Barclay Pearce Capital

- Aug 14, 2024

- 10 min read

The Morning Market Report - 14 August 2024

Receive daily market insights gathered from overnight equity data, top stories, companies in the press and market information.

Good morning,

Our team compiles this daily market report from global sources to highlight key market updates and what they mean for your investment portfolio.

Overnight Market Highlights:

![]() Wall Street finished higher overnight.

Wall Street finished higher overnight.

Dow Jones S&P-500 Nasdaq

+ 1.7% + 1.7% + 2.4%

___________________ __________________ _________________

Australian shares are set to open higher.

Australian shares are set to open higher.

Stock of Note:

Wellnex Life Impact Minerals

(ASX: WNX) (ASX: IPT)

0.023 AUD 0.014 AUD

0.0% 0.0%

___________________ __________________

🇺🇸 US Market Overview:

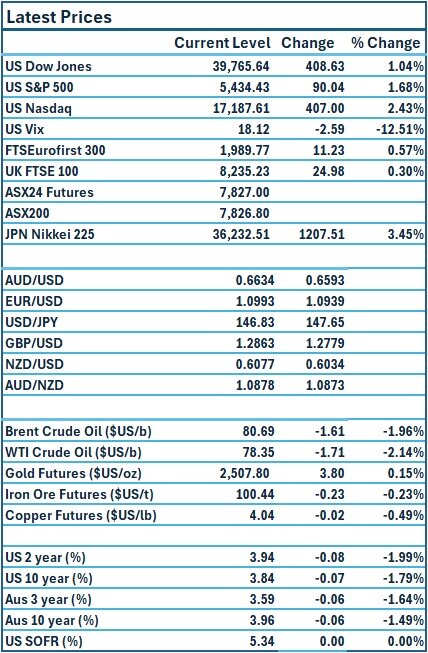

The Update: U.S. indexes closed up on Tuesday and hit a near two-week high after softer producer prices data reinforced bets of an interest-rate cut by the Federal Reserve in September. U.S. producer prices increased less than expected in July as a rise in the cost of goods was tempered by cheaper services, indicating that inflation continued to moderate. In the 12 months through July, the PPI increased 2.2% after climbing 2.7% in June. Source: Reuters

The Impact: Futures markets currently show a 54% chance of a 50 basis point cut by the Fed, with a 46% chance of a 25 basis point cut, and traders are pricing in a full percentage point of easing by year-end. U.S. Treasury yields slipped as the data was released. The US 10-year Treasury yield fell by 6 points to 3.84%. The US 2-year Treasury yield declined 8 points to 3.94%. Source: CommSec, Reuters

🇦🇺 Australian Market Overview:

-

ASX futures were up 0.7 per cent or 57 points. Source: AFR

- Australia’s wage growth rose 0.8 per cent in the June quarter, from the March period, under forecasts of a 0.9 per cent gain. The annual pace rose 4.1 per cent, above expectations of 4 per cent. Source: AFR

- Commonwealth Bank said the Australian economy remains resilient as higher interest rates gradually reduce inflation, as it reported a $9.8 billion cash profit for the year to June 30, down 2 per cent on the previous year but beating market expectations. CBA will pay a final dividend of $2.50 per share. Source: AFR

🇪🇺 European Market Overview:

European stocks closed higher on Tuesday, as market participants monitored a fresh batch of economic data following last week’s volatility. The pan-European Stoxx 600 index provisionally ended 0.5% higher. U.K. wage data released by the Office for National Statistics on Tuesday showed that pay excluding bonuses grew 5.4% year-on-year between April and June - the lowest rate in two years. The unemployment rate fell to 4.2% from 4.4%. Source: CNBC

📈 Global Commodities Update:

- Global oil prices tumbled 2% on Tuesday as traders grew less nervous about the potential for a wider war in the Middle East, with Iran yet to act on threats to retaliate against Israel for the assassination of a Hamas official in Tehran. Source: CommSec

- The gold futures price rose US$3.80 or 0.2% to US$2,507.80 an ounce on Tuesday, as the US dollar and US Treasury yields crept lower after the US producer prices data. Source: CommSec

⚡ Global Renewable Energy News:

Renewable energy-focussed investment fund NextEnergy Capital has reached an agreement to buy 12 solar power projects in Spain with an overall capacity of 248 megawatts (MW) and eyes more opportunities in the country, it said on Monday.

The projects are in Spain's northeast and the investment is made via NextEnergy's NextPower V ESG fund, which did not disclose how much it paid for the portfolio. Source: Reuters

📬 Market Insight by James Whelan:

In this week's market update, James reflects on the turbulent phases of his career, from the GFC to recent volatility. Despite dramatic predictions, the S&P 500 showed minimal change, underscoring the importance of staying calm. James discusses the current economic landscape, noting resilience in earnings despite growth concerns. He emphasises the value of remaining steady and focused, both in investing and in life. Plus, a nod to the Olympic team and a tribute to a memorable figure.

A quick detour to announce the BPC NRL Tipping Competition!

Welcome to the BPC NRL Tipping Competition for 2024. The season has kicked off with a bang in the glittery lights of Las Vegas. Panthers are favorites to take the crown again but the Broncos look like a formidable opponent to take revenge from the heartbreak of 2023. BPC loves its footy and we're very excited for the season ahead. We also love to win stuff so please keep an eye out for the prizes on offer. Sign up and join the game!

Subscribe to our free Morning Market Report email newsletter to stay on top of the markets.

Share Link