James Whelan

- May 27, 2024

- 5 min read

Take a breath(er) and look at data centres - Market Map with James Whelan

New job, new firm but the same Free Whelan. Thank you for your continued support and keep unlocking valuable insights into the global market every week with me!

Firstly a check in on copper, which saw an amazing rally since February, but after the lunacy of the last few weeks we’re hesitant to charge in here.

A little tongue in cheek also but when every second podcast is about something then definitely don’t go rushing in to buy it.

Source: TradingView

Speaking of which, we actually did touch on it and much more on the Friday podcast. We also talk to the head of Team Travel and Logistics at the NFL team Las Vegas Raiders. A brilliant chance to catch up with someone tasked with the role of moving 180 people from one place in the US to another for a few hours and then move them back, fed and watered. An absolute work of wizardry, spoken as someone managing a team that sometimes finds it difficult to be in a meeting room for 15 minutes at a week’s notice.

Link here for the podcast with lots more goodies contained.

Speaking of which there’s a nice little explainer podcast that actually explains more of the direct reasoning for the spike. Search for the Goldman Sachs The Markets podcast and listen to their rep from the Commodity Sales and Trading Team, Adam Gillard discuss the arb that emerged between London and the US (LME & COMEX) in price. Then the arb really became more profitable as the prices of copper on the two exchanges moved further apart. Here’s the quote:

“Because the price differential between copper in the US and copper in Europe and Asia became so wide that in theory, physical participants could move physical copper between Europe and the US and make money. Thus, the paper arbitrage, so the difference between those two copper prices, should in theory narrow. So macro buying on the medium-term structural bull thesis caused the ARB to rally and that caused people who are short the arbitrage, so short COMEX and long LME to step out of their position, which resulted in further momentum buying.”

I went on Ausbiz last week and lad a little look at some names to get ready for the next wave. I still like Alma Metals but we’re putting together a basket of names we like this week and I’ll publish that when I get a few seconds to organise it.

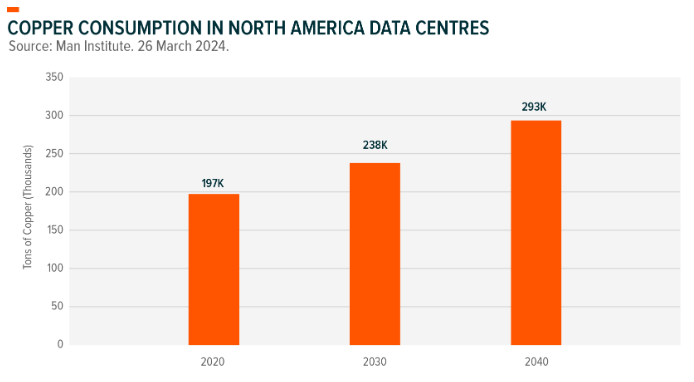

Source: Global X

Also, and this is from the recent newsletter from Global X, one of the big copper requirements is going to be (already is) in data centres. I’ve mentioned the data centre thing before but AI going exponentially exponential is a free kick for the increased demand on data centres and the power required to run them.

We are not ready.

Meanwhile, inflation is solved, get involved(er)

Tongue in cheek again with this one but the main gauge the Fed uses for inflation (core PCE ex food & energy) is expected to be low. See above.

Keep in mind we’ve been riding this dumb merry-go-round where inflationary data cycles between overheating and overheating slower.

Markets ebb and flow based on it and so much for the “sell in May” crowd because we’re a few days away from one of the best Mays THIS DECADE.

So if we have a little pull back then down be surprised and use it as a change to add. Also, this PCE number comes out on Friday, and if it’s hotter than expectations then expect swift profit-taking.

UGH

Finally Canva have just made an announcement. I’m not here to talk about that, but I was reminded as to how I will never work for big tech for just this reason.

https://x.com/dotnetschizo/status/1794548396239532445

Source: des - X

Dancers, rap singers, ugh.

Stay safe and all the best,

James

A quick detour to announce the BPC NRL Tipping Competition!

Welcome to the BPC NRL Tipping Competition for 2024. The season has kicked off with a bang in the glittery lights of Las Vegas. Panthers are favorites to take the crown again but the Broncos look like a formidable opponent to take revenge from the heartbreak of 2023. BPC loves its footy and we're very excited for the season ahead. We also love to win stuff so please keep an eye out for the prizes on offer. Sign up and join the game!

Share Link