James Whelan

- Feb 17, 2025

- 7 min read

On Little Tariff's Diabetes, China, Eggs and Swamp Draining - Market Map from James Whelan

New year, new insights but the same Free Whelan. Thank you for your continued support and keep unlocking valuable insights into the global market with me!

Another fortnight with lots going on, some of it the same and some of it refreshingly new and interesting.

To start, Wellnex are running a rights issue at the moment which, if completed, finally shakes off the last of the debt and the deferred payment for Pain Away, while clearing the runway for take-off for a London dual listing. There will be a shortfall which we’ll be picking up so if there’s any interest or further questions please let me know. $9m has already been committed by London Brokers which is amazing for a few days in.

Here’s our little desk note on the recent Chemist Warehouse merger/listing and how it impacts Wellnex. Link Here

Little Tariffs are starting school

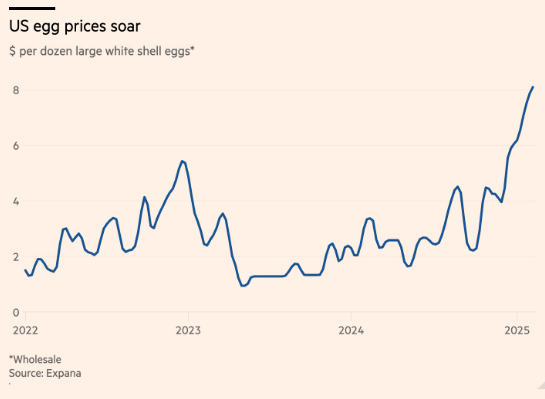

Re tariffs I’m fairly close to pulling that prank I ran on the media back in Trump’s first term when I convinced people that “Tariff” had become the second most popular baby name in the USA. It sounds so plausible! Little Tariffs would be starting Year 2 this year, unable to start their day with a proper breakfast though, because of eggs.

Source: Expana

And now that RFK is Secretary for Health it’s going to be back to healthier food choices for all.

This would mean less diabetes, which China apparently developed a cure for a while ago but the US medical industry isn’t talking about it because of the amount of money in insulin sales.

Source: Cell

It’s been said a few times and I agree wholeheartedly that if people just ate properly and exercised regularly the US market would halve overnight.

Inflation

There’s big conversations going on in the US about inflation rearing its ugly head again. We mention it on the podcast recorded this Friday just passed and it’s worth a listen as always. Link here.

Two data points out of the US and both told different pictures. The bond market flipped one way to excess and then back again the night after.

The flow into TIPS (Treasuries hedged for inflation) is the highest in three years. The market thinks inflation is a thing.

Source: BofA Global Investment Strategy, EPFR

I’m on the record that Trump's policies have no clear path to inflation or disinflation/deflation, however, if one were to take a side then yes inflationary is more probable.

This takes me back. There’s an ETF in the US that is filled with inflation beneficiaries:

Property, oil, and stock exchanges. All the favourites.

This trades with the code INFL in the USA and is the type of thing accessible via our platform service. Sing out if you’d like to know more.

Vals…

On valuations, we check in on where the market is sitting…

Source: FactSet

Source: FactSet

The forward 12-month P/E ratio for the S&P 500 is 22.2. This P/E ratio is above the 5-year average (19.8) and above the 10-year average (18.3).

So expensive yes.

Speaking of valuations my distraction is Europe and a wonderful podcast put together by J.P Morgan on European data and all things economic. The quote that jumped out for me, off the transcript (Bold highlight is mine):

“However, the strongest case for European equities is simply a value case. At the end of January, the MSCI Europe ex-UK had a forward PE ratio 14.7 times compared to 21.8 times for the S&P 500, a discount that is more than two-stand deviations greater than its average over the past 20 years. It also supported a dividend yield of 3.3% compared to 1.3% for the S&P 500.”

From Notes on the Week Ahead: Europe: The Slow and Steady Train, 10 Feb 2025

https://podcasts.apple.com/au/podcast/notes-on-the-week-ahead/id394242270?i=1000690804444&r=594

That’s something significant.

My first wife…

I had mind to write about China, after seeing that a string of 13Fs came out with some sizable holdings in China, and seeing that BABA had its first weekly close above the 200 day Moving Average since July 2021 makes my eye flinch. Long time readers know my career long battle with getting China right. If I had a dollar for every time I thought “this time it’s finally the time for China” I’d be writing this email from a yacht with my first wife.

Long time readers also know that I call my current and only wife “my first wife” because I know how funny she secretly thinks it is.

So is now the right time for China? Sure…why not? Technically always is the right time if you have a long enough view.

Draining the swamp…

Finally, there’s something very interesting going on in Washington that relates to jobs, deficits, US savings, property and a host of other things.

Here’s some Google search trends from DC.

Source: Libs of TikTok - X

“Criminal Defense lawyer”, “wire money”, “lawyer” are trending up.

Jobless claims in Washington are up 55% over the last six weeks.

Source: The Kobeissi Letter - X

Property inventory is up 23% Year on Year.

There really is something going on over there directly related to Trump 2.0 and DOGE. Rats leaving the ship?

All the best and stay safe,

James

Introducing BPC Wealth Management

BPC Wealth Management is dedicated to shaping a resilient investment portfolio, empowering you to achieve and sustain your financial aspirations. While the foundation of your portfolio focuses on long-term investments, through BPC, clients will be offered opportunities in equities trading and equity capital markets. This aspect is highly customised, allowing asset flexibility. Discover how our proactive and client-focused approach can help you achieve your financial aspirations by booking your discovery call with James Whelan.

Share Link