Barclay Pearce Capital

- Sep 25, 2024

- 10 min read

The Morning Market Report - 25 September 2024

Receive daily market insights gathered from overnight equity data, top stories, companies in the press and market information.

Good morning,

Our team compiles this daily market report from global sources to highlight key market updates and what they mean for your investment portfolio.

Overnight Market Highlights:

![]() Wall Street closed higher overnight.

Wall Street closed higher overnight.

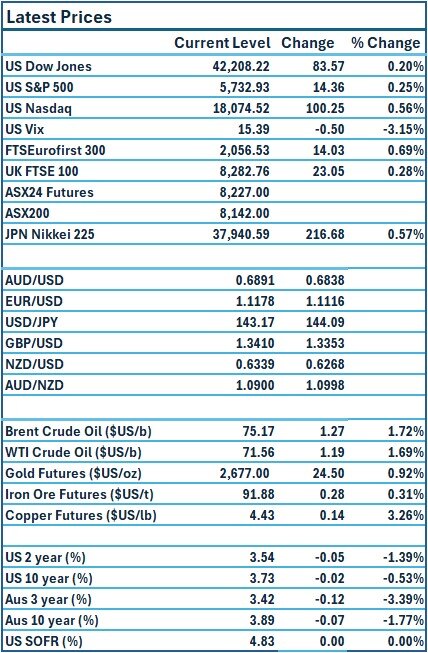

Dow Jones S&P-500 Nasdaq

+ 0.20% + 0.25% + 0.56%

___________________ __________________ _________________

ASX is set to open higher this morning.

ASX is set to open higher this morning.

Stock of Note:

Wellnex Life Impact Minerals Beforepay Group

(ASX: WNX) (ASX: IPT) (ASX: B4P)

0.021 AUD 0.013 AUD 0.0895 AUD

+5.00% 0% +2.29%

___________________ __________________ __________________

🇺🇸 US Market Overview:

The Update: The S&P 500 and Dow ended at record highs on Tuesday, shrugging off weak consumer confidence data, as mining stocks surged following China's announcement of a sweeping stimulus package. The indexes initially trimmed gains after a report from the Conference Board revealed an unexpected decline in U.S. consumer confidence in September, driven by growing concerns about the labour market's health. Source: Reuters

The Impact: US government bond yields fell on Tuesday after a gauge of US

consumer confidence slumped, adding to the case for another half-point interest-rate cut by the Federal Reserve next month. All eyes are on Friday's personal consumption expenditures figure for August - the Fed's preferred inflation gauge. Analysts say this release will be the week's most significant catalyst. Source: Reuters, CommSec

🇦🇺 Australian Market Overview:

-

Australian shares are poised to rise ahead of the release of Australia’s latest consumer price data, which will shed light on the state of inflation. ASX futures are up 25 points or 0.3 per cent. Source: AFR

- The Reserve Bank of Australia left the cash rate on hold at a 12-year high of 4.35 per cent as predicted by the market and economists. The Australian dollar rose to US68.57¢, the highest this year. Source: AFR

- In Australia, monthly consumer price data will be released at 11.30am. The consensus among economist is for the annual growth figure to slip to 2.7 per cent, from 3.5 per cent previously. Source: AFR

🇪🇺 European Market Overview:

European stocks closed higher Tuesday, buoyed by China’s central bank monetary stimulus measures. The pan-European Stoxx 600 index provisionally ended up 0.6%, with most sectors and major bourses in positive territory. The positive sentiment comes after Asia-Pacific markets climbed overnight following Beijing’s announcement of a range of policy easing measures in a bid to stimulate the economy. Source: CNBC

📈 Global Commodities Update:

- Global oil prices climbed 1.7% to a three-week high on Tuesday on news of monetary stimulus from China, the world's top importer, and concerns that conflict in the Middle East could hit regional supply while another hurricane threatened supply in the US. Source: CommSec

- Base metal prices advanced on Tuesday. Copper futures jumped 3.3% to a 10-week high after China unleashed wide-ranging stimulus measures to boost its flagging economy. Aluminium futures gained 3.2%. Source: CommSec

- The gold futures price rose US$24.50 or 0.9% to US$2,677 an ounce on Tuesday. Source: CommSec

⚡ Global Renewable Energy News:

Norway's Equinor has scrapped plans to export so-called blue hydrogen to Germany because it is too expensive and there is insufficient demand, a spokesperson for the energy company said on Friday.

Equinor and Germany's RWE signed a memorandum of understanding in January 2022 to build a hydrogen supply chain for German power plants to help reduce greenhouse gas emissions.

The plans included producing hydrogen from natural gas in combination with carbon capture and storage - known as blue hydrogen - in Norway and exporting it to hydrogen-ready gas power plants in Germany via the world's first offshore hydrogen pipeline. Source: Reuters

📬 Market Insight by James Whelan:

James explores the intersection of sports and finance, reflecting on the dominance of his teams and the upcoming matches. He discusses the recent Fed rate cut and its implications for equity fund flows, highlighting the robust US consumer and potential opportunities in the Consumer Discretionary sector.

James emphasises the importance of small caps in a shifting market and shares insights on strategic investments, including ETFs and specific stocks like Lovisa Pty Ltd. Tune in to the podcast for deeper analysis and exciting updates from H2X Global Limited.

Introducing BPC Wealth Management

BPC Wealth Management is dedicated to shaping resilient investment portfolios, empowering you to achieve and sustain your financial aspirations. While the foundation of your portfolio focuses on long-term investments, through BPC, clients will be offered opportunities in equities trading and equity capital markets. This aspect is highly customised, allowing asset flexibility. Discover how our proactive and client-focused approach can help you achieve your financial aspirations by booking your discovery call with James Whelan.

Subscribe to our free Morning Market Report email newsletter to stay on top of the markets.

Share Link