Barclay Pearce Capital

- May 1, 2024

- 10 min read

The Morning Market Report - 01 May 2024

Receive daily market insights gathered from overnight equity data, top stories, companies in the press and market information.

Good morning,

Our team compiles this daily market report from global sources to highlight key market updates and what they mean for your investment portfolio.

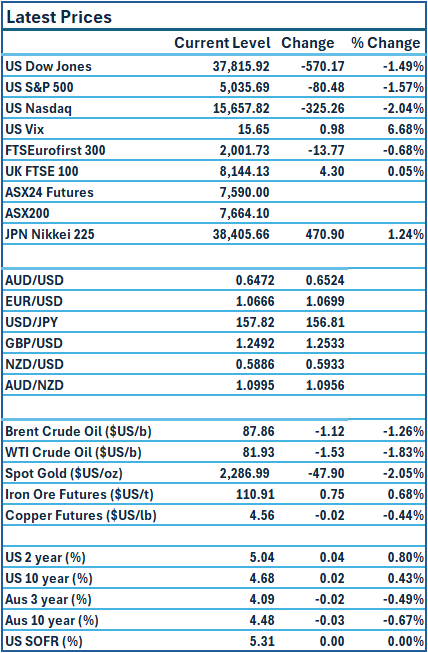

Overnight Market Highlights:

![]() Wall Street ended lower overnight.

Wall Street ended lower overnight.

Dow Jones S&P-500 Nasdaq

- 1.5% - 1.6% - 2.0%

___________________ __________________ _________________

Australian shares are poised to open lower.

Australian shares are poised to open lower.

🇺🇸 US Market Overview:

The Update: U.S. stocks ended lower on Tuesday as markets weighed economic data showing rising labour costs and deteriorating consumer confidence on the day of a key Federal Reserve policy meeting to decide the direction of interest rates. It was an ugly April for the major averages, with the Dow losing 5% for its worst monthly performance since September 2022. The S&P 500 slid about 4.2% this month, and the Nasdaq lost 4.4%. Economic data released showed US labour costs increased 1.2%, which was more than expected. Source: Reuters, CNBC

The Impact: The fall in equities overnight as well as the economic data released indicating sticky inflation, drove treasury yields up as expectations that the US Federal Reserve will delay the start of its easing cycle. Money markets are pricing in just about 31 basis points (bps) of rate cuts this year. Chair Jerome Powell is likely to sound cautiously hawkish on the economic outlook in his address on Thursday morning. Source: Reuters

🇦🇺 Australian Market Overview:

-

ASX futures were down 1.2 per cent or by 95 points.

-

Australian retail sales surprisingly fell 0.4 per cent in March as high-interest rates ate into household budgets. Data from the Australian Bureau of Statistics (ABS) on Tuesday showed retail sales fell 0.4 per cent in March from February when they rose 0.2 per cent. The consensus was for a gain of 0.2 per cent. Source: AFR

🇪🇺 European Market Overview:

European stocks closed lower on Tuesday and recorded their first negative month since October after a flurry of earnings and data weighed on investor sentiment. The regional Stoxx 600 index ended the day 0.6% lower, with all major bourses in the red. Source: CNBC

📈 Global Commodities Update:

Global oil prices fell on Tuesday on the back of rising US crude production, as well as hopes of an Israel-Hamas ceasefire. US crude output rose to 13.15 million barrels per day (bpd) in February from 12.58 million bpd in January in its biggest monthly increase since October 2021. Source: CommSec

⚡ Global Renewable Energy News:

Texas-headquartered Highly Innovative Fuels Global is backed by Porsche and wants to build a $1 billion synthetic fuels plant south of Burnie, Tasmania. The plant is one of several Australian proposals – using a range of technologies – that have the same goal: making a green version of diesel, methanol or aviation fuel that can be used in existing planes, ships and trucks without waiting for costly infrastructure needed to support hydrogen or battery-powered transportation.

Proponents of the plants say the ability to immediately substitute up to 100% – in the case of renewable diesel, for example – of fossil-based fuels with clean alternatives provides an opportunity for immediate action on emissions reduction. Source: AFR

📚 European Market Report by Jack Colreavy:

The UK market is abuzz from the takeover offer of LSE-listed Anglo American by BHP. The embattled Anglo has been seen as a takeover target for months due to its weak share price action but none were surprised that the offer was swiftly refused. Analyst expectations are for BHP to come back to the table with a better offer or the move may set off dominos for others to enter the fray.

One party who wouldn’t be particularly happy with the deal is the LSE. The exchange has been under pressure from a spat of delistings and losing IPO market-share to American-based exchanges. Taking another piece off the board will cause an impact on the FTSE 100.

📬 Market Insight by James Whelan:

Welcome to "The Theory of Thing Investment Podcast"! In this episode, join us as we explore the world of investment strategies with Plato long/short Alpha Fund Manager, David Allen. Discover valuable insights into navigating the markets with David's expert guidance. We'll also provide a comprehensive markets wrap-up, keeping you informed on the latest trends and developments. And for some fun, stay tuned for our footy tips segment, where we share our predictions for the upcoming games.

Tune in for an engaging discussion on investment strategies, market updates, and a dash of sports excitement.

A quick detour to announce the BPC NRL Tipping Competition!

Welcome to the BPC NRL Tipping Competition for 2024. The season has kicked off with a bang in the glittery lights of Las Vegas. Panthers are favorites to take the crown again but the Broncos look like a formidable opponent to take revenge from the heartbreak of 2023. BPC loves its footy and we're very excited for the season ahead. We also love to win stuff so please keep an eye out for the prizes on offer. Sign up and join the game!

Subscribe to our free Morning Market Report email newsletter to stay on top of the markets.

Share Link