Barclay Pearce Capital

- Jul 31, 2024

- 9 min read

The Morning Market Report - 31 July 2024

Receive daily market insights gathered from overnight equity data, top stories, companies in the press and market information.

Good morning,

Our team compiles this daily market report from global sources to highlight key market updates and what they mean for your investment portfolio.

Overnight Market Highlights:

![]() Wall Street finished mixed overnight.

Wall Street finished mixed overnight.

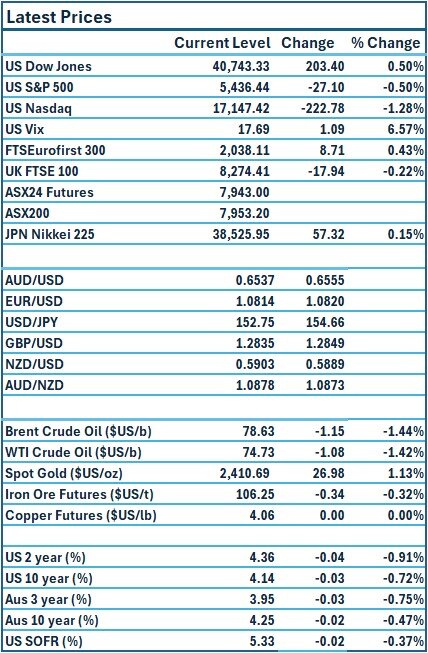

Dow Jones S&P-500 Nasdaq

+ 0.5% - 0.5% - 1.3%

___________________ __________________ _________________

Australian shares are set to open higher.

Australian shares are set to open higher.

Stock of Note:

Wellnex Life Impact Minerals

(ASX: WNX) (ASX: IPT)

0.024 AUD 0.015 AUD

-7.69% -5.88%

___________________ __________________

🇺🇸 US Market Overview:

The Update: The S&P 500 and Nasdaq closed lower on Tuesday, weighed down by weak chip and mega cap shares ahead of earnings from heavyweight tech companies this week, but the Dow managed modest gains. U.S. job openings fell modestly in June and data for the prior month was revised higher, suggesting the labour market continued to gradually slow and was not in danger of rapidly weakening. In its report after the bell, Microsoft said revenue from its Intelligent Cloud unit - home to the Azure cloud-computing platform - jumped 19% to $28.5 billion in the quarter ended June 30, but missed analysts' estimates of $28.7 billion. Source: Reuters

The Impact: The market is betting on a slight chance that the Fed will cut rates by at least 25 basis points at the end of its policymaking meeting on Wednesday, but it is completely pricing in a cut for the U.S. central bank's September meeting. US government bond yields drifted lower on Tuesday, as investors geared up for a US Federal Reserve that is expected to hold interest rates unchanged this week, while flagging monetary policy easing at the September meeting. Source: CommSec

🇦🇺 Australian Market Overview:

-

ASX futures up 28 points or 0.4% to 7942

- CPI data at 11.30 am AEST, with all eyes focused on the trimmed mean number – the RBA’s preferred measure of core inflation – which is expected to cool to 0.9%, from 1% in the March quarter. Source: AFR

🇪🇺 European Market Overview:

European markets on Tuesday closed higher as earnings continued to dominate stock action and investors braced for central bank decisions in the U.S. and U.K. The pan-European Stoxx 600 index preliminarily closed 0.53% higher, with most sectors in positive territory. Second-quarter gross domestic product for the eurozone came in at 0.3%. German inflation unexpectedly rose, with the preliminary consumer price index for July coming in at 2.3% on an annual basis. This was slightly above June’s 2.2%. Source: CNBC

📈 Global Commodities Update:

- Global oil prices slid over 1% to a seven-week low on Tuesday on worries about weaker demand from China and a stronger US dollar, and concerns OPEC+ could boost supplies in the future. Source: CommSec

- The gold futures price rose by US$26.40 or 1.1% to US$2,451.90 an ounce on Tuesday on US rate cut hopes. Source: CommSec

⚡ Global Renewable Energy News:

A portfolio of five solar and battery storage projects in Victoria totalling 30 megawatts has hit the auction block, as joint venture partners BNRG Renewables and Leeson Group seek a buyer willing to supply $65 million in capital expenditure. Source: AFR

📬 Market Insight by James Whelan:

Last week’s podcast covered significant market updates, including earnings from major companies and mixed commodity trends. Geopolitical events like the Olympics are also in focus, providing a lighter backdrop to market movements. James discusses the impact of small-cap stocks versus large-cap stocks and the shifting dynamics of tech investments, particularly AI. Key earnings reports from tech giants are imminent, and the market is watching for tangible results from AI investments. Lastly, the conversation touched on the evolving EV market and upcoming rate cuts by the US.

A quick detour to announce the BPC NRL Tipping Competition!

Welcome to the BPC NRL Tipping Competition for 2024. The season has kicked off with a bang in the glittery lights of Las Vegas. Panthers are favorites to take the crown again but the Broncos look like a formidable opponent to take revenge from the heartbreak of 2023. BPC loves its footy and we're very excited for the season ahead. We also love to win stuff so please keep an eye out for the prizes on offer. Sign up and join the game!

Subscribe to our free Morning Market Report email newsletter to stay on top of the markets.

Share Link