Barclay Pearce Capital

- Apr 17, 2024

- 9 min read

The Morning Market Report - 17 April 2024

Receive daily market insights gathered from overnight equity data, top stories, companies in the press and market information.

Good morning,

Our team compiles this daily market report from global sources to highlight key market updates and what they mean for your investment portfolio.

Overnight Market Highlights:

![]() Wall Street finished mixed overnight.

Wall Street finished mixed overnight.

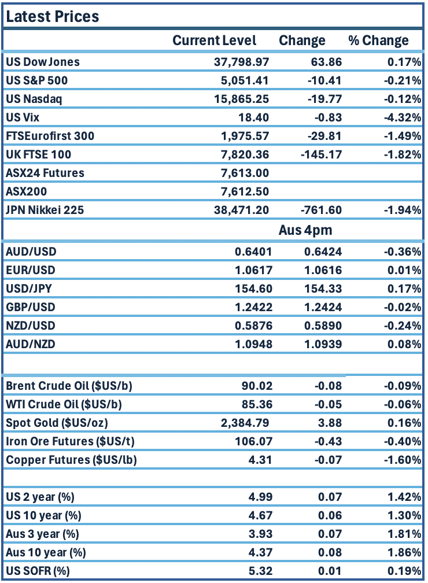

Dow Jones S&P-500 Nasdaq

+ 0.2% - 0.2% - 0.1%

___________________ __________________ _________________

Australian shares are poised to fall.

Australian shares are poised to fall.

🇺🇸 US Market Overview:

The Update: Wall Street stocks ended lower in choppy trading on Tuesday as Treasury yields climbed. Federal Reserve Chair Jerome Powell said on Tuesday that recent inflation data has not given policymakers enough confidence to ease rates soon. Source: Reuters

The Impact: US government bond yields rose on Tuesday as markets reevaluated how quickly the US central bank may move to cut interest rates this year given signs of strength in the global economy. Treasury 10-year yields climbed to 4.66 per cent. The US dollar gain rose against all of its developed-market counterparts. Source: Reuters, AFR

🇦🇺 Australian Market Overview:

-

ASX futures down 24 points or 0.3% to 7611.

-

Bank of Queensland will release its earnings and Rio Tinto and Evolution Mining are expected to detail production updates. Source: AFR

🇪🇺 European Market Overview:

European markets closed lower on Tuesday as investors followed developments in the Middle East. The regional Stoxx 600 index provisionally ended 1.6% lower with all sectors and major bourses in negative territory. Source: CNBC

📈 Global Commodities Update:

Oil prices settled marginally lower on Tuesday after economic headwinds pressured investor sentiment, curbing gains from geopolitical tensions with eyes on Israel and its pending response to Iran's attack on Israeli territory over the weekend. Source: Reuters

⚡ Global Renewable Energy News:

On Monday, Air New Zealand finalised its largest agreement for sustainable aviation fuel (SAF) with Neste, a petroleum refiner based in Finland. This partnership aims to reduce carbon emissions and achieve the airline's net-zero carbon emission goals. Under the deal, Air New Zealand will purchase nine million litres of SAF, manufactured at Neste's Singapore refinery, and supplied to Los Angeles International Airport from April 1 to Nov. 30, 2024. The airline stated that this SAF is anticipated to lower carbon emissions by up to 80% throughout its life cycle compared to traditional fossil jet fuel, encompassing production and transport emissions. Source: Reuters

📚 European Market Report by Jack Colreavy:

Pressure continues to mount on policymakers to scrap stamp duty on buying shares, in an effort to boost the attractiveness of the LSE, with a number of top fintech firms urging government action. The Unicorn Council for UK Fintech is just the latest name calling out the penalty that investors pay to back London-listed firms. However, government continues to resist the call as they rely heavily on the tax which brings in over £15 billion in revenue annually.

📬 Market Insight by James Whelan:

Earlier in the week we put out a trade idea to go long HHR -Hartshead Resources. We’re still banging the table on this one, believing the North Sea gas play has been oversold and is finding its way back to familiar levels. See the link here to find out more but incredibly cheap at these levels in our opinion.

A quick detour to announce the BPC NRL Tipping Competition!

Welcome to the BPC NRL Tipping Competition for 2024. The season has kicked off with a bang in the glittery lights of Las Vegas. Panthers are favorites to take the crown again but the Broncos look like a formidable opponent to take revenge from the heartbreak of 2023. BPC loves its footy and we're very excited for the season ahead. We also love to win stuff so please keep an eye out for the prizes on offer. Sign up and join the game!

Subscribe to our free Morning Market Report email newsletter to stay on top of the markets.

Share Link