James Whelan

- Aug 19, 2024

- 6 min read

On allocations and panic - Market Map with James Whelan

New job, new firm but the same Free Whelan. Thank you for your continued support and keep unlocking valuable insights into the global market every week with me!

It looks like we are continuing our way forward regarding markets,

I’ve had some things come across my desk regarding allocations and potential changes in the face of the shock events seen so I thought I’d write a little about that.

We have hit what some would call the “Goldilocks space” in the US. Inflation coming in a little weaker than expected and the consumer is still strong. Company reporting is still great and the world has changed a great deal from the concerns of a few weeks ago. Goldmans have dropped their recession risk from 25% to 20% as well. Good areas.

We discussed this on the podcast recorded on Friday. Click the link and have it in the background. 20 minutes of hassle-free podcast.

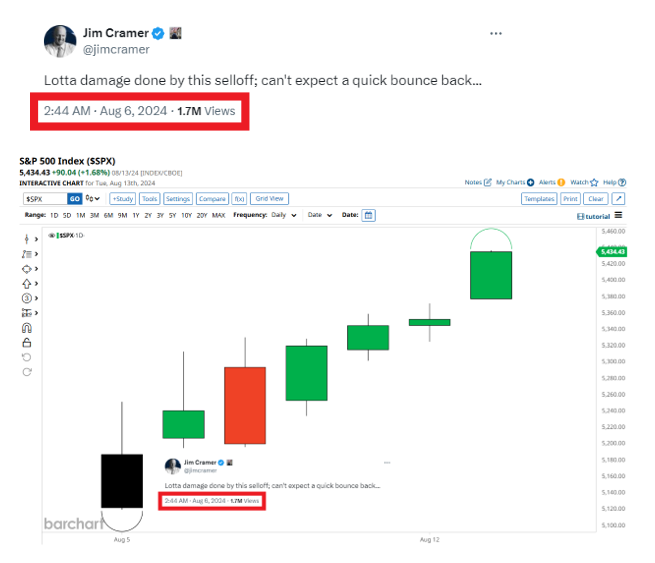

That’s why you don’t panic. Like this guy…

Source: Barchart - X

10 of 11 S&P 500 sectors have shown year-on-year revenue growth for the second quarter of 2024.

Source: FactSet

The economy is great, companies are great and the presidential election cycle is doing its usual thing.

The backwards-looking part of the BOFA Fund Manager Survey is showing exactly what happened during the moves of the BOJ shock.

Long bonds into the cutting phase aren’t the worst idea either.

The 60/40 is a sound place to be allocated for just these reasons.

Source: BofA Global Fund Manager Survey

Of note in the FMS, “Soft Landing" expectations at 76% with "No Landing" back down to 8% and "Hard Landing" at 13%. That’s probably problematic because when everyone agrees that’s when bad things happen.

China

And China, it seems, is not amazing from an allocation point of view. These took over the headlines early last week and should not be ignored.

Source: China's State Administration of Foreign Exchange

As everyone knows I prefer India to China and allocate as such.

I see…

Leverage

In the absolute low of the carry trade unwind crisis I jokingly searched for the worst possible thing to load up on for a high/high return/lose-your-house conviction trade. I discovered the 5x levered Magnificent 7 ETP, trading in London and Milan in a variety of currencies. If the mag 7 goes up a per cent, you’re up 5, same on the downside. Do not touch these with a barge pole. Leverage and panic are how money goes from retail to into so often.

That being said…

"We see the LEVERAGED ETF space's cumulative 5d rebalancing as the largest 1 week 'BUY FLOW' in the history of our data at +$34B of buying across these awful products in the past five sessions."

- Jesse Felder’s newsletter this week.

Source: Menthor Q - X

Do not touch these things. Please, people.

The final word on allocations comes from the UBS Global Family Office Report, showing the current mix across assets for family offices.

That gold allocation is too low in my opinion and 19% for fixed income seems lower than it should be. Private Equity is a great way to have holdings that can be marked to valuations of anything you want that’s not the actual market too, hence its appeal.

Source: Blokland Smart Multi-Asset Fund E

So that wraps up my little look at the allocation dust settling after the shock of the last few weeks.

Act accordingly.

Now for the fun stuff

Self-driving cars don’t know what to do when there are no literal adults around and the dystopian future we all know is coming is painfully funny and noisy.

Link here

https://x.com/MyLordBebo/status/1823817434949951961

All the best and stay safe,

James

Introducing BPC Wealth Management

BPC Wealth Management is dedicated to shaping a resilient investment portfolio, empowering you to achieve and sustain your financial aspirations. While the foundation of your portfolio focuses on long-term investments, through BPC, clients will be offered opportunities in equities trading and equity capital markets. This aspect is highly customised, allowing asset flexibility. Discover how our proactive and client-focused approach can help you achieve your financial aspirations by booking your discovery call with James Whelan.

Share Link