James Whelan

- Mar 3, 2025

- 5 min read

February seasonality, consumer skittishness and Vegas stimulation - Market Map from James Whelan

New year, new insights but the same Free Whelan. Thank you for your continued support and keep unlocking valuable insights into the global market with me!

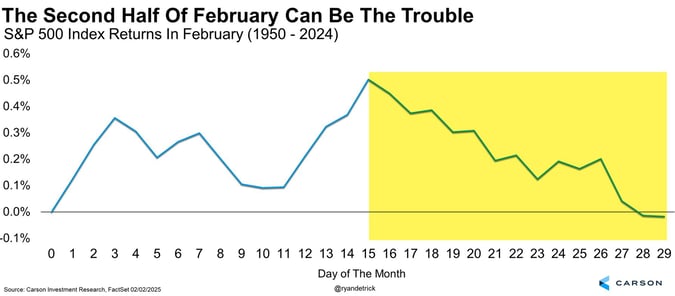

Starting with the seasonality side of things after a reasonably bad February and it turns out my bearish tilt on vals actually had years of history behind it too.

Source: Carson Investment Research, FactSet 02/02/2025

The second half of February is usually pretty bad. Speaking of the whole quarter, it’s usually weak after a Presidential election year.

Source: Carson Investment Research, FactSet 02/02/2025

So don’t expect much more from March that will change your life.

Is it a good time to buy? Usually, when confidence is down, it’s a great time to add to positions, and the headlines around confidence are pretty grim.

The GS panic Index is at a level not seen for a while.

Source: Goldman Sachs

And our treasured mega-tech stocks are at a place to start lining up…

Source: Reddit

Most oversold since August last year.

And the big news last week was the AAII Sentiment Survey vs S&P 500 5-years.

Source: AAII, Market Index

Source: AAII, Market Index

This is a chart of the bullish./bearish sentiment in a survey conducted by the American Association of Individual Investors (AAII) and asks the question of whether expectations stocks will rise or decline over the next six months. It’s returned the biggest bearish jump since August 2019 (when we were lining up for a simple inverted bond yield recession and Covid hadn’t been invented yet) and the highest reading since September 2022 (the “bottom of the 'everything has crashed' bear market)

I like the above chart because it’s overlaid with the main index of the US market. If nothing else, it shows that when the market is oversold and retail sentiment is tragically bearish, it’s time to back the truck up and get set.

The Global X FANG ETF (FANG.ASX) is ready to be bought. Meta, Crowdstrike, Apple, Amazon.

All the family, back together.

Economies and markets are not linked, so I can mention that the US tech is coming around to be a bit of a buy and also that the US economy is anecdotally quite weak.

Listening to the Animal Spirits podcast and they made reference to the apparent fact that for every one Federal employee, there are two external consultants attached to them.

So, the numbers, when you hear them, of how many Federal employees have been DOGE’d, the actual affected number is far worse.

With so many Aussies over in Vegas for the NRL, there’s two stories coming out.

The first is that Vegas is so far away from getting back to its 2007 peak.

+ Image: a video of Vegas

Source: vanko - X

And that being said…

+ Image: a photo of NRL field

Source: Sports Freakshow - X

The away contingent did its part to stimulate the economy.

I won’t delve too far into whatever that debacle was between Trump and Zelinsky, but I can tell you that the second there’s anything resembling a peace deal, oil will drop and airlines will get a great rally.

Act accordingly.

All the best,

James

Introducing BPC Wealth Management

BPC Wealth Management is dedicated to shaping a resilient investment portfolio, empowering you to achieve and sustain your financial aspirations. While the foundation of your portfolio focuses on long-term investments, through BPC, clients will be offered opportunities in equities trading and equity capital markets. This aspect is highly customised, allowing asset flexibility. Discover how our proactive and client-focused approach can help you achieve your financial aspirations by booking your discovery call with James Whelan.

Share Link