Barclay Pearce Capital

- Sep 4, 2024

- 9 min read

The Morning Market Report - 04 September 2024

Receive daily market insights gathered from overnight equity data, top stories, companies in the press and market information.

Good morning,

Our team compiles this daily market report from global sources to highlight key market updates and what they mean for your investment portfolio.

Overnight Market Highlights:

![]() Wall Street closed lower overnight on the first day of trading in September.

Wall Street closed lower overnight on the first day of trading in September.

Dow Jones S&P-500 Nasdaq

- 1.5% - 2.1% - 3.3%

___________________ __________________ _________________

Australian is set to open lower this morning.

Australian is set to open lower this morning.

Stock of Note:

Wellnex Life Impact Minerals Change Financial

(ASX: WNX) (ASX: IPT) (ASX: CCA)

0.023 AUD 0.014 AUD 0.085 AUD

0% 0% +3.66%

___________________ __________________ __________________

🇺🇸 US Market Overview:

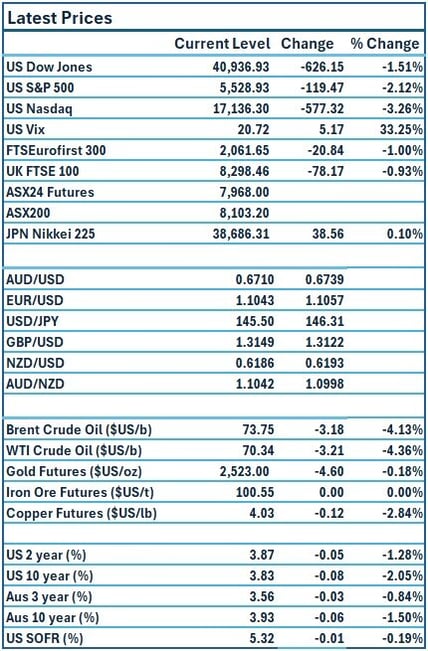

The Update: U.S. stocks slumped on Tuesday, at the start of one of the market's historically worst months, ahead of data likely to influence how much the Federal Reserve will lower interest rates. The benchmark S&P 500 index, Nasdaq Composite Index and the Dow Jones Industrial Average recorded their biggest daily percentage declines since early August. Nine out of 11 S&P 500 sectors fell, led by declines in technology, energy, communication services and materials. Source: Reuters

The Impact: Market sentiment weakened as Institute for Supply Management data on Tuesday showed U.S. manufacturing remained subdued despite a modest improvement in August from an eight-month low in July. The CBOE Volatility Index Wall Street's fear gauge that measures market expectations of stock market swings, jumped 33.2% to 20.72, the biggest daily percentage gain and highest close since early August. US government bond yields dropped on Tuesday. Source: Reuters, Commsec

🇦🇺 Australian Market Overview:

-

ASX futures were down 94 points, or 1.2 per cent.

- AirTrunk’s $23.5b AI pay day Blackstone emerged as the winning bidder in the year’s biggest merger and acquisition deal, netting its founder Robin Khuda a $1 billion payday. Source: AFR

- Can and glass bottle maker Orora has announced it is selling its North American packaging solutions business to Veritiv for $1.775 billion? Veritiv is an investee company of American private equity firm Clayton, Dubilier & Rice. Source: AFR

🇪🇺 European Market Overview:

European stocks closed lower Tuesday, continuing a lacklustre start to September trading. The pan-European Stoxx 600 index provisionally ended down 1%, with all major bourses and the majority of sectors in the red. US manufacturing data brought concerns about a slowdown in global growth back to the forefront ahead of an all-important US jobs report on Friday. Source: CNBC, CommSec

📈 Global Commodities Update:

- Global oil prices dropped almost 5% on Tuesday to their lowest levels in nearly nine months on signs of a deal to resolve a dispute that has halted Libyan production and exports. Source: CommSec

- The gold futures price fell US$4.60 or 0.2% to US$2,523 an ounce on Tuesday, pressured by a firmer US dollar. Source: CommSec

⚡ Global Renewable Energy News:

The United States and Australia have teamed up for the first time to help fund the next wave of critical minerals projects, as the US seeks to shore up non-Chinese supply chains and trade routes. The United States government financier, Reta Jo Lewis, said the one-stop shop will help Australian critical minerals producers and US companies access support from both countries.

It bolsters a push that Washington and Canberra have already unleashed in their own right on ASX-listed miners in a bid to create non-Chinese supply chains in sectors where China typically produces between 70 per cent and 100 per cent of global supply. Source: AFR

📬 Market Insight by James Whelan:

After a weekend in Melbourne filled with family time and unexpected footy excitement, I'm back with a lighter note today. The city never disappoints, whether it’s a stellar set shot in a suburban grand final or a perfect Father’s Day.

On the work front, don’t miss my latest podcast with David Scutt—it's a must-listen, especially for those keeping an eye on China. Plus, Wellnex Life’s FY24 numbers are in, showing impressive growth post-Pain Away acquisition. Stay long on gold as central banks continue to buy, and consider adjusting your portfolio as we move forward.

Introducing BPC Wealth Management

BPC Wealth Management is dedicated to shaping resilient investment portfolios, empowering you to achieve and sustain your financial aspirations. While the foundation of your portfolio focuses on long-term investments, through BPC, clients will be offered opportunities in equities trading and equity capital markets. This aspect is highly customised, allowing asset flexibility. Discover how our proactive and client-focused approach can help you achieve your financial aspirations by booking your discovery call with James Whelan.

Subscribe to our free Morning Market Report email newsletter to stay on top of the markets.

Share Link