Barclay Pearce Capital

- Jun 19, 2024

- 9 min read

The Morning Market Report - 19 June 2024

Receive daily market insights gathered from overnight equity data, top stories, companies in the press and market information.

Good morning,

Our team compiles this daily market report from global sources to highlight key market updates and what they mean for your investment portfolio.

Overnight Market Highlights:

![]() Wall Street finished higher overnight.

Wall Street finished higher overnight.

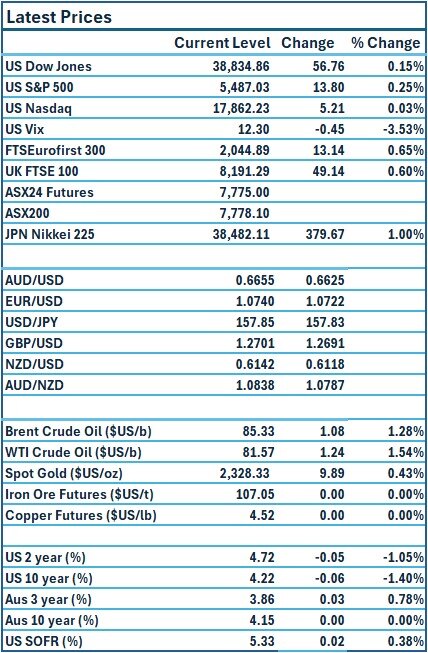

Dow Jones S&P-500 Nasdaq

+ 0.15% + 0.25% + 0.03%

___________________ __________________ _________________

Australian shares are poised to open lower.

Australian shares are poised to open lower.

🇺🇸 US Market Overview:

The Update: The S&P 500 and Nasdaq closed at record highs on Tuesday, buoyed by Nvidia's continued surge to new peaks, while the Dow ended barely higher in subdued pre-holiday trading following softer-than-expected U.S. retail sales data. Nvidia overtook Microsoft to become the world's most valuable company, ending the day with a market capitalization of $3.22 trillion. In economic data, retail sales rose 0.1% in May, versus the 0.3% growth forecast by economists polled by Reuters, while another report showed surprisingly strong May industrial production and manufacturing output. Source: Reuters

The Impact: Following the economic news, markets slightly increased bets on two Federal Reserve interest rate cuts this year. Fed officials' comments overnight offered little to shift market pricing for cuts. US government bond yields dipped on Tuesday after the data kept the US Federal Reserve on track to lower interest rates this year. New York Fed President John Williams said interest rates will come down gradually over time, while Richmond Fed's Thomas Barkin said he required more months of economic data before supporting a rate cut. The US 10-year Treasury yield slid 5 points to 4.22% and the US 2-year Treasury yield fell 4 points to 4.72%. Source: Reuters, CommSec

🇦🇺 Australian Market Overview:

-

ASX futures are down 8 points or 0.1 per cent to 7775.

- The Reserve Bank of Australia left the cash rate on hold at a 12-year high of 4.35 per cent as widely predicted by the market and economists. The RBA says “The outlook remains highly uncertain. The economic outlook remains uncertain and recent data have demonstrated that the process of returning inflation to target is unlikely to be smooth.” Source: AFR

🇪🇺 European Market Overview:

European stocks closed higher Tuesday after a mixed start to the trading week. The Stoxx 600 index provisionally closed 0.66% higher, with most sectors and all major bourses trading in the green. Construction stocks led gains, up 1.3%, while household goods dipped 0.5%. Source: CNBC

📈 Global Commodities Update:

Global oil prices settled more than 1% higher on Tuesday due to escalating tensions in Europe and the Middle East as wars in both regions continue to pose a threat to global supply. Prices rose following reports a Ukrainian drone strike caused a large fire in a fuel tank at an oil terminal in Russia's southern port of Azov. Source: CommSec

⚡ Global Renewable Energy News:

Goldwind and privately owned Omni Wind have commenced market soundings to sell 100% of Baldon wind farm, a 1.4-gigawatt development with an attached 400-megawatt-hour battery energy storage system due to begin construction in 2026. To be housed near NSW’s Balranald, within the South West Renewable Energy Zone, Baldon will run about 180 wind turbines of 7.8MWs each, enough to power 750,000 homes.

The current owners have secured an option to lease the 46,000-hectare site for 60 years and collected five years of wind data. Now, they are waiting for development approvals to land around mid-2025. Source: AFR

📚 European Market Report by Jack Colreavy:

The ECB has taken the lead in being one of the first to cut interest rates and now attention turns to the Bank of England which will make a decision on rates this week. With an early election called and without a watertight case for cutting rates, the market is expecting another hold so as not to be seen as influencing the outcome of the election.

Attention now turns to the meeting in August where it is expected that the first rate cut will occur though it is not a sure thing. Inflation sits at 2.3% but there are pockets of sectors with very high inflation including annual wage growth and services inflation both around 6%.

📬 Market Insight by James Whelan:

A quick detour to announce the BPC NRL Tipping Competition!

Welcome to the BPC NRL Tipping Competition for 2024. The season has kicked off with a bang in the glittery lights of Las Vegas. Panthers are favorites to take the crown again but the Broncos look like a formidable opponent to take revenge from the heartbreak of 2023. BPC loves its footy and we're very excited for the season ahead. We also love to win stuff so please keep an eye out for the prizes on offer. Sign up and join the game!

Subscribe to our free Morning Market Report email newsletter to stay on top of the markets.

Share Link