Barclay Pearce Capital

- Jul 10, 2024

- 8 min read

The Morning Market Report - 10 July 2024

Receive daily market insights gathered from overnight equity data, top stories, companies in the press and market information.

Good morning,

Our team compiles this daily market report from global sources to highlight key market updates and what they mean for your investment portfolio.

Overnight Market Highlights:

![]() Wall Street finished mixed overnight.

Wall Street finished mixed overnight.

Dow Jones S&P-500 Nasdaq

- 0.1% + 0.1% + 0.1%

___________________ __________________ _________________

Australian shares are poised to open lower.

Australian shares are poised to open lower.

🇺🇸 US Market Overview:

The Update: The S&P 500 and Nasdaq notched record-high closes on Tuesday, fueled by gains in Nvidia after U.S. Federal Reserve Chair Jerome Powell told lawmakers that more "good" economic data would strengthen the case for rate cuts. AI chipmaker Nvidia climbed 2.5%, offsetting declines in other chip stocks. In testimony before Congress, Powell said that while inflation "remains above" the 2% soft-landing target, it has been improving in recent months and "more good data would strengthen" the case for interest-rate cuts. Source: Reuters

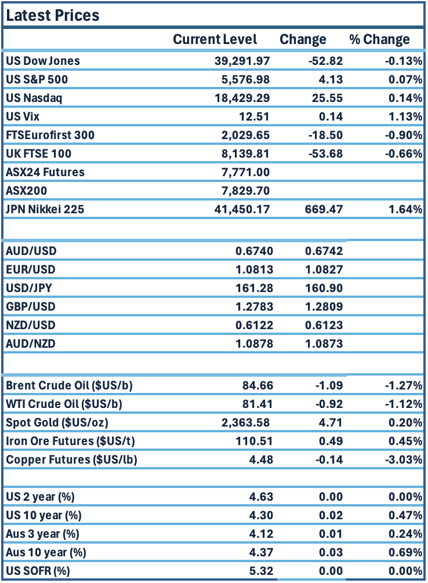

The Impact: Markets have stuck to pricing in 50 basis points of easing for the year, seeing a nearly 72% chance for a 25 bps cut by the Fed's September meeting, according to CME's FedWatch. Those bets were at under 50% a month ago. US government bond yields edged higher on Tuesday. The US 10-year Treasury yield rose 3 points to 4.30% and the US 2-year Treasury yield lifted 1 point to 4.63%. Source: Reuters, CommSec

🇦🇺 Australian Market Overview:

-

ASX futures down 41 points or 0.5% to 7771.

- In the NAB Monthly Business Survey business conditions edged down further in the month, continuing the long running trend since peaking in late 2022. Business confidence – driven by a broad-based increase across industries – rose sharply in the month to its highest level since early 2023. While the activity side of the survey has shown a consistent easing, capacity utilisation remains high. Source: NAB

- Australian consumer sentiment fell 1.1 per cent month on month to 82.7 points in July. Westpac noted that “fears of persistent inflation and further interest rate rises are again weighing more heavily on the consumer mood”. Source: AFR

🇪🇺 European Market Overview:

European stocks closed lower on Tuesday as investors in the region weighed up political uncertainty in France after Sunday’s election result. The pan-European Stoxx 600 index provisionally ended the day down 0.99%. Retail stocks led losses, down 1.65%. The U.K.’s FTSE 100 slipped into the red in afternoon deals, after bucking the wider negative trend through the morning.

It follows last week’s emphatic victory for the left-of-centre Labour Party, seen as broadly supportive of U.K. assets and sectors including house builders in particular. Source: CNBC

📈 Global Commodities Update:

Commodity prices generally declined in Northern Hemisphere trade, influenced by a stronger US Dollar. Global oil prices continued their decline from recent six-week highs as traders assessed the demand impact of prolonged higher US interest rates. Source: CommSec

⚡ Global Renewable Energy News:

The $2.3 billion EnergyConnect project, a critical high-voltage line connecting renewable projects in South Australia to the national power grid, has been hit by cost blowouts, delays and payment defaults.

The problems plaguing the cornerstone project have contributed to €70 million ($113 million) of losses for Spanish contractor Elecnor Group and added to major delays at other projects key to Australia’s energy transition including the $12 billion Snowy 2.0. Source: AFR

📬 Market Insight by James Whelan:

On of our house stocks Impact Minerals (ASX:IPT) is speaking at the Shares in Value conference in Sydney today and whilst they won’t necessarily have any substantially new news of a market moving nature we think their presentation to a large and savvy group of investors should be enough to help the stock along from these undervalued levels. Happy to pick some up this morning. IPT.ASX

A quick detour to announce the BPC NRL Tipping Competition!

Welcome to the BPC NRL Tipping Competition for 2024. The season has kicked off with a bang in the glittery lights of Las Vegas. Panthers are favorites to take the crown again but the Broncos look like a formidable opponent to take revenge from the heartbreak of 2023. BPC loves its footy and we're very excited for the season ahead. We also love to win stuff so please keep an eye out for the prizes on offer. Sign up and join the game!

Subscribe to our free Morning Market Report email newsletter to stay on top of the markets.

Share Link