James Whelan

- Apr 8, 2024

- 5 min read

On Melbourne and Nice Weather - Market Map with James Whelan

New job, new firm but the same Free Whelan. Thank you for your continued support and keep unlocking valuable insights into the global market every week with me!

Back from the disjointed few weeks that is Easter week as I crammed 3 weeks' worth of work into the first 4 day week and then was on a company roadshow in Sydney/Melbourne for the second week. Takeaways include:

1) Melbourne was slower than expected in foot traffic. My wife informed me this is because Victoria was on school holidays post-Easter. So...duh.

2) Despite this we still managed to fill the room in Melbourne and I might say the restaurant Society was amazing to us and our guests.

3) Invion (ASX: IVX) has a brilliant story to tell, updated with details of impending Phase 1 clinical trials. We put a few things together on it and if you get the chance have a listen and make your own mind up. Link here. **I am obviously biased by this story because we're working with them on this and just spent a week with them but it's still fascinating.**

4) Finally the weather in Melbourne was delightful. More delightful than Sydney last week.

El Nino?

On that note, I'd like to make an apology for my conviction call on how dry it was meant to be this year. I was misled by the BOM and my calls to hoard water were a little premature. That rain in Sydney over the weekend was something else.

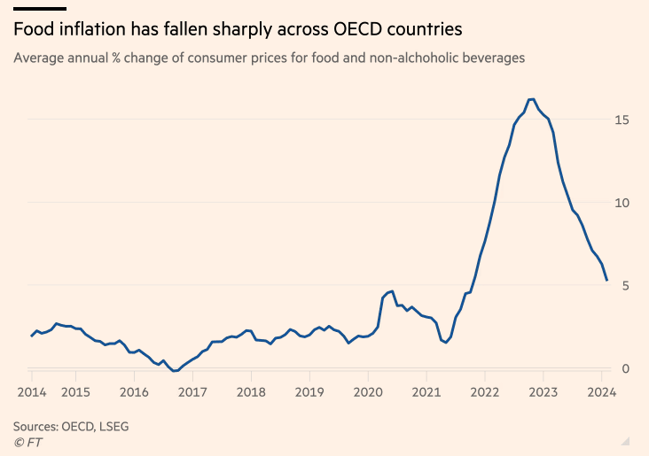

Regular readers would know that some of my all-time best investment themes involved being long food companies with the drought in the northern hemisphere a few years ago, then with Covid and the war in Ukraine this really ramped up. My famous "Fleisch est zu billig" note is still spoken about today. Here is the latest on food inflation which is a relief for shoppers everywhere.

Source: OECD, LSEG

Looks like we're well and truly on the other side of that mountain. The lag for this is a while so expect cheaper prices over the coming year. Outstanding.

Hydrogen

A few weeks back our Head of London and general renewables guru sat down with me for a chat about hydrogen and the movements ahead in the space. I really do believe it is the way forward for commercial transport and am really starting to embrace it for passenger transport. The only piece of the puzzle is the infrastructure to support it. Link here to the video

Gold

A mammoth break upwards to fresh highs for gold. As everyone knows I've got a liking for gold but have never really got the hang of why it moves. Somewhere between sentiment and the sentiment of sentiment. Or, as I postured once a few years ago, the price of gold is decided by "goodwill and unicorn farts". We turn to the best around to give us a summary of what's going on. Chris Weston of Pepperstone fame has a wrap-up of what's driving it. Link here

Again, there are a lot of gold stocks out there and to name a few here would put me offside with all the others. message me for a few names.

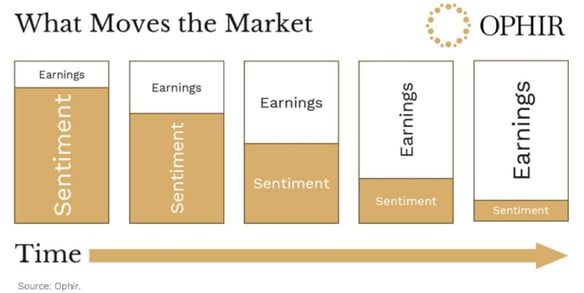

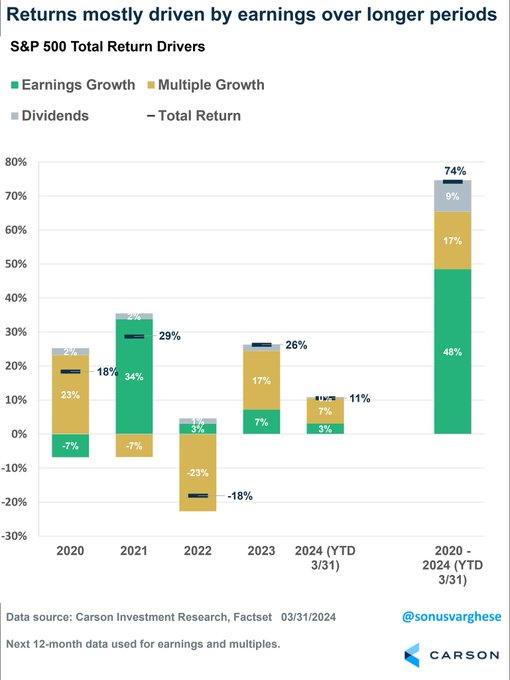

Finally, we head into US earnings again (seriously!!) and expectations from the market for 4% earnings growth. A reminder that not only are earnings the most important thing in long-term investing but they have actually underpinned much of the Covid-now "bubble" so many players call this.

Source: OPHIR

Source: THE SHORT BEAR - X

Good luck and stay safe,

James

A quick detour to announce the BPC NRL Tipping Competition!

Welcome to the BPC NRL Tipping Competition for 2024. The season has kicked off with a bang in the glittery lights of Las Vegas. Panthers are favorites to take the crown again but the Broncos look like a formidable opponent to take revenge from the heartbreak of 2023. BPC loves its footy and we're very excited for the season ahead. We also love to win stuff so please keep an eye out for the prizes on offer. Sign up and join the game!

Share Link