Barclay Pearce Capital

- Jul 8, 2024

- 5 min read

On the biggest risk to markets right now and clown shoes - Market Map with James Whelan

New job, new firm but the same Free Whelan. Thank you for your continued support and keep unlocking valuable insights into the global market every week with me!

A little chart storm for your week ahead. But firstly, if I may say Heath and I put on one of the sharper podcasts. Nice and concise with lots of laughs as well. We track some of the bigger questions out there in markets and in life.

Link here and please rate and subscribe, it helps more people find the show.

France

Must say I was a little off in my thinking that the National Front would have a bigger percentage of the second-round vote. Looks like the centre/left seems to have staged a valiant defence. France now appears in gridlock, as expected. The majority left-wing equals negatives for the banks. Trade accordingly.

UK

As expected. Who’d have thought that Cameron calling for a Brexit vote, losing, retiring when the UK needed leadership the most and handing it over to a progressively more ludicrous group of out-of-touch halfwits would have led to the biggest defeat in Tory history. David Cameron has a lot to answer for.

Hold the line in Europe. It’s stable at least.

USA

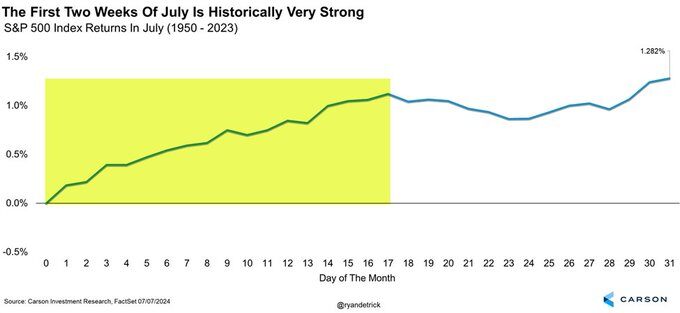

And so we settle into the seventh month of the year and a market that continues to stretch higher. No reason for it not to carry on with seasonality doing its thing.

Source: Carson Investment Research, FactSet 07/07/2024

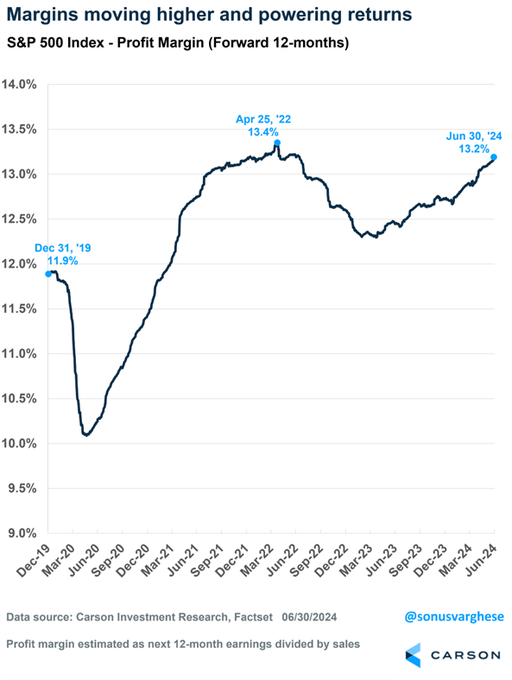

A few weeks ago I mentioned that you can invest in the US for the long term due to the simple fact that margins are expanding and margins, as we know, are everything. The era of AI adopters is upon us, expect margins to continue to grow.

Source: Carson Investment Research, FactSet 06/30/2024

We also celebrate the 2 year anniversary of the US 2s/10s yield curve inverting. It’s meant to be recessionary. It’s been 2 years.

Maybe the office vacancy rate approaching 20% is what we should be looking at.

As usual, I don’t think “the next big one” is in things we can see. I hate looking for negatives but someone asked and so I present now the greatest blow-up risk to markets: private credit.

I have noticed over the last few months the increase in offers from Instos and retailers to find and participate in new private credit products and investments. Fair enough, too. Rates where they are and borrowers need to find alternate forms from the risk-adverse banks.

ESG plays a part too, with lenders unable to provide credit to coal and oil, private is able to step in and there are some great deals there.

I just feel that the actual investments can be opaque, managers are not aligned with investors as well as they could be, assets are not marked to market, and the massive increase in the size of this investment class just screams ‘dumb money.’

Beware this space.

Copper

Last week I showed a note about Chinese stockpiles of copper coming off. It was small but enough to offer a small toe back in the water of copper markets.

I’m happy to say that far more confident now with the continuing drop in the USD. Copper is having a great run.

Buy on big dips.

Source: StockCharts.com

Finally, we are at the turning point, probably.

June was the first month since the dark days of COVID-19 that no central bank hiked rates.

Source: BofA Global Investment Strategy, Bloomberg

Almost 4 years of some sort of hiking going on and now nothing.

We wait. I actually believe the US inflation is far lower, or disinflationary, than a lot of pundits admit and as such I’m happy to be even longer US treasuries with a yield decline to be more pronounced than anticipated.

Source: BBC News

Source: BBC News

Good luck, PM, big clown shoes to fill.

All the best and stay safe,

James

A quick detour to announce the BPC NRL Tipping Competition!

Welcome to the BPC NRL Tipping Competition for 2024. The season has kicked off with a bang in the glittery lights of Las Vegas. Panthers are favorites to take the crown again but the Broncos look like a formidable opponent to take revenge from the heartbreak of 2023. BPC loves its footy and we're very excited for the season ahead. We also love to win stuff so please keep an eye out for the prizes on offer. Sign up and join the game!

Share Link