Roberto Russo

- Dec 16, 2021

- 6 min read

Technical Analysis - 2022 Watchlist

Our Equities Trader, Roberto Russo, discusses Technical Analysis for your 2022 watchlist.

As Christmas approaches, brokers and fund managers start to finish up for the year and by index standards, take a “well deserved” break of an overall bullish 2021, even though it looked a tad unstable towards the end.

We are expecting some low volume trading in the lead up to Christmas. This typically provides everyday retail traders with an opportunity to capitalise on reduced selling pressure and prepare for the start of the new year.

2022 Watchlist Ideas:

Metcash Limited (ASX:MTS) Weekly Chart

From 2005 - 2010, MTS has been unable to break this significant level of $4.80. The Company was in a downtrend for some time until the Covid-19 crash brought it back to life. Since then, MTS has fundamentally revived its financials and been a strong talking point across equity markets.

We are watching closely here for a significant push into new highs in the coming months.

Imugene Limited (ASX:IMU) Daily Chart

Paul Hopper's baby, IMU, shows clear signs of repeatable patterns, as the new market high was followed by a slow decline for a short time before moving positively again. This setup may take time and patience but looks rewarding if it does play out.

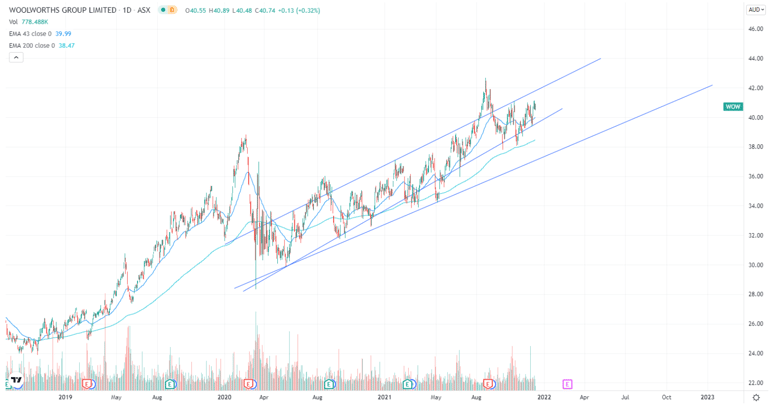

Woolworths Group (ASX:WOW) Daily Chart

The problem with technical analysis is that you can draw some fancy lines on the chart and form a bias opinion about a particular stock as shown below. You have two setups here that we are watching closely that could provide some strong volatility, either way, allowing traders to take advantage of both directions. The trend is your friend.

Summary

2022 is shaping to be a very volatile year on a macroeconomic scale, which in turn will be producing higher than normal market volatility and subsequently ripe opportunities for traders to take advantage of. We expect to have another busy year and I'm sure everyone is looking forward to a well-deserved break.

Feel free to contact me directly about any of the mentioned stocks or pop into our Adelaide Office!

Where to from here?

Trading equities is all about having access to the right investment opportunities and making decisions based on accurate, unbiased information. Often, this means hours of research on a daily basis, keeping up with several ASX announcements, understanding economy-impacting events and regularly consuming broader news updates. If you're not an equities trader by profession, then it can quickly become rather overwhelming, especially once you have built a considerable-sized investment portfolio.

Our Equities Trading team, backed by our independent research department is the ideal solution for said situation. Our clients receive access to exclusive investment opportunities, daily ASX research reports, our expert weekly outlook on the Australian markets and direct access to our equity traders.

Trading with Barclay Pearce Capital is about building long-term returns, trust, confidence and a mutually beneficial relationship.

Trading with Barclay Pearce Capital ensures the needs of investors of all magnitudes are met by our highly skilled and attentive trading professionals.

~ Trent Primmer, Director of Trading, Barclay Pearce Capital.

Share Link