Barclay Pearce Capital

- May 22, 2024

- 9 min read

The Morning Market Report - 22 May 2024

Receive daily market insights gathered from overnight equity data, top stories, companies in the press and market information.

Good morning,

Our team compiles this daily market report from global sources to highlight key market updates and what they mean for your investment portfolio.

Overnight Market Highlights:

![]() Wall Street ended higher overnight.

Wall Street ended higher overnight.

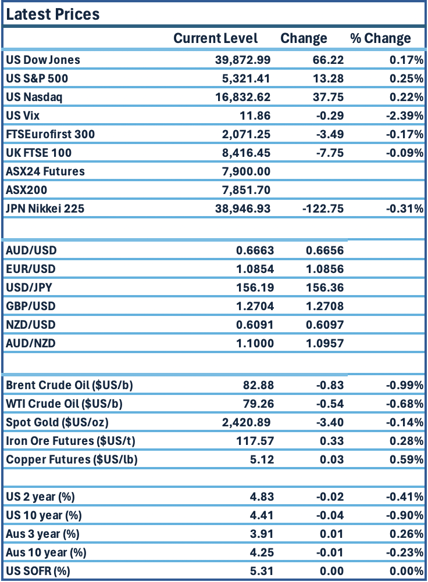

Dow Jones S&P-500 Nasdaq

+ 0.2% + 0.3% + 0.2%

___________________ __________________ _________________

Australian shares are poised to open higher.

Australian shares are poised to open higher.

🇺🇸 US Market Overview:

The Update: U.S. stocks closed with slight gains on Tuesday, sending the S&P 500 and Nasdaq to record levels, as investors assessed the latest comments from Federal Reserve officials for clues on the timing of a rate cut while quarterly earnings from Nvidia drew closer. The Nasdaq notched its fourth record close in the past six sessions while the S&P closed at a record for the first time since May 15. Source: Reuters

The Impact: US government bond yields fell on Tuesday as investors waited on minutes from the US Federal Reserve's latest policy meeting on Wednesday for any fresh clues on when the US central bank is likely to begin cutting interest rates. The market also kept a close eye on a handful of US Federal Reserve speakers, with Governor Christopher Waller saying a continued softening in data over the next three to five months would allow the Fed to consider cutting rates at the end of 2024. Source: CommSec

🇦🇺 Australian Market Overview:

-

ASX futures up 21 points or 0.3% to 7899.

- Minutes of the Reserve Bank May meeting show it considered lifting the cash rate after economic data was stronger than expected, saying that risks to inflation had risen. Source: AFR

🇪🇺 European Market Overview:

European markets closed lower Tuesday, reversing more positive sentiment seen at the start of the week. The Stoxx 600 index closed down 0.21%, with most sectors in the red. Food and beverage stocks fell 0.83%, while mining stocks rose 0.75%. Source: CNBC

📈 Global Commodities Update:

- Global oil prices settled 1% lower on Tuesday as lingering US inflation poised to keep interest rates higher for longer and likely weighed on consumer demand at the pump, while little support came from geopolitical risk. The U.S. will sell the nearly 1 million barrels of gasoline in a reserve in northeastern states, with bids due on May 28, the Department of Energy said on Tuesday. Source: CommSec, Reuters

- Copper futures rose 0.6%. Aluminium futures jumped 3.7% to near two-year highs on concerns about raw material supply. Source: CommSec

⚡ Global Renewable Energy News:

By 2026/27, annual investments in renewable energy development are projected to reach $20 billion, positioning it as the primary driver of growth in the construction sector over the next three years. This surge is spurred by the country's push towards ambitious carbon reduction targets and the accelerated closure of aging coal-fired power stations.

According to a report by forecasters Macromonitor, spending on renewable energy construction has already surged significantly, from $4 billion in 2021 to about $10 billion in 2023. Key projects fueling this growth include the Asian Renewable Energy Hub in Western Australia, the Marinus Link interconnector between Tasmania and Victoria, and the Star of the South offshore wind project in Victoria. Source: AFR

📚 European Market Report by Jack Colreavy:

Good news for the UK with the International Monetary Fund (IMF) upgrading its forecasts for the UK’s GDP growth this year. Following a mild technical recession in 2023, the IMF believes UK growth is recovering fast and is approaching a soft landing. It now forecasts growth of 0.7% in 2024, an upgrade from 0.5%. Moving into 2025, expectations are for 1.5% growth as disinflation brings about real income growth. However, the report wasn’t all sunshine and rainbows with warnings about government fiscal policy and the tough choices that need to be made to stabilise the national debt.

📬 Market Insight by James Whelan:

"It was around February this year when I started to get very excited about copper, urging positions to be taken in any way possible." - James Whelan, Barclay Pearce Capital.

A quick detour to announce the BPC NRL Tipping Competition!

Welcome to the BPC NRL Tipping Competition for 2024. The season has kicked off with a bang in the glittery lights of Las Vegas. Panthers are favorites to take the crown again but the Broncos look like a formidable opponent to take revenge from the heartbreak of 2023. BPC loves its footy and we're very excited for the season ahead. We also love to win stuff so please keep an eye out for the prizes on offer. Sign up and join the game!

Subscribe to our free Morning Market Report email newsletter to stay on top of the markets.

Share Link