. To be staring down the barrel of that makes you feel like you require an income of half a brick just to survive.

Adjust your expectations accordingly in your business conduct and advice.

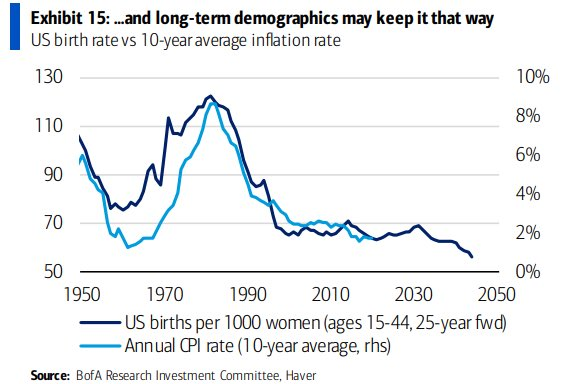

While we're on the subject of demographics the team at Bank of America did some work on birth rates and inflation.

They came up with this chart...

There's correlation there...

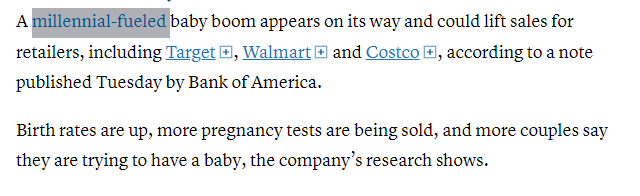

And apparently the US is having a little baby boom. This was from a few weeks ago but it's only just appeared on the radar.

Source: CNBC

Source: CNBC

So millenials, in the face of still high inflation (but slowing), who believe they need 4x as much income as the other guys to survive, are trying for and having kids in the US. That'll give a boost to retailers.

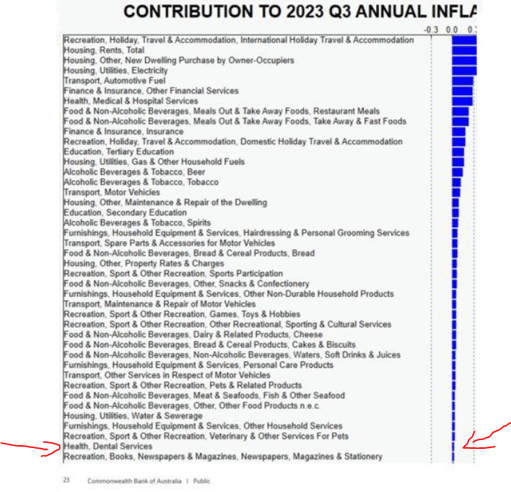

Meanwhile here in Oz we have the new Governor of the RBA telling us that it's trips to the dentist and hairdresser that's driving inflation.

She came as close to saying "stop going to the dentist or I'll keep raising rates" as she could.

We fact checked it with Gareth Aird, CBA Head of Aussie Economics and the facts show that the new RBA Governor is actually quite wrong.

Source: Commonwealth Bank

Remarkable.

That's all for today as we crack on with Wellnex.

Stay safe and all the best,

James

Share Link