Jack Colreavy

- Sep 5, 2023

- 5 min read

ABSI - The WeWork Quake: Shaking the Foundations of Commercial Real Estate

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

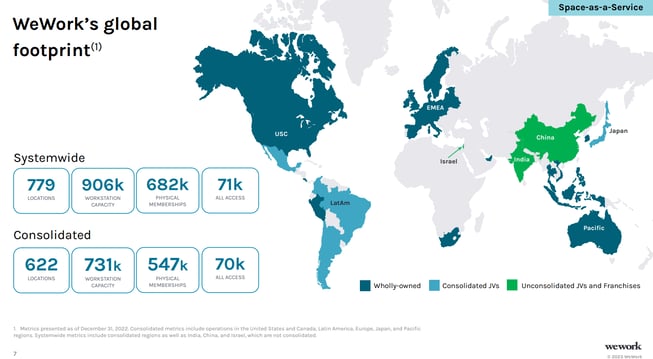

Most people would be familiar with WeWork. Either as the revolutionary tech company offering a SaaS platform, that’s space-as-a-service not software, or more simply as a real estate company that has lost billions offering aesthetically-pleasing flexible working space. Regardless of your affiliation with the brand, the NYSE-listed company told investors at its most recent earnings call that the Company was likely to soon fall into bankruptcy. This news doesn’t just materially affect investors but should also significantly impact its landlords as WeWork is one of the world’s biggest renters. This week ABSI will look at the potential fallout from a WeCrash on the commercial real estate market.

Most people would be familiar with WeWork. Either as the revolutionary tech company offering a SaaS platform, that’s space-as-a-service not software, or more simply as a real estate company that has lost billions offering aesthetically-pleasing flexible working space. Regardless of your affiliation with the brand, the NYSE-listed company told investors at its most recent earnings call that the Company was likely to soon fall into bankruptcy. This news doesn’t just materially affect investors but should also significantly impact its landlords as WeWork is one of the world’s biggest renters. This week ABSI will look at the potential fallout from a WeCrash on the commercial real estate market.

Source: Seeking Alpha

The WeWork saga is a well-documented one covered across a variety of mediums from articles to podcasts to a limited streaming series starring Oscar winner Jared Leto as the charismatic founder Adam Neuman. Despite the company’s reputation as proverbial Lazerus, it appears the end is nigh for WeWork. In August the Company posted a net loss of ~US$700m for the first 6 months of the year and doubts of the future as a going concern:

“Our losses and negative cash flows from operating activities raise substantial doubt about our ability to continue as a going concern”

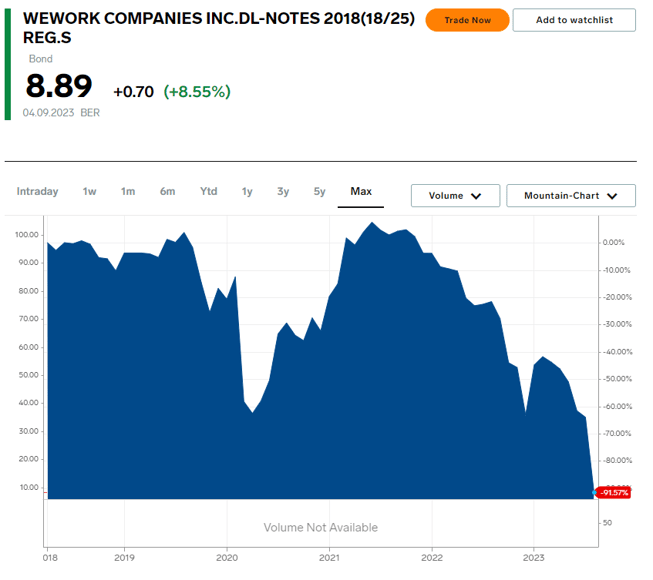

Unsurprisingly, the company once valued as high as ~US$46 billion has seen its share price tumble to ~US$0.11 per share (despite a recent consolidation) giving the company a market capitalisation of ~US$230m. I would say that equity value is very generous given the stress on the balance sheet with ~US$205m in cash and equivalents and ~US$2.9 billion in long-term debt. On an enterprise value, which is calculated as market cap minus cash plus debt, WeWork is valued at ~US$2.925 billion which is pretty much its debt value. Speaking of debt, WeWork bonds are also in a freefall with some debt paper trading at a 90% discount to their face value. As a result, it is unlikely that a white knight will save the day with a takeover bid and the fate of WeWork will be decided in bankruptcy court.

Source: Google Finance

Outside of WeWork debt and equity holders, it is commercial landlords who will suffer deeply from a collapse of the coworking giant. The struggles of office real estate landlords is well documented as they struggle with the dual-pressures of rising interest rates and lower demand due to the work-from-home revolution. WeWork is one of the world’s largest office real estate lease holders with some 600 locations in 33 countries.

Source: Business Insider

The UK is a global leader in coworking space, due to a myriad of reasons, and WeWork is reported to be the largest private sector tenant in London with 56 locations with ~3 million sq. ft. of space at its peak. Australia is another geography where WeWork has an outsized influence thanks to leases totalling 100k sq. m. across 18 locations. The estimated liability of these leases, some of which are up to 15 years in length, total ~A$900 million in Australia and a whopping £3 billion in the UK.

The potential for these leases being renegotiated at lower rates or terminated altogether forcing further supply in an already saturated market would be a difficult pill for commercial real estate owners to swallow. According to the Property Council of Australia, national office vacancy is at 3 decade highs of 12.8% while London has hit a 10-year high of 7.6% with forecasts to rise to 9% in 2024. Still it could be worse, CBRE reported recently that San Francisco ended Q2 2023 with a vacancy rate of 31.6%.

Looking at the ASX-listed REITs, it is GPT Group (ASX:GPT), LendLease (ASX:LLC), and Dexus (ASX:DXS) which have the greatest exposure to WeWork. In terms of previous 12-month share performance, GPT is flat while Dexus has seen a decline of ~8.5% and LendLease, with WeWork renting 6 floors at Barangaroo, has seen its share price weaken over 22%. It is important to note that these are large and diversified (client-wise) companies with WeWork just forming a very small portion of their business. Having said that, while the loss of WeWork shouldn’t materially affect earnings, the whole saga speaks to the underlying weakness in the commercial office market and the potential valuation impairment in the future.

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link