Barclay Pearce Capital

- Aug 7, 2024

- 9 min read

The Morning Market Report - 07 August 2024

Receive daily market insights gathered from overnight equity data, top stories, companies in the press and market information.

Good morning,

Our team compiles this daily market report from global sources to highlight key market updates and what they mean for your investment portfolio.

Overnight Market Highlights:

![]() Wall Street finished higher overnight.

Wall Street finished higher overnight.

Dow Jones S&P-500 Nasdaq

+ 0.8% + 1.0% + 1.0%

___________________ __________________ _________________

Australian shares are set to open lower.

Australian shares are set to open lower.

Stock of Note:

Wellnex Life Impact Minerals

(ASX: WNX) (ASX: IPT)

0.023 AUD 0.014 AUD

0.0% 0.0%

___________________ __________________

🇺🇸 US Market Overview:

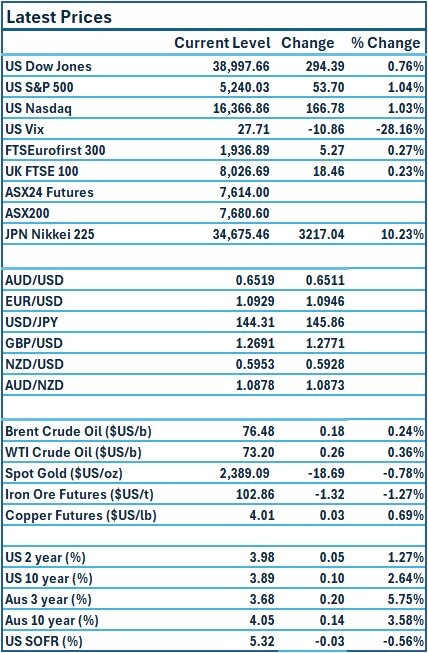

The Update: The S&P 500 and Nasdaq ended 1% higher on Tuesday as investors jumped back into the market a day after a dramatic sell-off, with recent comments by Federal Reserve officials easing U.S. recession worries. The Dow rose as well, but all three major stock indexes pared gains heading into the close and ended well off their highs of the day. The Cboe Volatility Index (VIX) - sank the most since 2010. Source: Reuters

The Impact: US government bond yields climbed on Tuesday as fears that the US economy is quickly entering a recession were seen as overdone, while safe-haven demand for US bonds also ebbed as stock markets recovered. The US 10-year Treasury yield rose by 11 points to 3.89%. The US 2-year Treasury yield lifted 9 points to 3.98%. Source: CommSec

🇦🇺 Australian Market Overview:

-

ASX futures were down 19 points or 0.3 per cent to 7615 near 7 am AEST; they fluctuated between modestly positive and modestly lower overnight. Source: AFR

- The RBA on Tuesday left the cash rate at a 12-year high of 4.35 per cent for its sixth consecutive meeting, saying that inflation was too high and was not ruling anything in or out. The central bank considered raising the cash rate. Source: AFR

🇪🇺 European Market Overview:

European stocks closed higher on Tuesday, rounding off a choppy session following Monday’s global rout. The pan-European Stoxx 600 closed up 0.2%, finding its footing after U.S. stock markets opened in the green, though paring gains shortly before the session end. Source: CNBC

📈 Global Commodities Update:

- Global oil prices rose in volatile trade on Tuesday, bouncing off multi-month lows hit in the previous session, as investor attention turned to supply tightness and financial markets recovered from their recent slump. Source: CommSec

- Copper futures gained 0.7% and aluminium futures lifted 2.2% as comments by US central bankers helped to ease fears about a potential recession. Source: CommSec

⚡ Global Renewable Energy News:

Andrew Forrest’s Fortescue has warned Australia risks losing its place in the global steel supply chain to Africa, Brazil and Europe without government and industry ramping up efforts to develop a green iron plan for the resource-rich Pilbara.

Western Australia’s low- to medium-grade iron ore is facing increased competition from higher grades overseas, and the country has little chance of replacing revenue lost to those developing markets, Fortescue said in a submission to the Senate inquiry into the Albanese government’s Future Made in Australia policy. Source: AFR

📬 Market Insight by James Whelan:

February's Market Wrap from William Smith covers the month's market activity; a summary of the key trends, emerging players and market movements.

A quick detour to announce the BPC NRL Tipping Competition!

Welcome to the BPC NRL Tipping Competition for 2024. The season has kicked off with a bang in the glittery lights of Las Vegas. Panthers are favorites to take the crown again but the Broncos look like a formidable opponent to take revenge from the heartbreak of 2023. BPC loves its footy and we're very excited for the season ahead. We also love to win stuff so please keep an eye out for the prizes on offer. Sign up and join the game!

Subscribe to our free Morning Market Report email newsletter to stay on top of the markets.

Share Link