Barclay Pearce Capital

- Jul 17, 2024

- 10 min read

The Morning Market Report - 17 July 2024

Receive daily market insights gathered from overnight equity data, top stories, companies in the press and market information.

Good morning,

Our team compiles this daily market report from global sources to highlight key market updates and what they mean for your investment portfolio.

Overnight Market Highlights:

![]() Wall Street finished higher overnight.

Wall Street finished higher overnight.

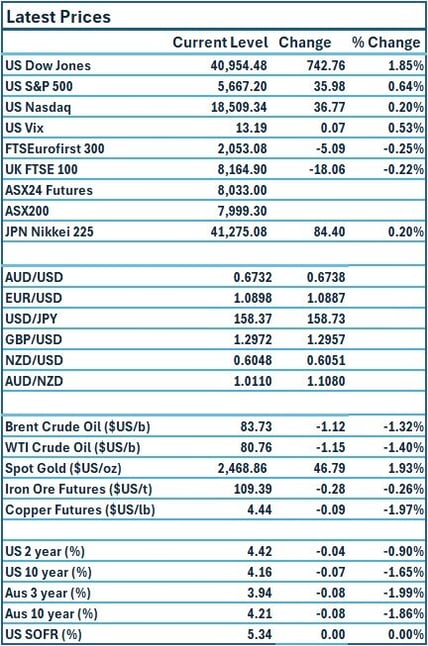

Dow Jones S&P-500 Nasdaq

+ 1.9% + 0.6% + 0.2%

___________________ __________________ _________________

Australian shares are poised to open rise.

Australian shares are poised to open rise.

Stock of Note:

Wellnex Life Impact Minerals

(ASX: WNX) (ASX: IPT)

0.030 AUD 0.015 AUD

- 3.23% 0.0%

___________________ __________________

🇺🇸 US Market Overview:

The Update: Wall Street stocks rose and the Dow Jones Industrial Average hit an all-time closing high on Tuesday after U.S. retail sales data supported the view that the Federal Reserve is approaching its easing cycle, reining in inflation while avoiding a recession. U.S. retail sales were unchanged in June as a drop in receipts at auto dealerships was offset by broad strength elsewhere, a display of consumer resilience that bolstered economic growth prospects for the second quarter.

May retail sales gain revised up to 0.3% from 0.1%. Core retail sales surge 0.9%; May data unrevised. The Russell 2000 scored a fifth straight day of gains greater than 1%, its longest winning streak since April 2000. Source: Reuters

The Impact: US government bond yields fell on Tuesday as investors balanced the likelihood of an impending US Federal Reserve interest rate cut against possibly inflationary policies if Donald Trump wins the November US presidential election. Currencies were weaker against the US dollar in European and US trade. Source: Reuters, CommSec

🇦🇺 Australian Market Overview:

-

ASX futures up 55 points or 0.7% to 8035.

- Closer to home, New Zealand’s consumer price index slowed to 0.4 per cent for the second quarter from 0.6 per cent in the previous three-month period. The figure was below the market consensus of 0.6 per cent. On an annualised basis, CPI came in at 3.3 per cent year-on-year compared to the previous period’s 4 per cent. Source: AFR

🇪🇺 European Market Overview:

European stocks closed lower Tuesday, bucking the trend across the Atlantic, as investors assessed the economic and political outlook in the region and beyond. The pan-European Stoxx 600 provisionally closed 0.21% lower, pulling back from larger losses earlier in the session. Mining stocks fell 1.6% as travel gained 0.5%. In Europe, it was a bad day for fashion houses, however, as Germany’s Hugo Boss plunged 7.5% after the company cut its full-year sales outlook, amid “persistent macroeconomic and geopolitical challenges.” Source: CNBC

📈 Global Commodities Update:

- Global oil prices declined on Tuesday on worries of a slowing Chinese economy crimping demand and despite a growing consensus the US Federal Reserve could begin cutting its key interest rate as soon as September. Source: CommSec

- Copper futures slid 1.9% after weak economic data from China. Source: CommSec

- The gold futures price rose by US$38.90 or 1.6% to a record high of US$2,467.80 ounce on Tuesday as US Federal Reserve interest rate cut hopes boost demand. Source: CommSec

⚡ Global Renewable Energy News:

BlackRock-owned Akaysha Energy will proceed to build a $1 billion battery in central-west NSW after sealing a $650 million debt deal for what will be the largest battery system in the national electricity market. Central to what counts among the world’s biggest lending deals for an energy storage project is a 12-year agreement with EnergyAustralia under which the major supplier will be able to virtually access almost half the plant’s capacity as if it owned it, helping manage its load in peak demand periods.

The Orana battery energy storage system to be installed near Wellington will have a maximum output of 415 megawatts and four hours of storage capacity, making 1660 megawatt-hours. Source: AFR

📬 Market Insight by James Whelan:

One of our house stocks Impact Minerals (ASX: IPT) spoke at the Shares in Value conference in Sydney recently and whilst they won’t necessarily have any substantially new news of a market-moving nature we think their presentation to a large and savvy group of investors should be enough to help the stock along from these undervalued levels. Happy to pick some up this morning. ASX: IPT

A quick detour to announce the BPC NRL Tipping Competition!

Welcome to the BPC NRL Tipping Competition for 2024. The season has kicked off with a bang in the glittery lights of Las Vegas. Panthers are favorites to take the crown again but the Broncos look like a formidable opponent to take revenge from the heartbreak of 2023. BPC loves its footy and we're very excited for the season ahead. We also love to win stuff so please keep an eye out for the prizes on offer. Sign up and join the game!

Subscribe to our free Morning Market Report email newsletter to stay on top of the markets.

Share Link