Barclay Pearce Capital

- Sep 11, 2024

- 9 min read

The Morning Market Report - 11 September 2024

Receive daily market insights gathered from overnight equity data, top stories, companies in the press and market information.

Good morning,

Our team compiles this daily market report from global sources to highlight key market updates and what they mean for your investment portfolio.

Overnight Market Highlights:

![]() Wall Street closed mixed overnight.

Wall Street closed mixed overnight.

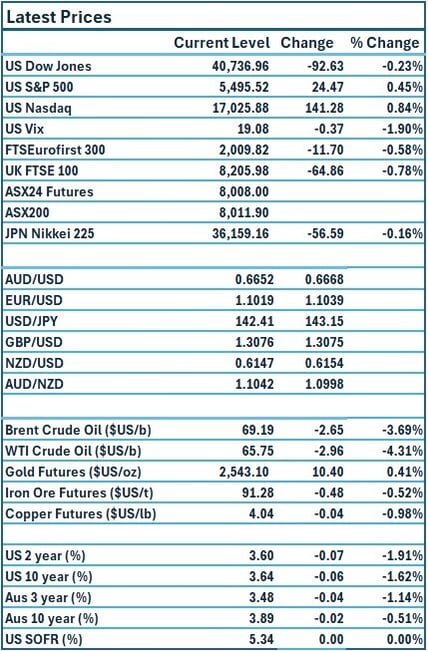

Dow Jones S&P-500 Nasdaq

- 0.23% + 0.45% + 0.84%

___________________ __________________ _________________

ASX is set to open higher this morning.

ASX is set to open higher this morning.

Stock of Note:

Wellnex Life Impact Minerals Change Financial

(ASX: WNX) (ASX: IPT) (ASX: CCA)

0.019 AUD 0.013 AUD 0.076 AUD

0% 0% -7.32%

___________________ __________________ __________________

🇺🇸 US Market Overview:

The Update: Wall Street's benchmark S&P 500 index closed up 0.5% on Tuesday but concerns about slowing economic growth stunted gains and the Dow dipped as bank stocks sank after warnings of current-quarter weakness while energy shares tumbled. Investors fretted over the economic implications of weaker energy demand on top of uncertainty about the Fed's decision on interest rates next week and its comment on the economy. Source: Reuters

The Impact: The dollar slid against some major currencies on Tuesday, consolidating Monday's gains ahead of key inflation data and a highly anticipated U.S. presidential debate, even though neither outcome is likely to affect overall monetary policy. US government bond yields declined on Tuesday on economic worries. Fed funds futures have priced in a 67% chance of a 25 basis point (bp) cut at the Sept. 17-18 policy meeting, and a 33% probability the Fed might do 50 bps, according to LSEG calculations. Source: Reuters, CommSec

🇦🇺 Australian Market Overview:

-

ASX futures are up 8 points or 0.1 per cent.

- Data centre owner and operator NextDC is cashing in on the exuberance for digital infrastructure sparked by the sale of AirTrunk to Blackstone, tapping investors for $750 million to fund NextDC’s expansion into Asia. Source: AFR

- Australian business conditions dropped on concerns that weaker trading conditions and profitability may hit the labour market, a National Australia Bank survey showed on Tuesday. Business conditions fell three points to +3 – a level last seen more than two years ago – and business confidence shed five points to -4. Source: AFR

🇪🇺 European Market Overview:

European stocks closed lower on Tuesday, following a more positive session at the start of the week. The pan-European Stoxx 600 provisionally ended down 0.5%, with most sectors and major bourses in negative territory. U.K. unemployment eased to 4.1% in May to July, while annual growth in regular employee earnings fell to 5.1% over the same period, data from the Office for National Statistics showed. Source: CNBC

📈 Global Commodities Update:

- Global oil prices retreated on Tuesday after OPEC+ said world oil demand would rise by 2.03 million barrels per day (bpd) in 2024, down from last month's forecast for growth of 2.11 million bpd. The Brent crude price fell US$2.65 or 3.7% to US$69.19 a barrel, the lowest level since December 2021. Source: CommSec

- Copper futures slid 1.1% on fund selling amid persistent worries about the health of

the Chinese economy. Source: CommSec - Iron ore futures dipped US48 cents or 0.5% to US$91.28 a tonne on Tuesday as the weakening Chinese demand outlook for steel outweighed softer supply and expectations of further stimulus from the top consumer. Source: CommSec

⚡ Global Renewable Energy News:

The new Starmer Labour government in the United Kingdom is considering the introduction of zonal pricing, which would offer cheaper power prices to communities who live near renewable energy zones.

The possible introduction of the scheme in Britain has raised the prospect of whether a similar pricing system could be rolled out in Australia to help win over sceptical local communities reluctant to host renewables sites. Source: AFR

📬 Market Insight by James Whelan:

Market Map from James Whelan:

As finals weekends approach for the AFL and NRL, it’s all about keeping your head up until the final siren. This mindset mirrors our work as we launch a fully integrated Wealth Management solution. While I tackle personal challenges in a #BackJimmy rugby test, we navigate the volatile market landscape.

As the markets face turbulence, with September traditionally weak, it's a good time to reassess exposure. The Sahm Recession Indicator has been triggered, signalling a potential recession, though the Fed has some room to manoeuvre. While a 50bps hike is unlikely now, it may come later this year. Despite the current outlook, long-term opportunities exist, and October could be a good time to deploy cash for strategic buys.

Stay informed and steady.

Introducing BPC Wealth Management

BPC Wealth Management is dedicated to shaping resilient investment portfolios, empowering you to achieve and sustain your financial aspirations. While the foundation of your portfolio focuses on long-term investments, through BPC, clients will be offered opportunities in equities trading and equity capital markets. This aspect is highly customised, allowing asset flexibility. Discover how our proactive and client-focused approach can help you achieve your financial aspirations by booking your discovery call with James Whelan.

Subscribe to our free Morning Market Report email newsletter to stay on top of the markets.

Share Link