Barclay Pearce Capital

- Aug 21, 2024

- 9 min read

The Morning Market Report - 21 August 2024

Receive daily market insights gathered from overnight equity data, top stories, companies in the press and market information.

Good morning,

Our team compiles this daily market report from global sources to highlight key market updates and what they mean for your investment portfolio.

Overnight Market Highlights:

![]() Wall Street ended lower overnight.

Wall Street ended lower overnight.

Dow Jones S&P-500 Nasdaq

- 0.2% - 0.2% - 0.3%

___________________ __________________ _________________

Australian is set to open lower this morning.

Australian is set to open lower this morning.

Stock of Note:

Wellnex Life Impact Minerals

(ASX: WNX) (ASX: IPT)

0.023 AUD 0.013 AUD

-4.17% -7.14%

___________________ __________________

🇺🇸 US Market Overview:

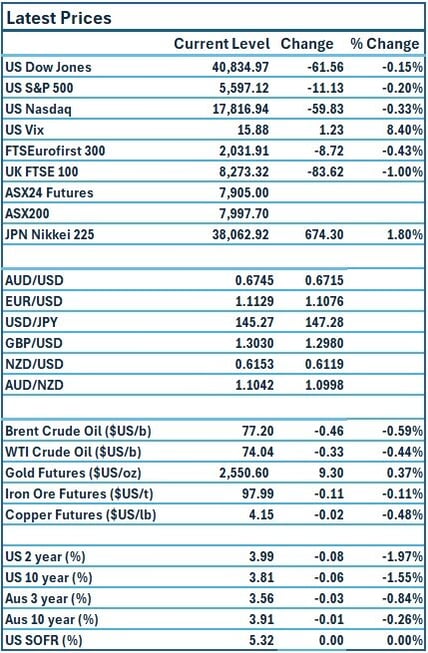

The Update: U.S. stocks closed slightly lower on Tuesday, breaking their recent winning streak amid a few market-moving catalysts ahead of the Jackson Hole Economic Symposium, set to get underway on Thursday. All three major U.S. stock indexes edged down, ending a multi-session rally in which the equities market bounced back from a steep sell-off driven by recession fears. Source: Reuters

The Impact: Financial markets are currently pricing in a 69.5% likelihood of a 25 basis-point reduction of the Fed funds target rate at the conclusion of the Federal Open Market Committee meeting in September, with a 30.5% chance of a super-sized cut of 50 basis points. US government bond yields slipped on Tuesday as an interest rate cut next month loomed large heading into US Federal Reserve Chair Jerome Powell's remarks on Friday. Source: AFR, CommSec

🇦🇺 Australian Market Overview:

-

ASX futures are down 44 points, or 0.6 per cent to 7897.

- Cleanaway Waste Management (ASX: CWY) posted a statutory net profit of $158.2 million for the year ended June 30, up from $23.5 million in the prior year. Source: AFR

- Domino’s Pizza (ASX: DMP) has lifted its final dividend despite tough times in the business, with same-store sales in the opening few weeks of 2024-25 down 1.3 per cent. Full-year net profit was up 136.5 per cent to $96 million. Source: AFR

🇪🇺 European Market Overview:

European stocks closed lower Tuesday afternoon as market uncertainty over the economic outlook lingers. The pan-European Stoxx 600 index provisionally closed 0.46% lower, with all but one sector — autos — and all major bourses trading in the red. In central bank news, Sweden’s Riksbank cut interest rates by 25 basis points to 3.5% from 3.75% and signalled two to three more rate cuts this year. Source: AFR

📈 Global Commodities Update:

- Global oil prices fell to a two-week low on Tuesday as Middle East supply concerns eased after Israel accepted a proposal to tackle disagreements blocking a ceasefire deal in Gaza, and as economic weakness in China weighed on fuel demand. Source: Commsec

- Aluminium futures gained 2.1%, hitting a five-week high, as a shortage of alumina, the raw material for making the metal, in top producer China and a sliding US dollar triggered fund buying. Source: CommSec

⚡ Global Renewable Energy News:

China will impose export controls on some antimony products from Sept. 15, it said on Thursday, citing national security, adding to measures imposed by Beijing since last year to curb shipments of strategic minerals. About a fifth of antimony was used to make photovoltaic glass to improve the performance of solar cells. Most of the rest was used in lead-acid batteries. Source: Reuters

📬 Market Insight by James Whelan:

Despite recent market shocks, we're in a "goldilocks space" with weaker-than-expected inflation and strong consumer performance. Company reports are solid, and recession risks have slightly decreased. On our latest podcast, we explore these developments and share insights on allocations. Notably, while the S&P 500 sectors show revenue growth, caution is advised with leveraged ETFs and Chinese investments.

Aluminium futures continue to drive upwards as supply constraints and a weakening US dollar drive buying. Keep an eye on ASX: MMI.

Introducing BPC Wealth Management

BPC Wealth Management is dedicated to shaping resilient investment portfolios, empowering you to achieve and sustain your financial aspirations. While the foundation of your portfolio focuses on long-term investments, through BPC, clients will be offered opportunities in equities trading and equity capital markets. This aspect is highly customised, allowing asset flexibility. Discover how our proactive and client-focused approach can help you achieve your financial aspirations by booking your discovery call with James Whelan.

Subscribe to our free Morning Market Report email newsletter to stay on top of the markets.

Share Link