Barclay Pearce Capital

- Oct 16, 2024

- 10 min read

The Morning Market Report - 16 October 2024

Receive daily market insights gathered from overnight equity data, top stories, companies in the press and market information.

Good morning,

Our team compiles this daily market report from global sources to highlight key market updates and what they mean for your investment portfolio.

Overnight Market Highlights:

![]() Wall Street's record run eased, with major US benchmarks finishing lower following a decline in oil prices and investor pull back on chip stocks ahead of trading updates this month.

Wall Street's record run eased, with major US benchmarks finishing lower following a decline in oil prices and investor pull back on chip stocks ahead of trading updates this month.

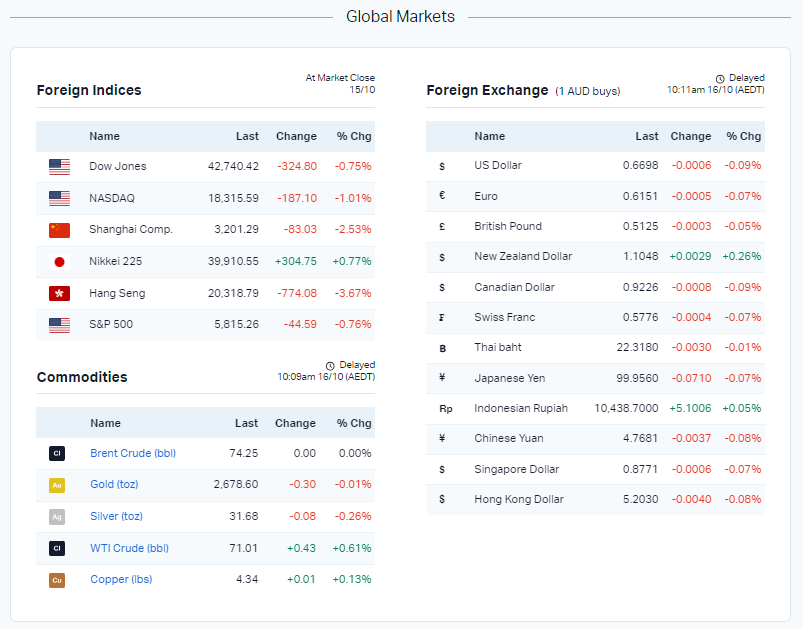

Dow Jones S&P-500 Nasdaq

- 0.75% - 0.80% - 1.10%

___________________ __________________ _________________

The ASX reset records again Tuesday with a rally in the major banks, but fell at the open today tracking losses on Wall Street and Tech related sectors overnight.

The ASX reset records again Tuesday with a rally in the major banks, but fell at the open today tracking losses on Wall Street and Tech related sectors overnight.

Stock of Note:

Wellnex Life Impact Minerals

(ASX: WNX) (ASX: IPT)

0.830 AUD 0.012 AUD

0.0% 0.0%

___________________ __________________

🇺🇸 US Market Overview:

The Update: Major benchmarks saw a decline, following challenges overnight including continued pullback in oil prices, a weak Chinese stock market amid growth and stimulus scepticism, chipmaker selloff after poor guidance from chip-manufacturer ASML, and ongoing geopolitical concerns.

The Impact: Negative factors above saw the US trading day become a large rotation from Semis and AI plays to value sectors including REITs and Financials.

🇦🇺 Australian Market Overview:

-

The S&P/ASX 200 (XJO) finished 65.6 points higher at 8,318.4, resetting another record due to a rally in the major banks.

- Financials (XFJ) (+1.3%) was the main driver, while Gold (XGD) (+1.1%) sub-index continued to rally, despite negligible activity in price.

- Industrials (XNJ), Information Technology (XIJ) and Communication Services (XTJ) were all up (+1.0%) respectively

- Consumer Staples (XSJ) (-0.31%) and Energy (XEJ) (-1.2%) were the worst performers.

The rally followed a strong session on Wall St the prior day, namely in Technology stocks. Of the laggards, Tyro Payments shares slumped 11.1 per cent to 80¢ following news that the federal government is planning to crack down on card surcharges. Shares of Smartpay Holdings shares sunk 17.7 per cent to 70¢ on the same news.

IDP Education also fell 7.4 per cent to $13.69 following a disappointing AGM forecast.

🇪🇺 European Market Overview:

Europe’s energy ministers are meeting to discuss imports of Russian natural gas that still flow to the region even as the war in Ukraine rages for a third winter. Source: Bloomberg

🗓️ Key Events This Week:

- US Q2 corporate reporting season - all week

- Speech by RBA Assistant Governor Sarah Hunter - Wednesday

- September jobs report - Thursday

- Quarterly business confidence - Thursday

- US retail sales - Thursday

- US jobless claims - Thursday

- European Central Bank rates decision - Thursday

- China monthly industrial production, retail sales, etc - Friday

📈 Global Commodities Update:

- Iron ore (Dalian): down 0.38% to US$111.26

- Brent crude: down US$3.21 or 4.1% to US$74.25

- Gold (spot): up US$12 or 0.45% to US$2,661.40

- Silver (spot): up 25 US cents or 0.79% to US$31.48

- Copper (LME): down 1.44% to US$9,520

- Nickel (LME): down 1.3% to US$17,415

- Lithium carbonate (China): down 0.33% to 75,600 yuan

- BHP: down 2.1% (US); down 1.46% (UK)

- Rio Tinto: down 1.82% (US); down 1.81% (UK)

(1) Base metals were largely unchanged from morning levels, with copper and nickel settling down well over a percent in reaction to China stimulus concerns, while aluminium also dropped about a percent…

(2) Gold and silver built on morning gains as a mid-morning uptick in the VIX following ASML's weak guidance and resulting midday pullback in tech and broader market outweighed the dollar index's reversal of earlier losses. Silver gained about 1.5%, while gold was up slightly over half a point…

(3) WTI crude oil maintained morning losses to settle down around 4% after seeing pressure overnight following Israel government's statements that it would limit retaliatory strikes on Iran to the country's military assets.

(4) Seaborne iron ore prices fell on the day, with physical trading liquidity remaining largely unchanged.

(5) Hard Coking Coal up $1/t on the day at $209/t

(6) Daily Australian alumina remained steady on the day at $645/t

⚡ Global Renewable Energy News:

Gas power emerges as latest battle front in energy wars

The opposition has opened a second front in the fight over energy policy by pledging to include gas in the capacity investment scheme, the federal government’s flagship policy spurring investment in clean power generation and storage needed for the transition.

On top of its pledge to build seven nuclear power plants, the Coalition says the government’s decision to limit generation to renewable power was a triumph of ideology over reality in that it would result in higher prices and greater instability of supply. Source: AFR

📬 As Barclay Sees It by Jack Colreavy:

China's recent stimulus package has sparked a rally in commodity prices and the stock market, as the nation faces slowing growth and property sector turmoil. The package aims to revive the economy through fiscal spending, tax cuts, and monetary easing. While industrial metals like iron ore have surged, ABSI this week notes that questions remain about the sustainability of this recovery, given deep structural issues in China's real estate market and consumer confidence.

Source: Market Index

Introducing BPC Wealth Management

BPC Wealth Management is dedicated to shaping resilient investment portfolios, empowering you to achieve and sustain your financial aspirations. While the foundation of your portfolio focuses on long-term investments, through BPC, clients will be offered opportunities in equities trading and equity capital markets. This aspect is highly customised, allowing asset flexibility. Discover how our proactive and client-focused approach can help you achieve your financial aspirations by booking your discovery call with James Whelan.

Subscribe to our free Morning Market Report email newsletter to stay on top of the markets.

Share Link