Jack Colreavy

- Oct 24, 2023

- 5 min read

ABSI - Victorian High Court Victory: Impact on EV Taxes and State Taxation Laws in Australia

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

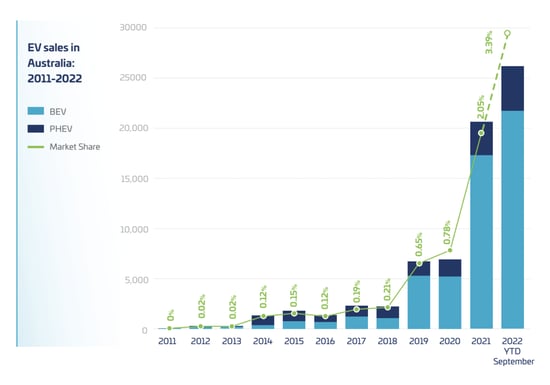

In 2021, the Victorian state government attempted to solve the issue of electric vehicles (EVs) not paying fuel excise taxes, and thus contributing to road infrastructure, by introducing a per km tax. However, in Daryl Kerrigan-like fashion, two Victorian EV owners took the Victorian government to the high court last week and won. The outcome not only affects the ~15,000 registered EVs owners in Victoria but across Australia as other states were looking to impose a similar tax. Moreover, the story has also sparked debate on the contribution EV owners should be making to road infrastructure. Finally, the high court judgement also opens the door to challenges to the legality of other state taxes. This week, ABSI will seek to address all these questions.

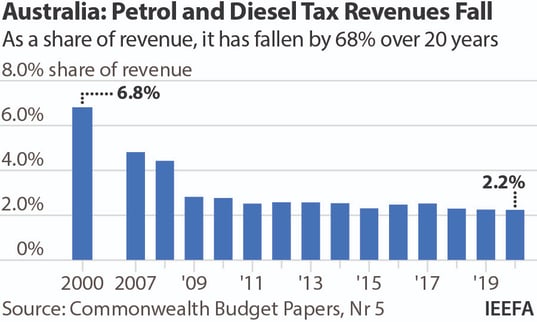

In Australia, road infrastructure is administered by the state but the federal government administers the fuel excise tax, which currently sits at A$0.48 and is imposed on per litre of fuel pumped at the bowser. Revenues from the tax are then distributed to the states for investment into road and transportation infrastructure.

This may seem counterintuitive but there is a constitutional reason for this. Section 90 of the Australian Constitution prohibits States from levying excise. The definition of an excise is something that I imagine millions have been spent on lawyers debating, but is generally defined as a tax levied on goods at the moment of manufacture for internal consumption rather than at sale. An excise sounds awfully similar to a sales tax, like GST, but is distinguished by the fact it is levied on a per unit basis and on a narrower range of products, typically goods deemed to have negative externalities such as tobacco and alcohol.

Source: IEEFA

Interestingly, the Australian States levied a “fuel franchise fee” until 1997, when the High Court ruled that a licence fee was unconstitutional in Ha V New South Wales. Granted this was on tobacco but State governments saw the writing on the wall and rescinded the tax and the Federal government subsequently introduced the fuel excise tax.

Today a conundrum is plaguing both levels of governments in that electric vehicles (EVs) don’t fill up at the bowser and are therefore exempt from paying taxes to use road infrastructure. Victoria attempted to solve the issue with the Zero and Low Emission Vehicle Distance-based Charge Act 2021 (ZLEV) but the High Court, in a 4-3 split decision, deemed the tax to be an excise and therefore unconstitutional. It is therefore up to the Federal government to decide if they would like to see EVs contribute to the funding of roads like their ICE counterparts.

It is important to appreciate that the decision isn’t so simple and the Federal Labor government is being torn in two directions. On one hand, Australia has legislated climate reduction targets from 2005 levels of 43% by 2030 and net zero by 2050. The switch to EVs is one area where a big impact can be made by individual consumers, as light vehicles account for ~11% of total greenhouse gas emissions (GHGs). Therefore, governments shouldn’t be discouraging uptake by making usage more expensive. On the other hand, an EV tax is an inevitability and waiting will result in a decreasing pool of motorists, generally poorer households who can’t afford expensive new EVs, to shoulder a greater burden of road infrastructure.

More concerningly, legal experts are weighing in on the implications that the decision could challenge other existing state taxes. In defence of ZLEV, Victorian barristers argued that the tax wasn’t an excise because it wasn’t a charge on production or point of sale and was calculated based on distance driven, not value or quantity of the product. The precedent set by the High Court could invalidate motor vehicle registration fees, taxes on the transfer of used goods including motor vehicles and land, and even mining royalties.

Source: PV Magazine Australia

In my opinion, with Australia registering a total of ~83,000 EVs against ~15 million passenger vehicles, there isn’t an issue. Having said that, I think now is the perfect time for the Federal government to look at how we charge road users in Australia. They should seek to remove the fuel excise tax and future-proof a new regime before the issue gets out of control. Yes we should be encouraging EV uptake, but this is already being done in other areas. Continually, EV prices are dropping year-on-year, quickly making them the most economical choice on a levalised-cost basis for motor vehicle ownership. As for the legality of other state taxes, I will leave that to legal experts to determine but I would watch this space.

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link