Barclay Pearce Capital

- Jan 29, 2025

- 8 min read

The Morning Market Report - 29 January 2025

Receive daily market insights gathered from overnight equity data, top stories, companies in the press and market information.

Good morning,

Our team compiles this daily market report from global sources to highlight key market updates and what they mean for your investment portfolio.

Overnight Market Highlights:

![]() Major US benchmarks ended higher, closing near their best levels of the day rebounding from yesterday's sharp sell off.

Major US benchmarks ended higher, closing near their best levels of the day rebounding from yesterday's sharp sell off.

Dow Jones S&P-500 Nasdaq

+ 0.30% + 0.90% + 2.0%

___________________ __________________ _________________

ASX shares rise at this mornings open, with traders ready to capitalize on a sell-off in Australian technology, utilities and some real estate stocks on Tuesday.

ASX shares rise at this mornings open, with traders ready to capitalize on a sell-off in Australian technology, utilities and some real estate stocks on Tuesday.

Stock of Note:

Wellnex Life Impact Minerals Ovanti

(ASX: WNX) (ASX: IPT) (ASX: OVT)

0.068 AUD 0.011 AUD 0.018 AUD

+ 0.0% + 0.0% +5.9%

___________________ __________________ __________________

🇺🇸 US Market Overview:

- Overnight, there was a rally following yesterday’s significant decline in the US market, where the Nasdaq dropped 3% amid a broad selloff in the AI sector.

- The sell-off reversed on Wednesday as traders seized the chance to buy some of the biggest technology names at a steep discount. Nvidia saw major gains, soaring 8.8% after falling more than 16% in the previous session.

- The S&P 500 is still down 0.55% over the last two sessions, while the Dow gained 0.96%, reaching a near two-month high.

Source: AFR, Market Index

🇦🇺 Australian Market Overview:

The S&P/ASX 200 (XJO) closed 9.8 points lower at 8,399.1, down 0.33% from its session highs.

- The hardest-hit sectors were Real Estate Investment Trusts (XPJ), which dropped 3.4%, particularly affecting local data center operators, and Utilities (XUJ), down 2.5%, as local power producers were impacted due to the high energy consumption of data centers.

- There were also potential negative implications for base metals, tied to the energy transition, and energy commodities. Overnight declines in these markets weighed on Energy (XEJ), -2.1%, and Resources (XJR), -0.73%.

- Tuesday’s movements were largely driven by potential DeepSeek impacts on local stocks, particularly regarding the company’s current technology, future developments, and its expected influence on the AI industry.

Source: AFR, Market Index

🗓️ Key Events This Week:

- Q2 consumer inflation report (CPI) - 11.30 am AEDT

- US Federal Reserve interest rate decision - tonight

- US earnings: Microsoft, Tesla, Meta, IBM - tonight

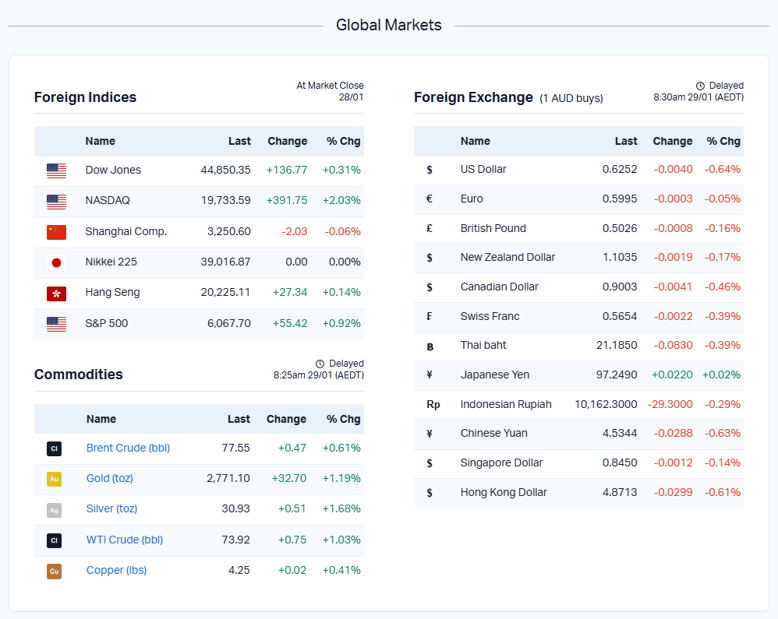

📈 Global Commodities Update:

- Iron ore (Singapore): down less than 0.1% to US$101.30 (Dalian closed for Lunar New Year holiday)

- Brent crude: up 41 US cents or 0.53% to US$77.49

- Gold (spot): up US$22.91 or 0.84% to US$2,764.39

- Silver (spot): up 24 US cents or 0.81% to US$30.42

- Copper (LME): down 0.87% to US$9,015.50

- Nickel (LME): up 0.32% to US$15,615

- Lithium carbonate (China spot battery grade): untraded at 9,458 yuan (Lunar New Year holiday)

Oil posted its second gain in nine sessions as energy markets rebounded from Monday’s decline, which was driven by concerns that weaker energy demand could result from Artificial Intelligence requiring less power generation than analysts had previously anticipated.

Gold and gold miners rebounded as uncertainty around US tariffs fuelled haven-buying. Gold futures rose 1.1%, recovering more than half of Monday night's 1.5% drop.

Source: Hot Copper

📬 As Barclay Sees It:

This week, Jack Colreavy, CFA discusses Goldman Sachs’ 2024 warning on AI infrastructure overbuilding and how it may be unfolding with DeepSeek’s R1 model. Claimed to rival U.S. AI leaders, R1 boasts groundbreaking cost efficiency. Jack dives into its disruptive potential, NVIDIA's $600B valuation hit and the implications for global AI competition, investment strategies and tech dominance.

Source: Market Index

Introducing BPC Wealth Management

BPC Wealth Management is dedicated to shaping resilient investment portfolios, empowering you to achieve and sustain your financial aspirations. While the foundation of your portfolio focuses on long-term investments, through BPC, clients will be offered opportunities in equities trading and equity capital markets. This aspect is highly customised, allowing asset flexibility. Discover how our proactive and client-focused approach can help you achieve your financial aspirations by booking your discovery call with James Whelan.

Subscribe to our free Morning Market Report email newsletter to stay on top of the markets.

Share Link