Barclay Pearce Capital

- May 15, 2024

- 10 min read

The Morning Market Report - 15 May 2024

Receive daily market insights gathered from overnight equity data, top stories, companies in the press and market information.

Good morning,

Our team compiles this daily market report from global sources to highlight key market updates and what they mean for your investment portfolio.

Overnight Market Highlights:

![]() Wall Street ended higher overnight.

Wall Street ended higher overnight.

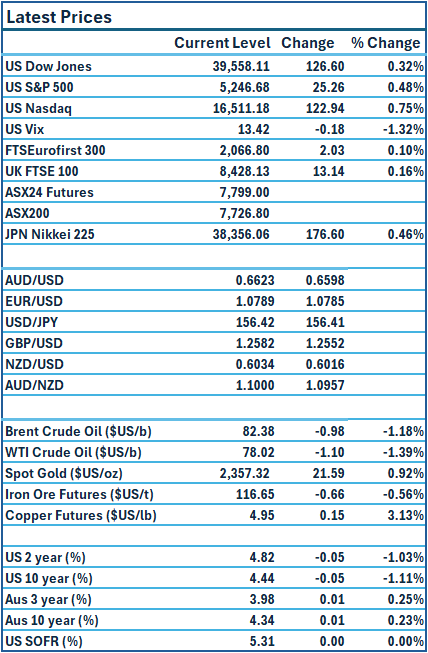

Dow Jones S&P-500 Nasdaq

+ 0.3% + 0.5% + 0.8%

___________________ __________________ _________________

Australian shares are poised to open higher.

Australian shares are poised to open higher.

🇺🇸 US Market Overview:

The Update: The Nasdaq scored a record closing high on Tuesday and the S&P 500 and the Dow also advanced as Federal Reserve Chair Jerome Powell reassured investors. Powell described the PPI report as more mixed than hot given that prior-period data was revised lower. The PPI for final demand rose 0.5% last month after falling by a downwardly revised 0.1% in March.

Economists polled by Reuters had forecast the PPI gaining 0.3%. U.S. President Joe Biden unveiled a bundle of steep tariff increases on an array of Chinese imports including electric vehicles, computer chips and medical products. Source: Reuters

The Impact: Investors cautiously awaited Wednesday's Consumer Price Index figures to assess whether upside surprises in the first quarter extended into April. Sticky inflation and persistent labour market strength have prompted financial markets and most economists to push bets for an initial Fed rate cut back to September from March previously. US government bond yields fell on Tuesday, The US 10-year Treasury yield fell by 4 points to 4.44%. Source: Reuters,

🇦🇺 Australian Market Overview:

-

ASX futures are up 36 points or 0.5 per cent to 7799.

-

ASX’s mining companies will be in focus this morning after the federal government outlined $17.6 billion in tax credit support for the critical minerals sector, as well as $6.7 billion tax incentive for hydrogen. Source: AFR

-

The Albanese government has increased net spending by more than $24 billion over the next four years, including $300 in power bill discounts for every household and $325 for small businesses, in a move which Treasury says will cut inflation by 0.5 percentage points next financial year. Source: AFR

🇪🇺 European Market Overview:

European stocks closed slightly higher on Tuesday as global investors reacted to the latest U.S. inflation data. The pan-European Stoxx 600 index ended 0.2% higher, with most sectors in positive territory. Auto stocks led the gains, up more than 1.3% for the session. Source: CNBC

📈 Global Commodities Update:

- Oil prices settled lower on Tuesday, after U.S. data stoked concerns that interest rates may stay high, but potential risks to supply from Mideast tensions and wildfires in Canada put a floor under prices. Source: Reuters

- The gold futures price rose US$16.90 or 0.7% to US$2,359.90 an ounce on Tuesday, helped by a pullback in the US dollar and US Treasury yields. Source: CommSec

- US copper futures jumped 3.1% to a record peak, fuelled by robust demand and fund buying. Source: CommSec

⚡ Global Renewable Energy News:

The Australian Renewable Energy Agency is set to receive an additional $5.1 billion to spearhead crucial elements of Australia's transition towards becoming a renewable energy leader. This funding represents the largest portion of the substantial $24 billion allocated across various federal agencies.

It will be dedicated to overseeing initiatives such as the $1.7 billion Future Made in Australia Innovation Fund, $1.5 billion allocated to Solar Sunshot and Battery Breakthrough programs and $1.9 billion aimed at revitalising Arena's core mission, which focuses on fostering, commercialising, and implementing new technologies deemed vital for achieving the nation's clean energy goals. Source: AFR

📚 European Market Report by Jack Colreavy:

BHP came back to the table with an upsized takeover bid for LSE-listed Anglo American (LSE: AAL) taking their all-scrip offer from £25 to £27.53/share. The offer was strictly rebuked by the Anglo board before releasing their “Crown Jewel Defense” involving the demerger of their De Beers diamond business, a sale of its South African platinum unit, and the sale of coking coal mines in Australia. While not a true crown jewel defence in the sense that BHP is after Anglo’s copper and iron ore assets, the move is likely to see BHP walk away from the table.

📬 Market Insight by James Whelan:

Budget Week reflections: While I'm still waiting for my birthday present, the boost in critical minerals mapping caught my eye - $566m dedicated to locating these essential resources. Amidst market insights and global concerns, let's not lose sight of our humanity. Stay informed, stay aware.

A quick detour to announce the BPC NRL Tipping Competition!

Welcome to the BPC NRL Tipping Competition for 2024. The season has kicked off with a bang in the glittery lights of Las Vegas. Panthers are favorites to take the crown again but the Broncos look like a formidable opponent to take revenge from the heartbreak of 2023. BPC loves its footy and we're very excited for the season ahead. We also love to win stuff so please keep an eye out for the prizes on offer. Sign up and join the game!

Subscribe to our free Morning Market Report email newsletter to stay on top of the markets.

Share Link