Barclay Pearce Capital

- Feb 14, 2024

- 11 min read

The Morning Market Report - 14 February 2024

Receive daily market insights gathered from overnight equity data, top stories, companies in the press and market information.

Good morning,

Our team compiles this daily market report from global sources to highlight key market updates and what they mean for your investment portfolio.

Overnight Market Highlights:

![]() Wall Street tumbled overnight.

Wall Street tumbled overnight.

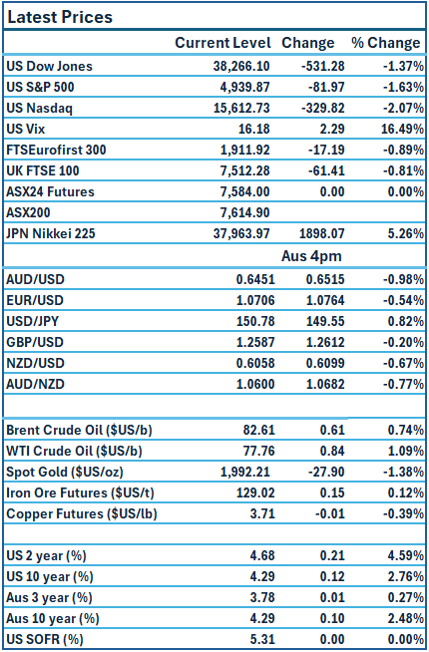

Dow Jones S&P-500 Nasdaq

-1.35% -1.37% -1.80%

___________________ __________________ _________________

ASX is set to fall this morning.

ASX is set to fall this morning.

🇺🇸 US Market Overview:

The Update: Inflation data in the US came in hotter than anticipated overnight. The consumer price index rose 0.3% in January from December. CPI was up 3.1% on an annual basis. Economists polled by Dow Jones expected CPI to have increased by 0.2% month over month in January and 2.9% from a year earlier. Core prices, which exclude volatile food and energy components, rose 0.4% month over month and 3.9% from a year ago. Core CPI was expected to have increased 0.3% in January and 3.7% from a year earlier, respectively. Super core services, which strips out rental inflation, jumped 0.9 percent in January. Source: CNBC, AFR.

The Impact: Wall Street's main indexes tumbled on Tuesday after a higher-than-expected consumer inflation reading pushed back market expectations of imminent interest rate cuts, driving U.S. Treasury yields higher. As mentioned in yesterday's morning report, the effect of a hot CPI read can be seen overnight within the US markets. Markets fall heavily, treasury yields have risen amid a sell-off of bonds, and traders have reduced their bets on a May rate cut of 25 basis points from about 58% to 38%. The yield on the US 10-year note spiked above 4.3 percent, more than 40 basis points higher than a week ago. Source: Reuters, AFR

🇦🇺 Australian Market Overview:

-

ASX futures up 16 points or 0.2% to 7580.

-

Commonwealth Bank’s cash profits have fallen 3 percent in the first half of the financial year to $5 billion as profit margins continued to suffer from competition in the mortgage market. The bank announced it will pay a $2.15 per share dividend. Source: AFR

🇪🇺 European Market Overview:

European markets closed lower on Tuesday as investors assessed incoming corporate earnings reports and a key U.S. inflation print. Losses deepened after new figures showed U.S. inflation rose by more than expected in January. Source: CNBC

📈 Global Commodities Update:

Oil prices rose after the United States, according to sources, rejected Russian President Vladimir Putin's suggestion of a ceasefire in Ukraine. U.S. crude rose 95 cents to settle at $77.87 a barrel, while Brent crude 64 cents to $82.64. Source: Reuters

⚡ Global Renewable Energy News:

Last week, UK Labour leader Keir Starmer caused a stir in Westminster by abandoning a commitment to allocate £28 billion (equivalent to $54 billion) annually for climate-related policies. The revised spending plan now stands at £15 billion, although it hasn't been completely discarded. Throughout Europe, there's a prevailing perception that the post-pandemic and post-Ukraine cost-of-living crisis has rendered the energy transition challenging for politicians seeking re-election and companies dealing with increased capital costs. However, the current impact seems to be more about slowing down the energy transition rather than fundamentally altering its trajectory. Source: AFR

📚 European Market Report by Jack Colreavy:

The latest UK stock shorts have hit the newswires this week with oil & gas exploration firm Petrofac (LSE: PFC) topping the list as the most shorted stock. Despite the firm’s stock is in the dundrums, down ~65% over the past 12 months, it still has an outstanding short sale of 11.5% of total shares reinforcing the view that hedge funds think there is more to go. Other companies in the short report paint a picture of the current macro environment in the UK with the inclusion of home improvement supplier Kingfisher (LSE: KGF), financial services firm Hargreaves Lansdown (LSE: HL), and fashion brands ASOS (LSE: ASC) and Burberry (LSE: BRBY).

📬 Market Insight by James Whelan:

A One for your Watchlist: I had a little tip come across my desk just recently. MMA.ASX. Silver/lead resource in northwest Queensland. Drill results have been good with the potential for it to be a major resource. RDM owns over 50% of it and this is just a sneaky tip to put it on the watchlist, maybe keep some in a bottom drawer if you're that way inclined.

A quick detour to announce the BPC NRL Tipping Competition!

Welcome to the BPC NRL Tipping Competition for 2024. The season is set to kick off with a bang in the glittery lights of Las Vegas. Panthers are favorites to take the crown again but the Broncos look like a formidable opponent to take revenge from the heartbreak of 2023. BPC loves its footy and we're very excited for the season ahead. We also love to win stuff so please keep an eye out for the prizes on offer when announced. Until then, sign up and get tipping for Round 1.

Subscribe to our free Morning Market Report email newsletter to stay on top of the markets.

Share Link