Barclay Pearce Capital

- Jun 12, 2024

- 8 min read

The Morning Market Report - 12 June 2024

Receive daily market insights gathered from overnight equity data, top stories, companies in the press and market information.

Good morning,

Our team compiles this daily market report from global sources to highlight key market updates and what they mean for your investment portfolio.

Overnight Market Highlights:

![]() Wall Street finished mixed overnight.

Wall Street finished mixed overnight.

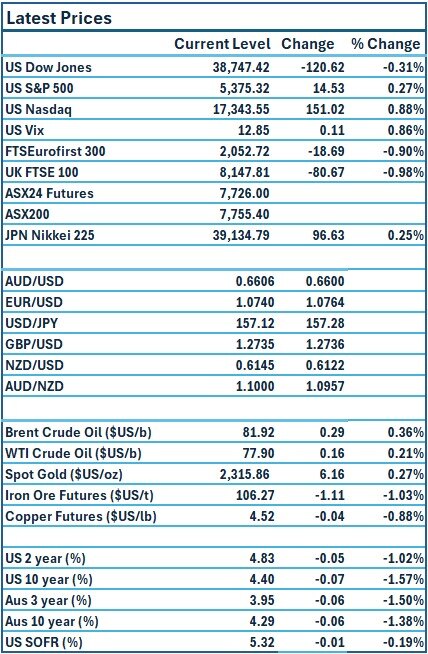

Dow Jones S&P-500 Nasdaq

- 0.3% + 0.3% + 0.9%

___________________ __________________ _________________

Australian shares are poised to open lower.

Australian shares are poised to open lower.

🇺🇸 US Market Overview:

The Update: The S&P 500 and Nasdaq registered record closing highs for a second straight day on Tuesday, helped by a gain of more than 7% in Apple shares, while investors also awaited consumer prices data and a policy announcement from the Federal Reserve. Source: Reuters

The Impact: US government bond yields declined on Tuesday after an auction of 10-year notes drew unusually strong demand. Investors also awaited key inflation data and a policy statement from the US Federal Reserve. The US Treasury sold US$39 billion of 10-year notes at a yield of 4.438% into strong demand. The US 10-year Treasury yield fell 7 points to 4.40%. Source: CommSec

🇦🇺 Australian Market Overview:

-

ASX futures down 38 points or 0.5% to 7725.

- Business confidence fell back into negative territory in May as conditions continued to gradually soften, suggesting the subdued economic activity seen in the Q1 GDP data has continued into Q2, a monthly National Australia Bank survey showed on Tuesday. Source: AFRThe Melbourne Institute Inflation expectations came in at 4.5% last week, the same as the previous month. It is trending downwards.

🇪🇺 European Market Overview:

European stocks fell on Tuesday as investors looked ahead to the Federal Reserve’s next meeting and U.S. inflation data. The Stoxx 600 index closed down 0.9%, paring slight gains earlier in the session. All sectors and major bourses closed in the red, with banks leading losses, down 2.17%. Source: CNBC

📈 Global Commodities Update:

- Oil prices settled slightly higher on Tuesday as the U.S. Energy Information Administration (EIA) raised its global oil demand growth forecast for the year, while OPEC stuck to its forecast for relatively strong growth in 2024. Source: Reuters

- Copper futures slid 0.7% to a seven-week low, pressured by rising inventories and weak indicators in China. Source: CommSec

⚡ Global Renewable Energy News:

Rio Tinto is set to invest $215 million to expedite its efforts in low-carbon steel production. The company plans to construct a large microwave facility south of Perth, aiming to address the carbon footprint of the Pilbara iron ore industry. This decision to advance the "BioIron" project with a microwave facility in the Rockingham industrial area marks one of Rio Tinto's largest investments in decarbonizing the steel sector.

Though the Rockingham plant is still categorised as a research and development facility rather than fully commercial, it will be ten times larger than its European predecessor, producing one tonne of pure metallic iron, or direct reduced iron (DRI), per hour. Source: AFR

📬 Market Insight by James Whelan:

In this episode of "The Theory of Thing Investment Podcast," we explore Heath Moss's expert silver analysis, debate the appropriateness of bringing a parent to a job interview, and examine how Pelosi manages to hit the mark once more. Plus, enjoy a lighthearted segment with Heath's notoriously bad footy tips. Tune in for insightful discussions and some fun moments.

A quick detour to announce the BPC NRL Tipping Competition!

Welcome to the BPC NRL Tipping Competition for 2024. The season has kicked off with a bang in the glittery lights of Las Vegas. Panthers are favorites to take the crown again but the Broncos look like a formidable opponent to take revenge from the heartbreak of 2023. BPC loves its footy and we're very excited for the season ahead. We also love to win stuff so please keep an eye out for the prizes on offer. Sign up and join the game!

Subscribe to our free Morning Market Report email newsletter to stay on top of the markets.

Share Link