Barclay Pearce Capital

- Jul 3, 2024

- 9 min read

The Morning Market Report - 03 July 2024

Receive daily market insights gathered from overnight equity data, top stories, companies in the press and market information.

Good morning,

Our team compiles this daily market report from global sources to highlight key market updates and what they mean for your investment portfolio.

Overnight Market Highlights:

![]() Wall Street finished higher overnight.

Wall Street finished higher overnight.

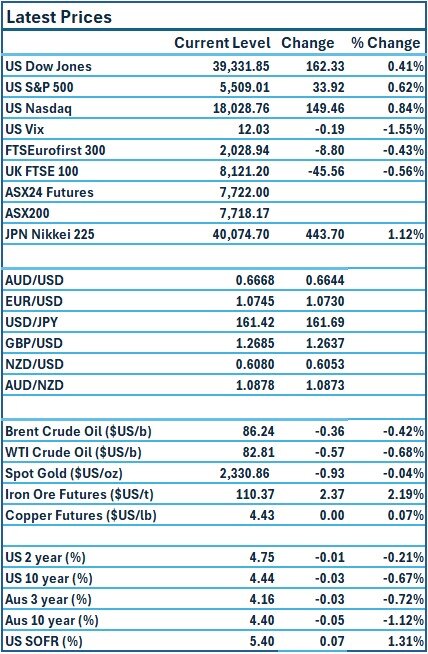

Dow Jones S&P-500 Nasdaq

+ 0.4% + 0.6% + 0.8%

___________________ __________________ _________________

Australian shares are poised to open higher.

Australian shares are poised to open higher.

🇺🇸 US Market Overview:

The Update: Wall Street's main stock indexes closed higher on Tuesday, boosted by gains in Tesla and megacap growth stocks, but volumes were thin ahead of the July Fourth holiday and the closely watched release of June nonfarm payrolls on Friday. The U.S. job openings and labor turnover survey, or JOLTS, showed job openings increased in May. Tesla surged to its highest level since the start of January after the EV maker reported a smaller-than-expected 5% drop in vehicle deliveries in the second quarter. U.S. Federal Reserve Chairman Jerome Powell told a panel that recent economic data represented "significant progress," though he noted that the Fed needed to see more before changing policy. Source: Reuters

The Impact: Investors initially flinched at stronger jobs figures before taking comfort from Fed Chair Powell's comments that highlighted the Fed's progress on inflation. Bond yields acted similarly, drifting higher in early trade and then moderating to finish lower as Jerome Powell recognised the Bank's progress on inflation. Source: Reuters, CommSec

🇦🇺 Australian Market Overview:

-

ASX futures up 19 points or 0.3% to 7722.

- Minutes of the Reserve Bank’s June gathering on Tuesday showed the board discussed two options when it left the key rate at 4.35%, noting the need to remain “vigilant” to upside risks to inflation. The RBA reiterated it was “difficult either to rule in or rule out” future policy moves. Market analysis from ANZ earlier this morning showed traders were pricing a 70% chance of a rate hike from the central bank before the end of the year. Source: AFR

🇪🇺 European Market Overview:

European stocks ended Tuesday in the red, as market participants assessed the euro zone’s latest inflation data. Headline inflation in the euro area dipped to 2.5% in June, the European Union’s statistics agency announced, in line with the expectation of economists polled by Reuters. However, the closely watched figures for core and services inflation remained stubbornly high, holding at 2.9% and 4.1%, respectively. Source: CNBC

📈 Global Commodities Update:

Global oil prices surrendered early gains that saw prices in the region of two-month highs on Tuesday. Sellers were encouraged by forecasts relating to Hurricane Beryl that suggested oil infrastructure along the Gulf Coast is less likely to be hindered by the storm's progress in coming days. In addition to the weather narrative, prices are being supported by the demand picture for the Independence Day holiday driving period with The American Automobile Association (AAA) predicting record holiday travel this year. Source: CommSec

⚡ Global Renewable Energy News:

NSW’s proposed renewable energy zone near Dubbo has become the first REZ in the country to secure planning approval, allowing construction to start on a venture capable of delivering 4.5 gigawatts of power this decade.

The milestone for the Central-West Orana zone, which involves 240 kilometres of transmission lines and supporting infrastructure, comes a day after the Australian Energy Market Operator released a $122 billion blueprint for the power grid to support the drive to net zero emissions by 2050. Source: AFR

📬 Market Insight by James Whelan:

In the latest podcast, James discusses why the Mag 7 stocks are justified in their positions and announces the BCP NRL TippingComp winner. Wellnex Life continues strong revenue growth with 40% gross margins. Insights from Scott Helfstien at the Global X Thematic Conference highlight US market strengths and justified valuations. French elections show National Rally at 34%, causing potential instability.

In the US, Trump’s chances strengthen, while Biden may be replaced. The S&P 500 has the potential for more all-time highs, and copper prices are turning favourable. Stay tuned for more updates.

A quick detour to announce the BPC NRL Tipping Competition!

Welcome to the BPC NRL Tipping Competition for 2024. The season has kicked off with a bang in the glittery lights of Las Vegas. Panthers are favorites to take the crown again but the Broncos look like a formidable opponent to take revenge from the heartbreak of 2023. BPC loves its footy and we're very excited for the season ahead. We also love to win stuff so please keep an eye out for the prizes on offer. Sign up and join the game!

Subscribe to our free Morning Market Report email newsletter to stay on top of the markets.

Share Link