Barclay Pearce Capital

- Feb 21, 2024

- 9 min read

The Morning Market Report - 21 February 2024

Receive daily market insights gathered from overnight equity data, top stories, companies in the press and market information.

Good morning,

Our team compiles this daily market report from global sources to highlight key market updates and what they mean for your investment portfolio.

Overnight Market Highlights:

![]() Wall Street fell overnight as trading resumed after the holiday.

Wall Street fell overnight as trading resumed after the holiday.

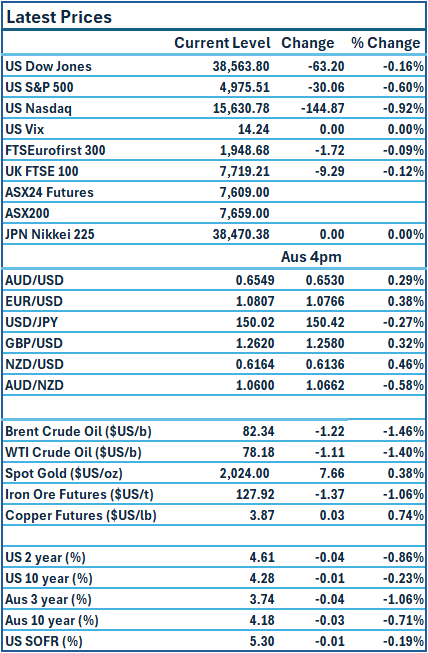

Dow Jones S&P-500 Nasdaq

-0.14% -0.64% -1.02%

___________________ __________________ _________________

ASX is set to fall this morning.

ASX is set to fall this morning.

🇺🇸 US Market Overview:

The Update: U.S. stocks were lower on Tuesday, with the Nasdaq showing the heaviest declines as chipmaker Nvidia stumbled ahead of its highly awaited earnings report. Nvidia earnings will be released after the market closes on Wednesday. The moves follow a losing week on Wall Street after economic data raised concerns that the Federal Reserve may not begin cutting interest rates as soon, or by as much, as market participants expected this year. Source: Reuters

The Impact: Investors are also awaiting the release of minutes from the Fed's latest policy meeting as well as remarks from a few central bank officials later this week. The dollar eased and a gauge of global stock performance fell on Tuesday as fading optimism that central banks will soon cut interest rates dampened sentiment. The two-year Treasury yield fell 4.8 basis points to 4.608%, while the yield on the benchmark 10-year note was down 2.4 basis points at 4.271%. Source: Reuters

🇦🇺 Australian Market Overview:

- In a big week for earning reports, Australia’s share market could forge a fresh record this week with nearly 80 major listed companies scheduled to report earnings over the next five days. Source: AFR

- Woolworths has announced that chief executive Brad Banducci will retire from the supermarket after 13 years at the helm. Source: AFR

- The minutes from the most recent RBA policy meeting were released yesterday. Board members noted that uncertainty about the economy was high, and the cost of not achieving low inflation within the next couple of years was very high. The RBA considered raising the cash rate by 25 basis points. Source: AFR

🇪🇺 European Market Overview:

European stocks ended the day slightly lower on Tuesday as sentiment struggled to pick up in global markets. The pan-European Stoxx 600 index provisionally closed down 0.1%, breaking a run of four positive sessions that took it near to record highs. Source: CNBC

📈 Global Commodities Update:

Global oil prices retreated on Tuesday due to the uncertain outlook for global demand. Source: CommSec

⚡ Global Renewable Energy News:

The Albanese government is planning a “think big” multibillion-dollar initiative to try to compete with the United States’ $624 billion Inflation Reduction Act and similar schemes elsewhere, in a bid to drive the domestic development of clean energy technology. The scheme, which sources said is likely to be a combination of subsidies and co-investment, will aim to stem the flow of capital to the US, where President Joe Biden’s IRA is acting as a magnet. The government already has several initiatives in play but has been under pressure to do more. Source: AFR

📚 UK Market Report by Jack Colreavy:

A recent letter from financial services professional body TheCityUK implores UK chancellor, Jeremy Hunt, to “roll out the red carpet for companies that may seek to list in the UK with better and more proactive support” as an answer to a listings drought in London. The LSE has been struggling to attract new listings to the exchange due to an unfavourable regulatory and legal environment. In 2023 just 23 IPOs successfully listed on the LSE, down from 45 in 2022, and 119 in 2021. The City UK also suggests streamlining the regulatory process and scrapping the stamp duty on share trading, a tax on liquidity. With an election in 2025, it will be interesting to see what solutions the major parties propose to spark the London financial market.

📬 Market Insight by James Whelan:

Wow RDM had some kind of day on Monday. 22%! So much for "keep it on the watchlist/bottom drawer".

Either way, on to the next one. Impact Minerals (IPT.ASX) made an announcement yesterday that they were able to produce "4N HPA" which is a fancy way of saying they turned mud into 99.99% (hence the 4Ns) High Purity Alumina.

HPA is amazingly valuable as a critical mineral (USD $20k/tonne) and Impact, in my view, are on track to produce the best of it at the cheapest cost. They will now produce more using their proprietary process and eventually, a pre-feasibility study scheduled for late 2024. Lake Hope (the "mud" as mentioned above), holds about 880,000 tonnes of alumina in the top 2 metres of the surface.

Happy to hold this one through the story.

All the best,

James

A quick detour to announce the BPC NRL Tipping Competition!

Welcome to the BPC NRL Tipping Competition for 2024. The season is set to kick off with a bang in the glittery lights of Las Vegas. Panthers are favorites to take the crown again but the Broncos look like a formidable opponent to take revenge from the heartbreak of 2023. BPC loves its footy and we're very excited for the season ahead. We also love to win stuff so please keep an eye out for the prizes on offer when announced. Until then, sign up and get tipping for Round 1.

Subscribe to our free Morning Market Report email newsletter to stay on top of the markets.

Share Link