Barclay Pearce Capital

- Jan 15, 2025

- 8 min read

The Morning Market Report - 15 January 2025

Receive daily market insights gathered from overnight equity data, top stories, companies in the press and market information.

Good morning,

Our team compiles this daily market report from global sources to highlight key market updates and what they mean for your investment portfolio.

Overnight Market Highlights:

![]() Major US benchmarks ended mostly higher, though they closed off their best levels.

Major US benchmarks ended mostly higher, though they closed off their best levels.

Dow Jones S&P-500 Nasdaq

+ 0.50% + 0.10% - 0.20%

___________________ __________________ _________________

Australian shares rise slightly at the open this morning, after choppy movement overnight, in line with Wall Street's performance.

Australian shares rise slightly at the open this morning, after choppy movement overnight, in line with Wall Street's performance.

Stock of Note:

Wellnex Life Impact Minerals Ovanti

(ASX: WNX) (ASX: IPT) (ASX: OVT)

0.068 AUD 0.011 AUD 0.018 AUD

+ 0.0% + 0.0% +0.0%

___________________ __________________ __________________

🇺🇸 US Market Overview:

- The S&P 500 built on yesterday's gains after late rally in yesterday's session, while the Nasdaq continued to pull back.

- Small caps, defensive stocks, and rate-sensitive sectors outperformed, while tech and growth stocks lagged.

- Stocks reacted positively to a weaker-than-expected US December Producer Price Index, following last week's strong jobs report and Fed minutes that had heightened concerns about inflation risks.

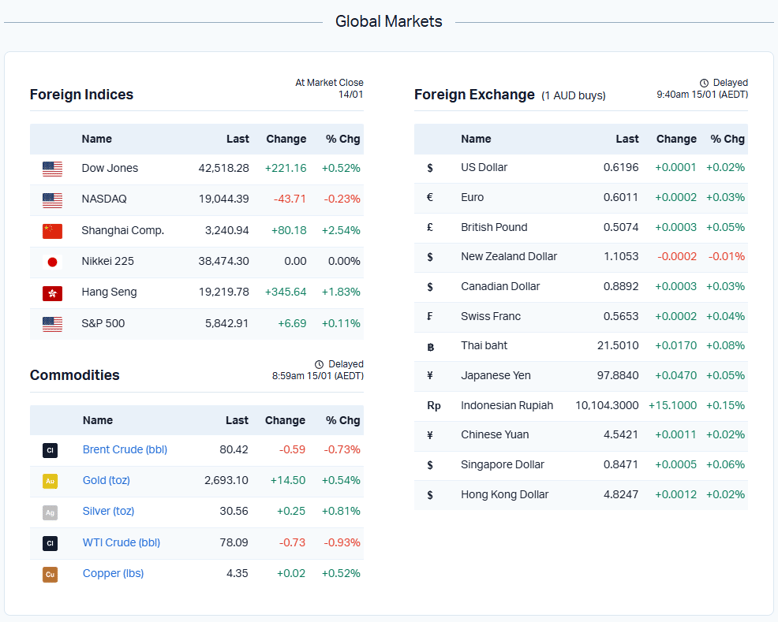

Source: Market Index

🇦🇺 Australian Market Overview:

-

The S&P/ASX 200 (XJO) finished 39.1 points higher at 8,231.0 yesterday.

- Resources (XJR) (+1.4%) and Energy (XEJ) (+1.2%) re-surged.

- Underperforming were high-risk, yield-sensitive sectors like Information Technology (XIJ) (-0.49%), Financials (XFJ) (-0.02%), and Consumer Discretionary (XDJ) (-0.00%).

-

The Australian dollar rallied slightly trading at US 61.92¢.

Source: Market Index, Bloomberg

🗓️ Key Events This Week:

- US consumer inflation (CPI) - tonight

📈 Global Commodities Update:

- Iron ore (Dalian): up 2.22% to US$106.79

- Brent crude: down US$1.09 or 1.35% to US$79.92

- Gold (spot): up US$4.18 or 0.16% to US$2,672.08

- Silver (spot): up 13 US cents or 0.43% to US$29.79

- Copper (LME): up 0.76% to US$9,164

- Nickel (LME): up 0.19% to US$15,925

- Lithium carbonate (China): up 0.51% to 9,192 yuan

- Uranium(spot): steady at US$74

Iron ore rose for a fourth consecutive session, driven by a drop in ore shipments to China last week, according to consultancy Mysteel. Shipments from Australia and Brazil fell 9% week-on-week, Mysteel reported. Additionally, a separate report revealed that Chinese steel exports surged by 25% last month compared to the same period in 2023.

Oil pulled back a day after new US sanctions on Russian producers pushed Brent crude to a five-month high.

Copper extended its strong start to 2025, continuing a rally that has boosted prices by 4% since the beginning of the month.

📬 As Barclay Sees It:

This week, Jack Colreavy, CFA discusses the seismic shift in Australia’s media landscape as British sports-streaming platform DAZN acquires Foxtel for A$3.4 billion. Jack analyses what this means for the future of streaming, the challenges DAZN faces and why Australian sporting leagues might emerge as the ultimate winners in this high-stakes deal.

Source: Market Index

Introducing BPC Wealth Management

BPC Wealth Management is dedicated to shaping resilient investment portfolios, empowering you to achieve and sustain your financial aspirations. While the foundation of your portfolio focuses on long-term investments, through BPC, clients will be offered opportunities in equities trading and equity capital markets. This aspect is highly customised, allowing asset flexibility. Discover how our proactive and client-focused approach can help you achieve your financial aspirations by booking your discovery call with James Whelan.

Subscribe to our free Morning Market Report email newsletter to stay on top of the markets.

Share Link