Roberto Russo

- Dec 18, 2022

- 3 min read

'Recession Like No Other' says Blackrock

Trading Operations Manager, Roberto Russo, discusses how markets will perform during the anticipated recession.

Blackrock, the world's largest asset manager, is anticipating a unique recession unlike others we have seen in US history. This coincides with many other asset managers and interestingly enough some 'Finfluencers' in the industry, the most notable of the bunch being Robert Kiyosaki.

According to Blackrock, despite central banks appearing to do whatever it takes to combat inflation and many claiming it will be "the big one," markets may not be pricing in the predicted recession.

Let's look at how markets behave in times of recession now that the risk of one is present and it may be necessary to get inflation under control.

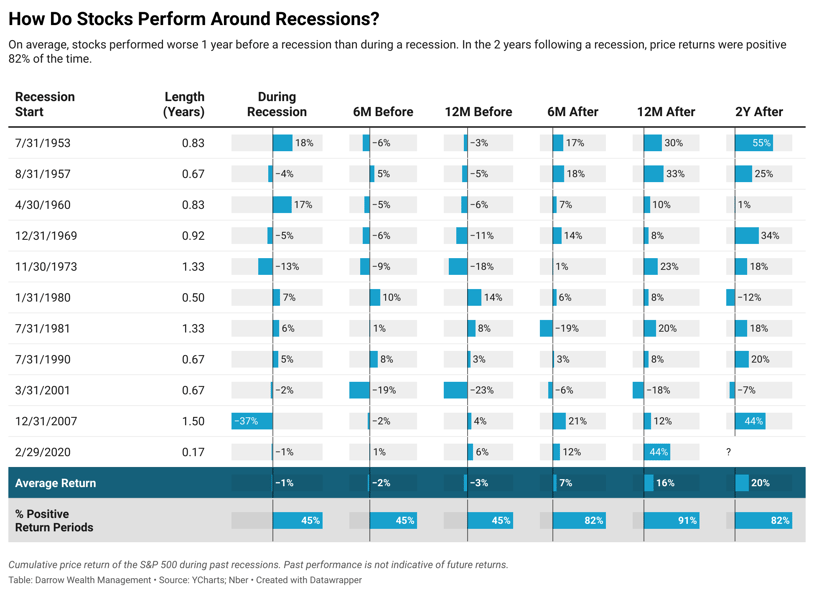

With history as a guide rather than an answer, this image from Forbes shows in detail what happens.

The market appears to feel the pain prior to recessions, being "Priced In" as the market is forward-looking, seemingly all hands on deck once the recession is announced. As many investors wait for signs of a recession to eventuate before investing in stocks they perceive to be "value," the phrase "Sell the rumour, buy the fact" could almost be used to describe their strategy.

This being said, anything could happen because past performance is never a reliable indication of future performance. A unique recession is potentially developing due to inflation and the ripple effects of COVID. Will we see the usual market rally after if or when it is announced? The market's volatility is currently offering investors unique trading opportunities, allowing them to buy and sell more frequently and introducing new perspectives for typical long-term investors. However, with the looming prediction that this recession will hit hard, trading during these times can be dangerous, but with proper guidance can be profitable.

Where to from here?

Trading equities is all about having access to the right investment opportunities and making decisions based on accurate, unbiased information. Often, this means hours of research on a daily basis, keeping up with several ASX announcements, understanding economy-impacting events and regularly consuming broader news updates. If you're not an equities trader by profession, then it can quickly become rather overwhelming, especially once you have built a considerable-sized investment portfolio.

Our Equities Trading team, backed by our independent research department is the ideal solution for said situation. Our clients receive access to exclusive investment opportunities, daily ASX research reports, our expert weekly outlook on the Australian markets and direct access to our equity traders.

Trading with Barclay Pearce Capital is about building long-term returns, trust, confidence and a mutually beneficial relationship.

Trading with Barclay Pearce Capital ensures the needs of investors of all magnitudes are met by our highly skilled and attentive trading professionals.

~ Trent Primmer, Director of Trading, Barclay Pearce Capital.

Share Link