Barclay Pearce Capital

- Jul 24, 2024

- 9 min read

The Morning Market Report - 24 July 2024

Receive daily market insights gathered from overnight equity data, top stories, companies in the press and market information.

Good morning,

Our team compiles this daily market report from global sources to highlight key market updates and what they mean for your investment portfolio.

Overnight Market Highlights:

![]() Wall Street finished lower overnight.

Wall Street finished lower overnight.

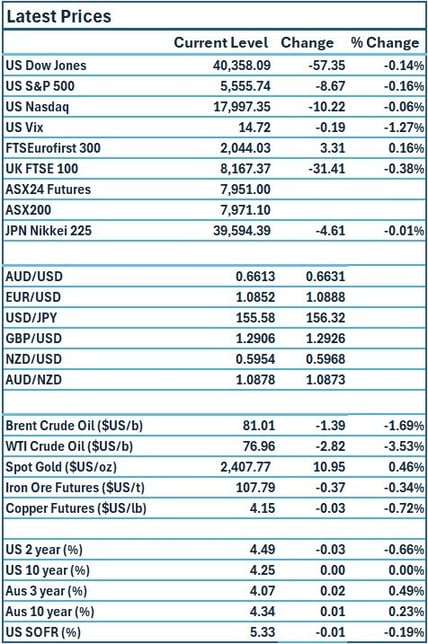

Dow Jones S&P-500 Nasdaq

- 0.1% - 0.2% - 0.1%

___________________ __________________ _________________

Australian shares are set to open higher.

Australian shares are set to open higher.

Stock of Note:

Wellnex Life Impact Minerals

(ASX: WNX) (ASX: IPT)

0.031 AUD 0.015 AUD

0.0% 0.0%

___________________ __________________

🇺🇸 US Market Overview:

The Update: Wall Street's main indexes ended slightly lower on Tuesday, having given up intraday gains in the final minutes of trading, as investors switched their focus to the latest earnings from Alphabet and Tesla. Tesla recorded a surprise rise in revenue as it handed over more vehicles than analysts had expected, helped by price cuts and incentives. Alphabet, meanwhile, surpassed revenue estimates driven by a rise in digital advertising sales and healthy demand for its cloud computing services. Source: Reuters

The Impact: US government bond yields dipped on Tuesday after a weak reading on the US housing market and a solid bond auction underscored market bets on interest rate cuts. Currencies were mixed against the US dollar in European and US trade. Source: CommSec

🇦🇺 Australian Market Overview:

-

ASX futures up 11 points, or 0.1%, to 7952

- Pilbara Minerals recorded a 58 per cent jump in revenue to hit $305 million for the June quarter, according to the lithium exporter’s latest trading update. Source: AFR

🇪🇺 European Market Overview:

European stocks closed slightly higher Tuesday as investors assessed the latest earnings reports from regional companies. The pan-European Stoxx 600 index closed up 0.13% higher, with sectors ending in mixed territory. Tech stocks added 1.4%, while mining stocks fell 1.71%. Source: CNBC

📈 Global Commodities Update:

- Global oil prices fell almost 2% to a six-week low on Tuesday on rising expectations of a ceasefire in Gaza and growing demand concerns in China. Source: CommSec

- Copper futures extended their fall to a seventh straight session, down 0.8%, to hit

their lowest in three and a half months on growing concern over demand in China. Source: CommSec

⚡ Global Renewable Energy News:

Australia's Woodside Energy wants to become one of the world's largest independent producers of liquefied natural gas (LNG). Woodside (ASX: WDS), opens new tab said on Monday it has agreed to acquire all of Tellurian (TELL.A), open a new tab for a total value of $1.2 billion, including a cash payment of some $900 million, or $1 per share, a premium of 75% to the U.S. company's last closing price. Source: Reuters

📬 Market Insight by James Whelan:

What an eventful week it was last week.

Nothing new in the news. Biden dropped out, Max can’t drive a Formula One car sensibly, the Swans lose in a thriller, and the Tigers just don’t know how to win sometimes. Also, some computer stuff happened on Friday.

A quick detour to announce the BPC NRL Tipping Competition!

Welcome to the BPC NRL Tipping Competition for 2024. The season has kicked off with a bang in the glittery lights of Las Vegas. Panthers are favorites to take the crown again but the Broncos look like a formidable opponent to take revenge from the heartbreak of 2023. BPC loves its footy and we're very excited for the season ahead. We also love to win stuff so please keep an eye out for the prizes on offer. Sign up and join the game!

Subscribe to our free Morning Market Report email newsletter to stay on top of the markets.

Share Link