Barclay Pearce Capital

- Sep 9, 2024

- 6 min read

On Specific Dates and Being Angry in Australia - Market Map with James Whelan

New job, new firm but the same Free Whelan. Thank you for your continued support and keep unlocking valuable insights into the global market every week with me!

Top of the afternoon to you and here’s to a wonderful opening of the finals weekends for AFL and NRL ahead.

Swans managed to get it done in just the right amount of time vs a worthy Giants opposition. I never doubted them for a second and it really brought home something I tell the girls at home that there’s only one point in time that matters if you’re ahead and that’s after the siren sounds.

Until then never drop your head.

Not dropping the head is imperative to my life for the next few weeks as we not only rumble along towards the formal launch of a wholly integrated Wealth Management solution but I’ve also decided to test myself on a #BackJimmy rugby union/league challenge. It certainly has my focus, and having a 250 game/Australian Kangaroos rep/all-time great Centre rumbling towards you as you wait for the high ball to arrive is certainly a good way to get my attention.

Links here to the clips we’ve managed to capture.

The point of it all is that if I, a complete amateur, can be surrounded by experts the help me on the way to becoming competent in the game, then surely we, experts in our field, can get any amateur up to speed on the management of their portfolios. I have the utmost confidence I am correct about both theories.

Can’t put it off any longer

I’ve stalled as long as I can and I can’t put it off any longer. The market…she’s not so good.

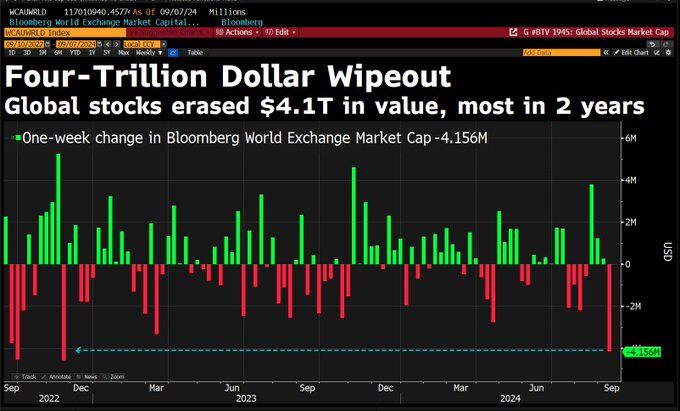

In last week’s note from the Windy City, I mentioned September was traditionally weak and with the look of the market it seemed prudent to reduce exposure. We also cover it in the Theory of Thing podcast recorded Friday which has all the figures you require. Link here.

Source: Bloomberg

“reduce exposure” was a slight understatement.

If we take a look back to pre- Jackson Hole days we had a lot of panic about the Sahm Rule being triggered. As a reminder, it’s when…you know what let’s just get the definition from the St Louis Fed:

“Sahm Recession Indicator signals the start of a recession when the three-month moving average of the national unemployment rate (U3) rises by 0.50 percentage points or more relative to the minimum of the three-month averages from the previous 12 months.”

So, a sharper increase in the unemployment rate moving average over the shorter term as compared to the longer term.

Source: Sahm, Claudia, National Bureau of Economic Research, Game of Trades

It’s finally been triggered and it has a 100% record of predicting recessions.

So, despite the current pricing and commentary around it, I believe there’s a real chance that 50bps comes to the fore. “If the Fed goes 50 it means there’s something really wrong”.

It won’t be this time but I’ll up the chances of chatting around one later in the year. By then things will start to shape up as not looking so grim. Which they aren’t.

I’ll very rarely, if ever, call for panic. The Fed has wiggle room.

Regarding our strategy, there’s always a chance to do some buying and since we’re all about long-term investing here there’s a lovely chance to add.

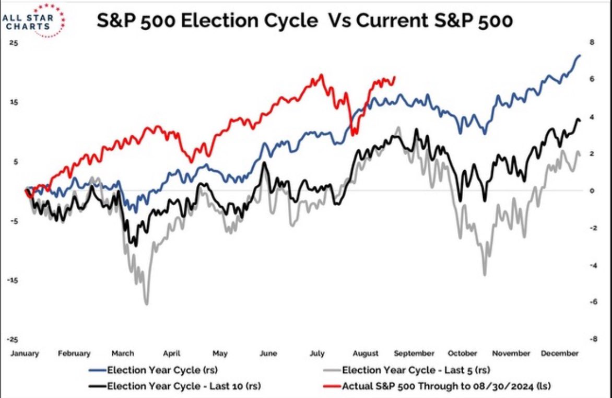

I mentioned the above over the weekend and someone asked me when? You want a date? Fine…

October 8th 2024

Wow, that was easy.

Source: All Star Charts

But if you think there’ll be a recession then leave it a few weeks later.

But seriously no one can pick the date. But if you have cash on the sidelines then it might be an idea to push some in around that date.

And be careful about the Mag 7 being bought purely for the old AI reasons. At least if your idea of AI is people using Chat GPT (which it isn’t. This chart is still something though)

Source: Similarweb, Data compiled by Goldman Sachs Global Investment Research

And if it feels like you’re in a personal recession here in Australia then you are correct. I can’t write about it because it makes me too angry.

Source: MacroBusiness

Could be time to become ungovernable.

All the best and stay safe,

James

Introducing BPC Wealth Management

BPC Wealth Management is dedicated to shaping a resilient investment portfolio, empowering you to achieve and sustain your financial aspirations. While the foundation of your portfolio focuses on long-term investments, through BPC, clients will be offered opportunities in equities trading and equity capital markets. This aspect is highly customised, allowing asset flexibility. Discover how our proactive and client-focused approach can help you achieve your financial aspirations by booking your discovery call with James Whelan.

Share Link

-BPC%20Desk%20Note.png?width=767&name=Castile%20Resources%20(ASX-CST-OCTQB-CLRSF)-BPC%20Desk%20Note.png)