Barclay Pearce Capital

- May 29, 2024

- 9 min read

The Morning Market Report - 29 May 2024

Receive daily market insights gathered from overnight equity data, top stories, companies in the press and market information.

Good morning,

Our team compiles this daily market report from global sources to highlight key market updates and what they mean for your investment portfolio.

Overnight Market Highlights:

![]() Wall Street finished mixed overnight.

Wall Street finished mixed overnight.

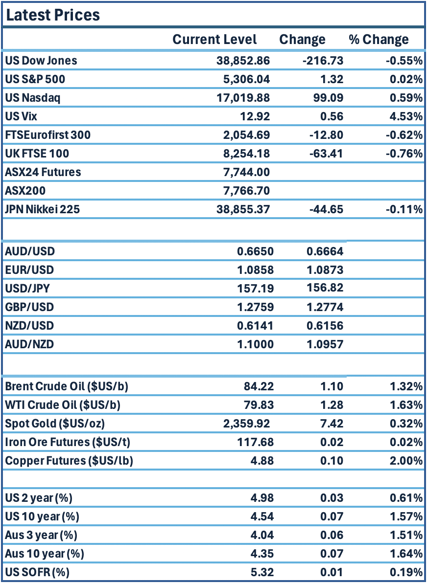

Dow Jones S&P-500 Nasdaq

- 0.6% + 0.02% + 0.6%

___________________ __________________ _________________

Australian shares are poised to open lower.

Australian shares are poised to open lower.

🇺🇸 US Market Overview:

The Update: The Nasdaq crossed 17,000 for the first time ever on Tuesday, boosted by gains in Nvidia, while the S&P 500 closed barely higher and the Dow ended lower as Treasury yields rose. Nvidia jumped 7% and boosted shares of other chip stocks as traders returned from a holiday-extended weekend. Source: Reuters

The Impact: US government bond yields rose on Tuesday after two US government debt auctions attracted tepid demand, which left dealers holding more paper than has been the case for recent sales. The impact of higher yields saw the stock market respond negatively. The U.S. core Personal Consumption Expenditures Price Index report for April is due later this week. The Fed's preferred inflation barometer is expected to hold steady on a monthly basis. Source: CommSec, Reuters

🇦🇺 Australian Market Overview:

-

ASX futures down 48 points or 0.6% to 7744.

- Australian retail trade rose 0.1% in April, rebounding from a 0.4% fall the previous month. The market consensus was for a 0.2% rise. Year-on-year, retail trade was up 1.3%. Source: AFR

- The Melbourne Institute Inflation expectations came in at 4.5% last week, the same as the previous month. It is trending downwards.

🇪🇺 European Market Overview:

European markets closed lower on Tuesday as investors await inflation data from both sides of the Atlantic due later in the week. The pan-European Stoxx 600 index provisionally closed 0.6% lower, with most sectors and major bourses in negative territory. Travel and leisure stocks led losses, down around 2.6%. Source: CNBC

📈 Global Commodities Update:

- Global oil prices climbed on Tuesday as tensions flared in the Middle East, with a vessel attacked in the Red Sea and reports that Israeli tanks have reached the centre of Rafah. Source: CommSec

- Copper futures climbed 2% as the prospect of interest rate cuts, a weaker US dollar and some robust industrial profits data from China encouraged buying. Source: CommSec

⚡ Global Renewable Energy News:

The NSW government has announced that it will pay up to $450 million of public money to Origin Energy to keep all four units of Australia’s largest coal power station, Eraring, open to 2027, two years beyond its planned August 2025 closure, with a potential two-year extension.

The chronic failure of the NSW government to accelerate the evaluation and approval of key new replacement electricity generation capacity ahead of the closure of end-of-life coal power assets has introduced an element of doubt. Clean energy infrastructure has been left languishing in the development pipeline for years. Source: AFR

📚 European Market Report by Jack Colreavy:

The biggest news over the past week has been the UK Prime Minister’s decision to call the election early, setting a date for July 4. The move came as a surprise to many, including members of the ruling conservative party, considering all polls point to the incumbents being obliterated. Given the recent positive green shoots in the economy, from GDP growth to low inflation, many would’ve thought the sensible move would be for the Tories to wait as long as possible to allow the economy to sufficiently improve; maybe even get a rate cut in to boost chances. I think the decision points to Rishi Sunak’s fatigue in the job and lack of optimism in being able to turn it all around. Come July 5 it is likely we will see Labour leader Keir Starmer in 10 Downing Street and Rishi handing in his resignation to return to the private sector.

📬 Market Insight by James Whelan:

AI going exponentially exponential is a free kick for the increased copper demand on data centres and the power required to run them. We are not ready.

A quick detour to announce the BPC NRL Tipping Competition!

Welcome to the BPC NRL Tipping Competition for 2024. The season has kicked off with a bang in the glittery lights of Las Vegas. Panthers are favorites to take the crown again but the Broncos look like a formidable opponent to take revenge from the heartbreak of 2023. BPC loves its footy and we're very excited for the season ahead. We also love to win stuff so please keep an eye out for the prizes on offer. Sign up and join the game!

Subscribe to our free Morning Market Report email newsletter to stay on top of the markets.

Share Link