Barclay Pearce Capital

- Jun 26, 2024

- 9 min read

The Morning Market Report - 26 June 2024

Receive daily market insights gathered from overnight equity data, top stories, companies in the press and market information.

Good morning,

Our team compiles this daily market report from global sources to highlight key market updates and what they mean for your investment portfolio.

Overnight Market Highlights:

![]() Wall Street finished mixed overnight.

Wall Street finished mixed overnight.

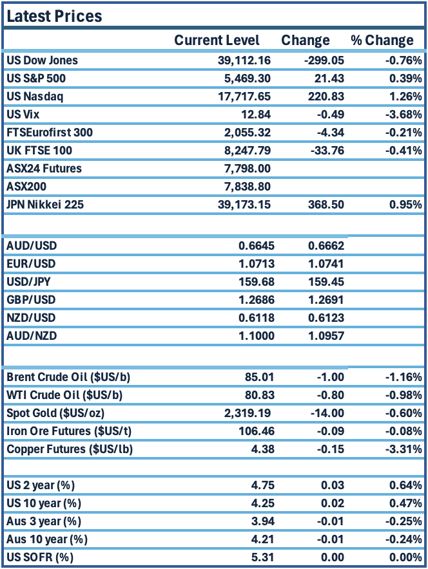

Dow Jones S&P-500 Nasdaq

- 0.8% + 0.4% + 1.3%

___________________ __________________ _________________

Australian shares are poised to open lower.

Australian shares are poised to open lower.

🇺🇸 US Market Overview:

The Update: The Nasdaq rallied 1.3% on Tuesday, buoyed by strength in Nvidia and other tech megacaps, while the Dow slipped as retailers weighed and investors waited for crucial inflation data due out this week. Conference Board's survey, showed U.S. consumer confidence eased slightly in June amid worries about the economic outlook. Its consumer confidence index fell to 100.4 from a downwardly revised 101.3 in May. Source: Reuters

The Impact: US government bond yields eased from session highs on Tuesday after the first of this week's three auctions was well received by investors. Earlier in the session, yields rose following the release of stronger-than-expected Canadian inflation data. Federal Reserve Governor Michelle Bowman said she sees a number of upside risks to the inflation outlook. The US Treasury sold US$69 billion of 2-year notes at a yield of 4.706% into strong demand. The US 10-year Treasury yield was steady near 4.25% and the US 2-year Treasury yield rose by 1 point to 4.75%. Source: CommSec

🇦🇺 Australian Market Overview:

-

ASX futures are down 29 points or 0.4% to 7801.

- Australia will release its monthly CPI indicator at 11.30 am, when most analysts are expecting the inflation gauge to rise to 3.8% in annual terms, from a 3.6%rise in April. Source: AFR

🇪🇺 European Market Overview:

European stocks closed lower Tuesday, failing to recover even as U.S. sentiment brightened after a tech-driven sell-off. The pan-European Stoxx 600 index provisionally finished 0.3% lower, with sectors and major bourses diverging. Industrial stocks sank 1.7%, while health care rose 0.8%. The euro also weakened as the spectre of political risk hangs over the region, falling 0.23% against the U.S. dollar. Source: CNBC

📈 Global Commodities Update:

- Global oil prices fell 1% on Tuesday as a stronger US dollar overshadowed rising geopolitical risks. Soft US consumer confidence data also fuelled worries about the economic outlook and added to demand concerns after a slow start to the US summer driving season. Source: CommSec

- Copper futures slid 3.2% with stalled demand growth in China and soaring inventories reinforcing negative sentiment. Source: CommSec

⚡ Global Renewable Energy News:

Rio Tinto has joined a £300 million ($575 million) investor syndicate to bankroll British energy-storage play Highview Power, which claims its technology can store and firm renewable energy more effectively than batteries or hydro. The plant will have a storage capacity of 300 megawatt-hours and an output power of 50 megawatts an hour for six hours and is expected to start running in early 2026.

Highview’s tech uses excess energy to cryogenically liquefy and store ambient air in 45-metre-high tanks. To release the energy, the liquefied air is reheated and then expands through a steam turbine that returns the energy to the grid. Source: AFR

📚 European Market Report by Jack Colreavy:

Last Friday the UK’s May retail sales data was released and it was surprisingly upbeat given the April GDP figures were stagnant. Sales volumes in May grew 2.9% which exceeded consensus and offset the fall in April. Consumer confidence is also recovering with the highest numbers recorded since Nov 2021. With inflation at 2% and the Bank of England on the cusp of a rate cut in August, things are looking up for the UK economy for the rest of 2024.

📬 Market Insight by James Whelan:

A quick detour to announce the BPC NRL Tipping Competition!

Welcome to the BPC NRL Tipping Competition for 2024. The season has kicked off with a bang in the glittery lights of Las Vegas. Panthers are favorites to take the crown again but the Broncos look like a formidable opponent to take revenge from the heartbreak of 2023. BPC loves its footy and we're very excited for the season ahead. We also love to win stuff so please keep an eye out for the prizes on offer. Sign up and join the game!

Subscribe to our free Morning Market Report email newsletter to stay on top of the markets.

Share Link