Barclay Pearce Capital

- Sep 2, 2024

- 5 min read

On getting excited at random football games and 60/40 portfolios - Market Map with James Whelan

New job, new firm but the same Free Whelan. Thank you for your continued support and keep unlocking valuable insights into the global market every week with me!

Light on the note due to being in Melbourne on a windy Monday putting together a few things for the branch office.

Had the most delightful weekend here in the windy city with my eldest needing to audition for something in the outer suburbs and my wife thinking it’d be neat to all travel together for Father’s Day/our Anniversary. Lunch at the Sandringham Hotel and then back to the burbs and what do I find but a random U16 Div 2 Grand Final! I didn’t stick around until the end but it really looked like Port South was getting the job done over Prahan. I was lucky enough to be in the box seat for what might be one of the calmest and best-set shots in Div 2 suburban footy history. So good I had to tweet it. (I get a little excited too and I won’t apologise for that.)

https://x.com/jameswhelan42/status/1830100569643467121

It’s hard not to love this town.

No time to be humble either so I’ll just come right out and say it: the episode of the podcast I recorded on Friday with David Scutt of StoneX was one of the all-time great recaps of what’s happened and what’s ahead. Pay attention to China for a few weeks. Some things in the pipes there.

More information via this link to the recording.

In stock news, Wellnex just released their prelim FY24 numbers with revenue up, margins up and the contrast between pre-Pain Away acquisition and post-like night and day. It’s always a good day for good news. Link here.

August is now gone. Gawn!!! As the expression goes.

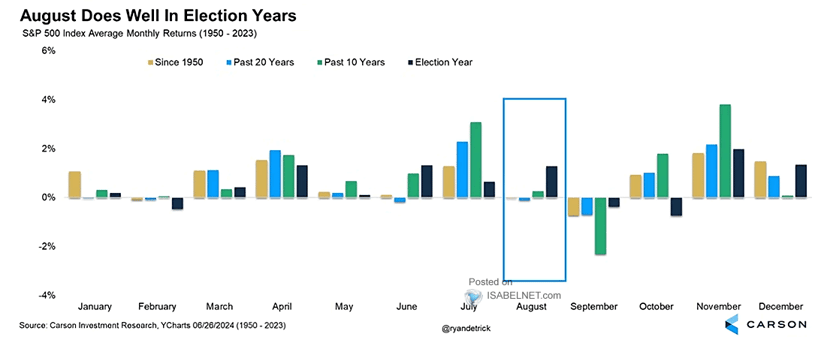

Let’s check in on the seasonality and maybe lighten the load yeah?

Source: Carson Investment Rosoarch, YCharts 06/26/2024 (1950-2023)

The best days are behind us. The better days are ahead. Right now though….

Gold is continuing to grow.

Source: Metals Focus, World Gold Council

Courtesy The Kobeissi Letter (traditionally bearish but they do make a good chart)

“Global net gold purchases by central banks reached 483 tonnes in the first half of 2024, the most on record. This is 5% higher than the previous record of 460 tonnes set in the first half of 2023. In Q2 2024, central banks bought 183 tonnes of gold, marking a 6% year-over-year increase. On the other hand, this was 39% lower than the 300 tonnes of purchases seen in Q1. The largest buyers were the National Bank of Poland, the Reserve Bank of India, and the Central Bank of Turkey.”

Stay long gold. Zero immediate reason to not be overweight the stuff.

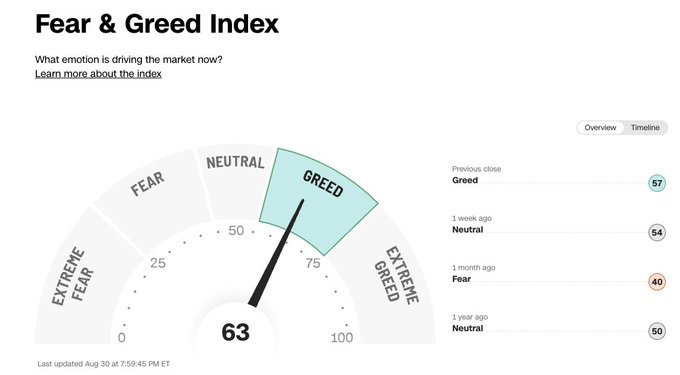

And finally, the Fear and Greed index is signalling to lighten the load a little too. Act accordingly.

Source: Barchart - X

Actually that’s not the end. Since a fair amount of the Wealth offering we’ve built is based upon the notion that a buy-and-hold 60/40 portfolio is usually the way to go I thought I’d show you this.

Source: BofA Global Investment Strategy, EPFR

Treasury inflow is the largest since about this time last year. This would be a massive tailwind to the balanced portfolio we offer.

Also how rare is it for everything to hit the wall at the same time? Hen’s teeth have nothing on this rarity.

Since 1926 there have only been three occurrences when stocks and bonds have both come off.

Source: Parabolic

If you’d like to know more about what I’m referring to above please send me a note. I’d love to chat.

All the best and stay safe,

James

Introducing BPC Wealth Management

BPC Wealth Management is dedicated to shaping a resilient investment portfolio, empowering you to achieve and sustain your financial aspirations. While the foundation of your portfolio focuses on long-term investments, through BPC, clients will be offered opportunities in equities trading and equity capital markets. This aspect is highly customised, allowing asset flexibility. Discover how our proactive and client-focused approach can help you achieve your financial aspirations by booking your discovery call with James Whelan.

Share Link