Barclay Pearce Capital

- Sep 18, 2024

- 9 min read

The Morning Market Report - 18 September 2024

Receive daily market insights gathered from overnight equity data, top stories, companies in the press and market information.

Good morning,

Our team compiles this daily market report from global sources to highlight key market updates and what they mean for your investment portfolio.

Overnight Market Highlights:

![]() Wall Street closed mixed overnight.

Wall Street closed mixed overnight.

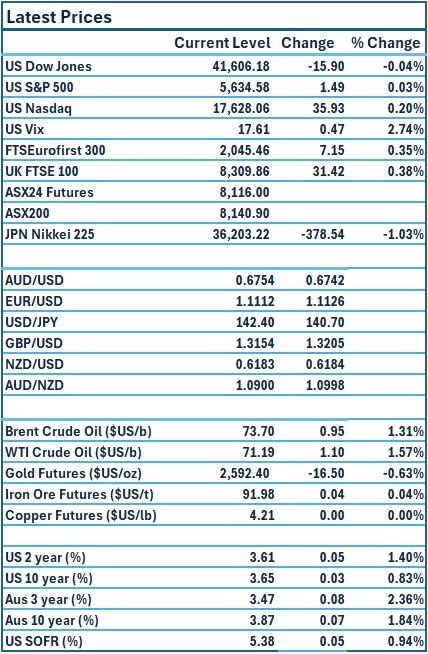

Dow Jones S&P-500 Nasdaq

- 0.04% + 0.03% - 0.2%

___________________ __________________ _________________

ASX is set to open lower this morning.

ASX is set to open lower this morning.

Stock of Note:

Wellnex Life Impact Minerals Change Financial

(ASX: WNX) (ASX: IPT) (ASX: CCA)

0.019 AUD 0.012 AUD 0.073 AUD

-5.00% 0% -5.19%

___________________ __________________ __________________

🇺🇸 US Market Overview:

The Update: .S. stocks closed nearly unchanged on Tuesday, giving up earlier gains that had vaulted the S&P 500 and Dow Industrial Average to record highs as investors braced for the first Federal Reserve rate cut in 4-1/2 years. The latest report from the U.S. Commerce Department showed retail sales rose unexpectedly in August, after a decline in auto dealership receipts was offset by strength in online purchases, suggesting the economy was on solid footing through most of the third quarter. The Russell 2000 index tracking small caps, which investors view as likely to benefit from a lower rate environment, outperformed the three major indexes, climbing 0.74% on the session. Source: Reuters

The Impact: Markets are pricing in a 65% chance the Fed will cut borrowing costs by 50 basis points at the conclusion of its two-day meeting on Wednesday, according to the CME's FedWatch Tool. US government bond yields rose on Tuesday after retail sales in the world's largest economy increased unexpectedly last month, suggesting there is no urgency for the US Federal Reserve to do a supersized rate cut of 50 basis points on Wednesday. Source: Reuters, CommSec

🇦🇺 Australian Market Overview:

-

ASX futures are down 39 points, or 0.5 per cent near 7 am AEST. The benchmark S&P/ASX 200 closed at a fresh all-time high of 8140.9 on Tuesday. Source: AFR

- Macquarie Group is weighing a stake sale in Wavenet, an IT services provider in the UK, which could be valued at £1.2 billion ($2.4 billion) or more in a deal, people with knowledge of the matter said. Source: AFR

🇪🇺 European Market Overview:

European stocks closed higher Tuesday, rebounding from a negative session at the start of the week as upcoming central bank meetings remained in focus. The pan-European Stoxx 600 index provisionally closed 0.42% higher, trimming earlier gains. German economic sentiment darkened slightly in September in another sign of woe for the country’s troubled economy. Source: CNBC

📈 Global Commodities Update:

- Global oil prices rose by over 1% on Tuesday as supply disruptions mounted and traders bet that demand will grow if the US Federal Reserve lowers borrowing costs this week, as is widely expected. Source: CommSec

- The gold futures price fell US$16.50 or 0.6% to US$2,592.40 an ounce on Tuesday as the US dollar and US Treasury yields firmed. Source: CommSec

⚡ Global Renewable Energy News:

Renewable energy reached a fresh record in its share of total electricity production this week, highlighting the progress still being made in Australia’s troubled energy transition but also exposing the challenges of eliminating carbon-polluting coal power.

The share of electricity generated by renewables reached an all-time high of 72.2 per cent in the half-hour leading up to midday on Monday, marginally bettering the previous high set in October last year.

In terms of total share of electricity generation, renewable energy accounts for 37.4 per cent so far this quarter, according to UNSW data. That’s an improvement on a poor June quarter where it sat at just under 32 per cent, but still short of 38.7 per cent in the third quarter last year – and leaving a big gap to the 82 per cent target by 2030. Source: AFR

📬 Market Insight by James Whelan:

Last week was packed with insights from mining conferences and discussions on the critical minerals-AI link. My latest podcast covers big updates, including Robbie Farah joining our Wealth Management team and my own football journey with the #BackJimmy campaign.

Market analysis shows a strong rally despite earlier caution, with September proving to be a strong month. I discuss disinflationary trends, such as consumer pullbacks and shipping cost declines and highlight silver’s potential in the current environment.

Introducing BPC Wealth Management

BPC Wealth Management is dedicated to shaping resilient investment portfolios, empowering you to achieve and sustain your financial aspirations. While the foundation of your portfolio focuses on long-term investments, through BPC, clients will be offered opportunities in equities trading and equity capital markets. This aspect is highly customised, allowing asset flexibility. Discover how our proactive and client-focused approach can help you achieve your financial aspirations by booking your discovery call with James Whelan.

Subscribe to our free Morning Market Report email newsletter to stay on top of the markets.

Share Link