Barclay Pearce Capital

- Feb 5, 2025

- 9 min read

The Morning Market Report - 05 February 2025

Receive daily market insights gathered from overnight equity data, top stories, companies in the press and market information.

Good morning,

Our team compiles this daily market report from global sources to highlight key market updates and what they mean for your investment portfolio.

Overnight Market Highlights:

![]() Major US benchmarks closed higher finishing near their best levels and almost breaking even for the week, as tariffs for Mexico and Canada were lifted for 30 days.

Major US benchmarks closed higher finishing near their best levels and almost breaking even for the week, as tariffs for Mexico and Canada were lifted for 30 days.

Dow Jones S&P-500 Nasdaq

+ 0.30% + 0.70% + 1.40%

___________________ __________________ _________________

Australian shares open higher, following gains on Wall Street after China’s measured response to the new US tariffs.

Australian shares open higher, following gains on Wall Street after China’s measured response to the new US tariffs.

Stock of Note:

Wellnex Life Impact Minerals Ovanti

(ASX: WNX) (ASX: IPT) (ASX: OVT)

0.064 AUD 0.010 AUD 0.019 AUD

- 5.9% - 9.1% +0.0%

___________________ __________________ __________________

🇺🇸 US Market Overview:

- Stocks gained after the White House revealed it would give Mexico and Canada 30 days to address the issues that led President Donald Trump to announce a 25% tariff on imports from its closest neighbours.

- Yet, Trump’s 10 percent tariff on all imports from China was implemented late in the session, as promised. In response, Beijing swiftly imposed retaliatory tariffs on US goods: 15 percent on coal and liquefied natural gas, and 10 percent on oil and agricultural equipment.

- Bitcoin dropped from $US102,000 back below $US100,000, briefly falling as low as $US92,000 on Monday.

Source: AFR, Hot Copper, Market Index

🇦🇺 Australian Market Overview:

- The S&P/ASX 200 index ended the day 0.1 percent, or 5.4 points, lower at 8374 points.

- Eight of the ASX's 11 sectors closed lower, while materials/mining and tech sectors saw gains, and the healthcare sector remained flat.

-

Property was the biggest loser, dropping 1.1%, with Goodman Group falling 1.2% and Stockland retreating 1.6%.

-

On the other hand, tech was the top performer, rising 1.5%. Appen surged 9.7%, Technology One gained 1.9%, and Wisetech Global climbed 3.6%.

-

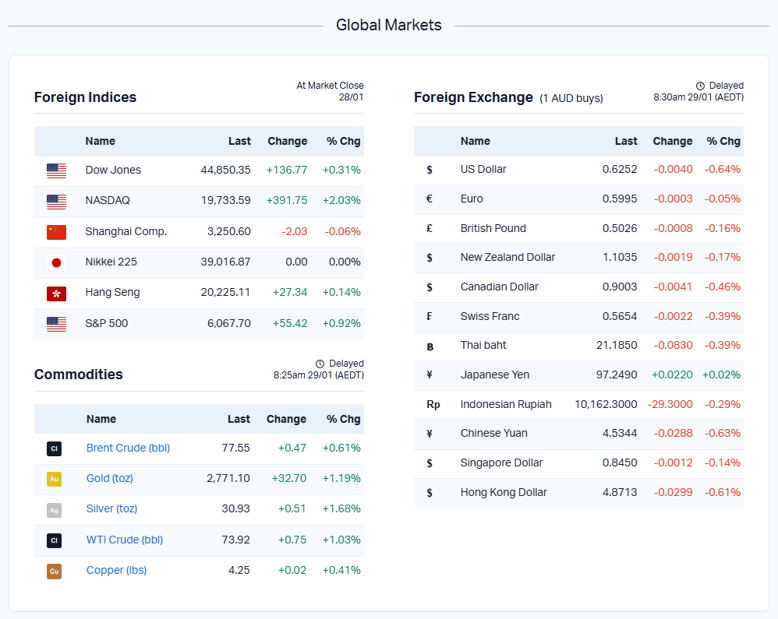

The Australian dollar dropped 0.47% overnight and is now trading at US 62.56¢.

Source: AFR, Market Index, Morningstar

🗓️ Key Events This Week:

- Earnings: Amcor, Cettire, Centuria Industrial REIT, Dexus Industria REIT, BWP Trust (source: Market Index)

- US earnings: Disney, Ford - tonight

- US private payrolls - tonight

- US services PMI - tonight

📈 Global Commodities Update:

- Iron ore (Singapore): up 0.4% to US$105.40

- Brent crude: up 24 US cents or 0.32% to US$76.20

- Gold (spot): up US$27.91 or 0.99% to US$2,841.69

- Silver (spot): up 60 US cents or 1.9% to US$32.09

- Copper (LME): up 0.82% to US$9,174

- Nickel (LME): up 1.44% to US$15,340

- Lithium carbonate (China spot battery grade): untraded at 9,458 yuan (Lunar New Year holiday)

- Uranium (spot): up 0.36% to US$70.75

Industrial metals rose after the Mexico-Canada tariff pause and as the additional US tariff on Chinese imports fell short of President Trump’s campaign threat of 60% tariffs.

Source: Hot Copper

📬 Wellnex Life (ASX:WNX): Wellnex obtains Market Authorisation with TGA

BPC is pleased to share Wellnex Life(ASX: WNX)'s announcement of the approval of a new Market Authorisation (MA) for a liquid paracetamol plus caffeine soft gel after the successful submission with TGA of the pharmaceutical dossier.

📬 As Barclay Sees It:

This week, Jack Colreavy, CFA discusses the impact of Trump’s newly imposed tariffs on global markets, particularly currency movements. With a 25% levy on Canadian and Mexican imports (excluding energy) and a 10% tariff on Chinese goods, the move has triggered a sharp depreciation in key currencies, including the Australian dollar, which hit a four-year low. Jack examines how markets are reacting and what this means for inflation, trade and economic growth.

Source: Market Index

Introducing BPC Wealth Management

BPC Wealth Management is dedicated to shaping resilient investment portfolios, empowering you to achieve and sustain your financial aspirations. While the foundation of your portfolio focuses on long-term investments, through BPC, clients will be offered opportunities in equities trading and equity capital markets. This aspect is highly customised, allowing asset flexibility. Discover how our proactive and client-focused approach can help you achieve your financial aspirations by booking your discovery call with James Whelan.

Subscribe to our free Morning Market Report email newsletter to stay on top of the markets.

Share Link