James Whelan

- Aug 5, 2024

- 5 min read

By the time you read this it'll be something else entirely - Market Map with James Whelan

New job, new firm but the same Free Whelan. Thank you for your continued support and keep unlocking valuable insights into the global market every week with me!

One of those days when I’m happy not to be sleeves up in the pits trading anymore. Definitely happy not to be doing the overnight thing managing money on a discretionary basis.

However, when called upon to write a weekly note you can’t make it too specific to time when there’s volatility like we’re seeing now.

As I write this on Monday mid-morning the Japanese market has triggered a circuit breaker, meaning it’s fallen so sharply so swiftly that it needs a breather.

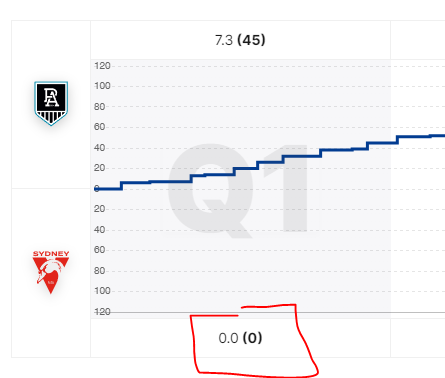

The Swans could have used that sort of thing to help them against Port on Saturday. Hang on that’s what the first quarter break is for.

But I digress.

We zoom out and review the plan we’ve set over the last few weeks, and not to crow but we have been saying the market looks expensive for a while and best to see how the Mag 7 handles the “show me” part of the AI story after overcooking the “tell me” part.

Source: FactSet

Currently 20.7x, just above the 5-year and well above the 10-year averages. Note these numbers may be wildly different by the time you read this.

Long story short: wait.

Fed Rate cuts and where the yen comes into it

As the master of the 10-word explainer, I’ll have a tilt at why and what….

The Yen has been so cheap to borrow for so long that it’s been borrowed heavily to fund other “things” (bear with me)

Now that the carry trade that this entails is no longer the case, with Japan on a hiking strategy and the US and the rest of the world on a cutting path, along with a string of weak economic data from the US and the mega-tech stocks not reporting the perfection, everything is being unwound.

This has sent Japan into an official bear market with nowhere to hide for now. It’s also summertime in the US so desks are thin, there’s a closer-than-expected election in the US in a few months and there’s a war coming, apparently.

So bad news is, strangely enough, being treated as bad news.

Heath and I cover it extensively on the podcast which we recorded on Friday last week. Link here.

We also talk about the ongoing theme we’ve had of hiding outside the bigger end of the market to ride this out.

Technicals

When in doubt, chart it out

Source: TradingView

I’ve drawn some hilariously rudimentary lines of support for the top 100 companies on the Nasdaq.

One line is potentially about to get broken, which then brings the next into play and the next potential.

Don’t forget we’re looking to find our entry to get set for life on the biggest and best stocks on the planet, if you’re looking for reasons why have a look at my thematic work of the last few months.

These companies are mostly (he says) immune to economic calamities over the long term.

Gold?

In an unwind scenario correlation goes to 1. Everything gets sold. Sometimes things that should be bought are getting sold to fund positions that aren’t looking good. Gold is one of those things today.

Remember last week (and the week before I think) we said it’s always good to have a little gold in your portfolio. It hit a new all-time high and there’s no reason to stop the music with all the things I just talked about.

Have a look at the GOLD ETF. One of the first ETFs I ever knew about when I first started as a junior assistant in broking decades ago.

Happy to be a buyer on little pullbacks.

Source: TradingView

Aside from that, there’s not really much else to say.

Historically when the Fed starts cutting rates the damage is already done and the market, on average, performs badly.

Wait for the sugar rush to hit, the narrative to change and make very bold, confident buys of quality.

And then don’t look at it every day.

Stay safe and all the best,

James

A quick detour to announce the BPC NRL Tipping Competition!

Welcome to the BPC NRL Tipping Competition for 2024. The season has kicked off with a bang in the glittery lights of Las Vegas. Panthers are favorites to take the crown again but the Broncos look like a formidable opponent to take revenge from the heartbreak of 2023. BPC loves its footy and we're very excited for the season ahead. We also love to win stuff so please keep an eye out for the prizes on offer. Sign up and join the game!

Share Link