Barclay Pearce Capital

- Jun 5, 2024

- 9 min read

The Morning Market Report - 05 June 2024

Receive daily market insights gathered from overnight equity data, top stories, companies in the press and market information.

Good morning,

Our team compiles this daily market report from global sources to highlight key market updates and what they mean for your investment portfolio.

Overnight Market Highlights:

![]() Wall Street finished higher overnight.

Wall Street finished higher overnight.

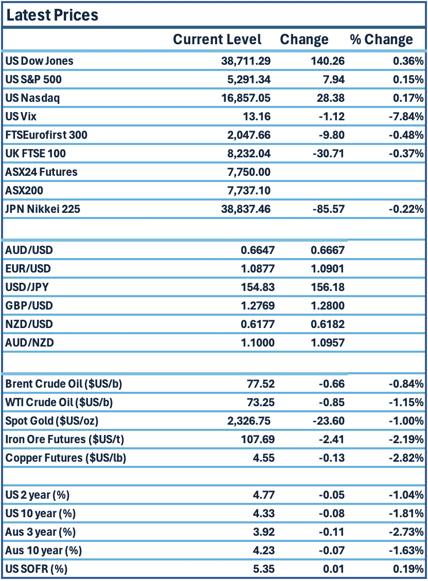

Dow Jones S&P-500 Nasdaq

+ 0.4% + 0.2% + 0.2%

___________________ __________________ _________________

Australian shares are poised to open lower.

Australian shares are poised to open lower.

🇺🇸 US Market Overview:

The Update: U.S. stocks ended a shade higher on Tuesday following softer-than-expected labor market data that reaffirmed expectations of an interest rate cut by the Federal Reserve. Data on Tuesday showed that U.S. job openings fell to their lowest level in more than three years in April. Megacap technology stocks, including Amazon.com, Alphabet, Nvidia and Microsoft, ended higher after losing ground early in the session. Oil giants Exxon Mobil and Chevron fell 1.6% and 0.8%, respectively, as demand concerns weighed on crude prices. Source: Reuters

The Impact: US government bond yields tumbled on Tuesday after data showed that US job openings fell more than expected in April, before highly anticipated jobs data on Friday may give fresh clues on US Federal Reserve policy. Market expectations for a September rate reduction now stand around 65%, versus below 50% last week, according to the CME's FedWatch tool. Source: Reuters, CommSec

🇦🇺 Australian Market Overview:

-

ASX futures are down 5 points or 0.1 per cent to 7750.

- Later today, The Australian Bureau of Statistics will release quarterly GDP figures, when most market watchers will be expecting a 0.2 per cent gain.

🇪🇺 European Market Overview:

European markets closed lower Tuesday, as positive momentum from the past few days faltered. The pan-European Stoxx 600 provisionally closed 0.5% lower, with all major bourses and most sectors in the red. Mining stocks lost 2.3% while health-care stocks were the biggest gainer, adding 0.8%. Source: CNBC

📈 Global Commodities Update:

- Global oil prices fell to the lowest in four months on Tuesday on scepticism about an OPEC+ decision at the weekend to boost supply later this year into a global market where demand has already shown signs of weakness. Source: CommSec

⚡ Global Renewable Energy News:

Brookfield will emerge as the largest owner and operator of renewable energy in Australia after unveiling a $10 billion bid to buy France’s Neoen – six months after Origin Energy shareholders dismissed a takeover offer from the Canadian investment giant. Including projects in development and expected to be delivered over six to 10 years, Neoen’s domestic pipeline of projects over the next decade is nearly 10 gigawatts. The takeover bid, which is being supported by Neoen’s board, is at €39.85 ($65.14) per share, nearly 27% higher than where the French group last traded. Source: AFR

📚 European Market Report by Jack Colreavy:

UK M&A activity has hit a bit of a slump according to the latest data from the Office for National Statistics. The report outlined 426 M&A transactions for Q1, including just 100 in March, which was 18 fewer than the previous quarter. The underlying cause of the downturn was a steep decline in foreign interest in acquiring UK companies, with deal volumes dropping ~40% in that category. With an upcoming election, it is likely that Q2 won’t be much better. However, with inflation under control and rate cuts on the horizon, there is reason to hope for a turn of the tides come Q3.

📬 Market Insight by James Whelan:

A quick detour to announce the BPC NRL Tipping Competition!

Welcome to the BPC NRL Tipping Competition for 2024. The season has kicked off with a bang in the glittery lights of Las Vegas. Panthers are favorites to take the crown again but the Broncos look like a formidable opponent to take revenge from the heartbreak of 2023. BPC loves its footy and we're very excited for the season ahead. We also love to win stuff so please keep an eye out for the prizes on offer. Sign up and join the game!

Subscribe to our free Morning Market Report email newsletter to stay on top of the markets.

Share Link