James Whelan

- Apr 15, 2024

- 7 min read

On Inflation hacks, Seinfeld and Aussie debt - Market Map with James Whelan

New job, new firm but the same Free Whelan. Thank you for your continued support and keep unlocking valuable insights into the global market every week with me!

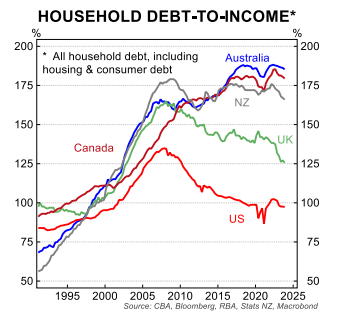

Hi all and happy turn of the month when apparently everything goes back to bullish normal.

Source: Carson Investment Research, Factset 04/11/2023

A few things going on at the moment. The project I’ve been working on for the last few months is now at completion and we are now moving clients onto a platform with an allocation to various products that weren’t possible to be accessed before. It’s nice to see things through to completion and help people get to where they need to be.

The podcast on Friday was a belter. We had David Sokulsky, CIO of Carrera Capital talk all things markets and football.

Link is here if you want to listen but we get around China, the US and domestic markets.

Also, at the back end, I get the chance to have a catch-up with one of the greats of the game and Tigers Assistant Coach, Robbie Farah, to talk about who’s hot and who’s not in the League so far this year, along with the announcement of the winner of the first leg of our NRL tipping comp. $500 is a good prize for tipping. Link here to join and you can still win lots.

It’s nice having David on the podcast once in a while. He’s a great guy and his opinions don’t often track the herd. One of the things we mention about markets is US inflation being very much still untamed.

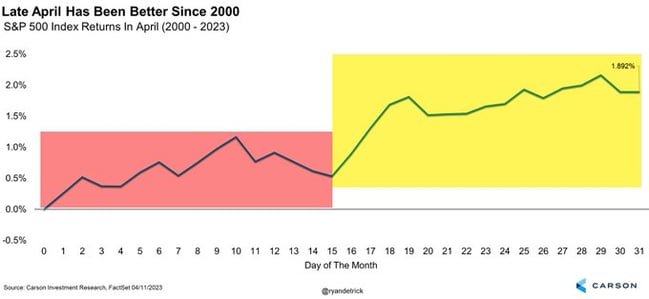

What’s painful in the whole core vs non-core numbers and how much is excluded from presented numbers?

Many economists will say I’m unqualified to say this, but then again, many economists are like this guy…

Source: Paul Krugman - X

Krugman is a hack but it’s an example of how much inflation gets reported to regular people that doesn’t tell the whole story. Central Banks can remove things from the Inflation numbers but we can’t. Cost increases in the energy market do trickle down to everything else we do. Same as rent, the same as food.

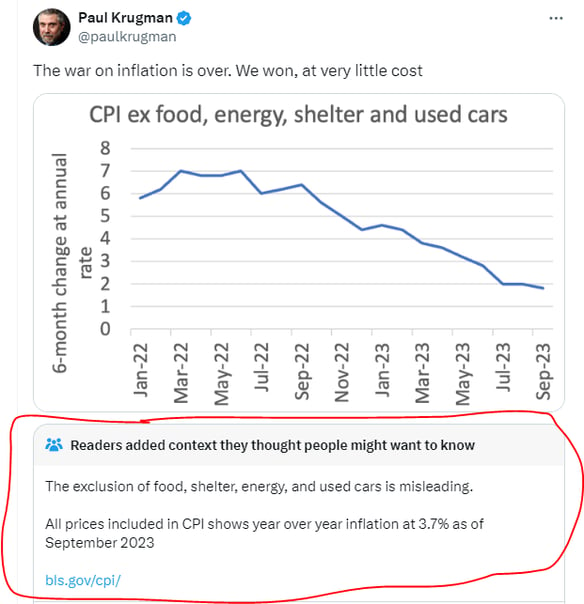

Any Seinfeld fans out there know the great “write-off” gag they did, and some genius reworded it for the loons on Financial Twitter as a dig at Krugman.

Source: BuccoCapital Bloke - X

Actual Numbers

This is from the Kobeissi Letter, who are perennially bearish but still speak the truth.

“Core services less shelter inflation is a key metric that the Fed follows, also known as SuperCore inflation. In March, this metric jumped by 0.7% month-over-month, the biggest jump since September 2022. SuperCore inflation is now up 5.0% year-over-year, its highest since April 2023. This comes after multiple monthly increases since the 2023 low. Meanwhile, headline CPI inflation is up for 2 straight months for the first time since September 2023. All while real wage growth is turning negative again. The fight against inflation is far from over.”

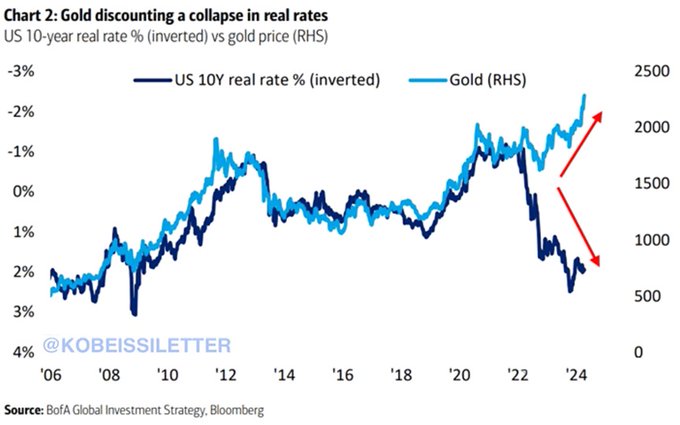

I agree, that inflation is far from over in the USA. Rates will remain higher for longer. Theoretically, this means gold should be sold off. However, as mentioned last week gold doesn’t make any sense.

Source: BofA Global Investment Strategy, Bloomberg

Source: BofA Global Investment Strategy, BloombergWhat about the best country in the world, Jimmy James?

As for here, I’m happy to put my boot on the table and join CBA’s Gareth Aird in his rate cut call. Lower much sooner.

Here are some good bits from his note late last week, which can be found here Issues-12-Apr-2024-0910-1.pdf and I’m responsible for the highlighting.

- Fiscal policy is also a lot tighter in Australia compared to many other jurisdictions. Australian households have handed over an increasing proportion of their income to the fiscal authorities (this has largely ‘repaired’ the Budget).

- The upshot is that consumer spending per capita in Australia has fallen materially since Q4 22 and further falls are anticipated over H1 24. Our outcomes sit in stark contrast to the US consumer. Lower consumer demand will mean lower inflation.

- Our base case sees the RBA commence an easing cycle in September 2024 and we look for 150bp of policy easing by mid‑2025.

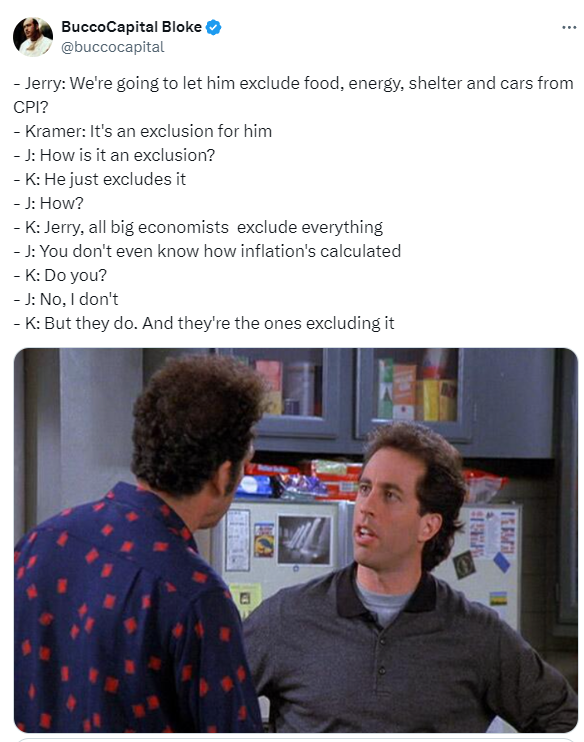

And one of the charts in a whole list of amazing charts that, if you’re feeling drowsy, will wake you up like a slap in the face.

yikes

Great time to refi your house at a variable rate if you agree it will come down over the next 12 months. I guess going long Aussie bonds at the short end should work too if you’re into that sort of thing.

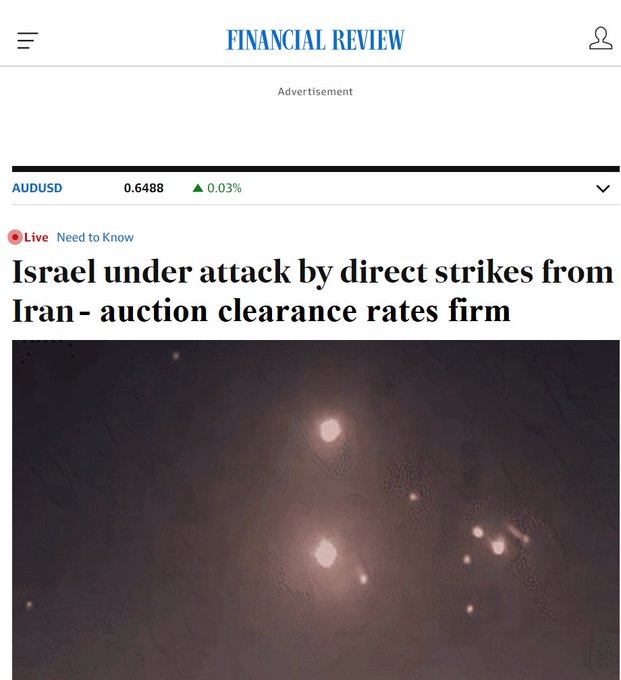

Source: Financial Review

Source: Financial ReviewSpeaking of which, it’s good to know the Fin have their priorities straight.

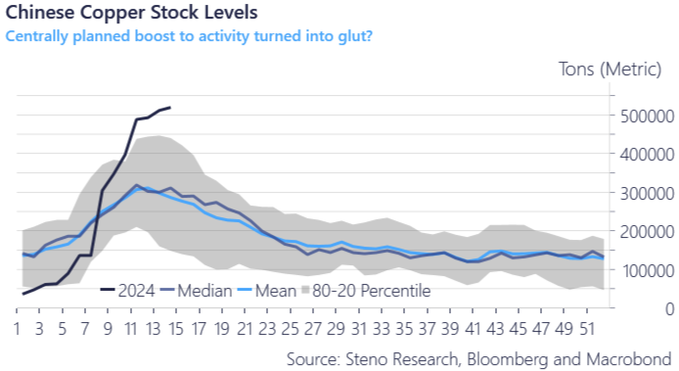

Finally, and I should always mention copper. Copper keeps rallying. You should pay more attention. We like Alma Metals for copper exposure (ASX: ALM)

Source: Steno Research, Bloomberg and Macrobond

China is getting set for some kind of second half of the year and I’m fearful the world is underprepared for it.

Act accordingly.

Good luck and all the best,

James

A quick detour to announce the BPC NRL Tipping Competition!

Welcome to the BPC NRL Tipping Competition for 2024. The season has kicked off with a bang in the glittery lights of Las Vegas. Panthers are favorites to take the crown again but the Broncos look like a formidable opponent to take revenge from the heartbreak of 2023. BPC loves its footy and we're very excited for the season ahead. We also love to win stuff so please keep an eye out for the prizes on offer. Sign up and join the game!

Share Link