Jack Colreavy

- Oct 3, 2023

- 4 min read

ABSI - New RBA Boss has a Chance to Surprise the Market

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

It’s the first Tuesday of the month signalling another RBA monetary policy meeting to decide on the level of interest rates in Australia. Today’s meeting will be the first for new RBA governor Michele Bullock and all eyes will be on what she does in her first meeting in the top job. ABSI this week will discuss the latest economic data which will influence the decision.

It’s the first Tuesday of the month signalling another RBA monetary policy meeting to decide on the level of interest rates in Australia. Today’s meeting will be the first for new RBA governor Michele Bullock and all eyes will be on what she does in her first meeting in the top job. ABSI this week will discuss the latest economic data which will influence the decision.

There are several strong arguments for why the RBA doesn’t need to raise interest rates again and that the current level of 4.1%. Roughly one month ago the bond traders were aligned to the no further hike narrative and starting to speculate on when the cuts would arrive.

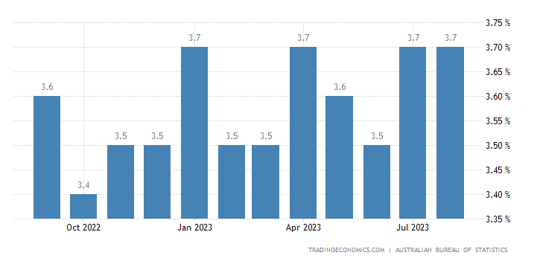

Australian Unemployment Rate

Source: Trading Economics

The uptick in unemployment in July from 3.5% to 3.7% was just the piece of data that the RBA was looking for as a means to take the tailwinds off inflation. At face value, the continuation at 3.7% in August was a positive sign that the tight monetary policy was starting to have its desired effects.

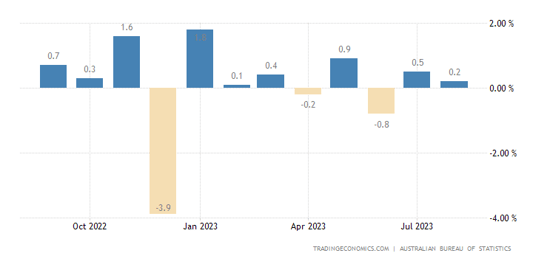

Weakness in retail sales is another data point tracking in the right direction for the RBA. In August, retail sales creeped 0.2% higher in seasonally adjusted terms, which was below expectations and a solid slowdown from July’s 0.5% growth. The slowdown in discretionary spending isn’t surprising considering Australian households have had to tip into their bank account savings for the first time since the GFC as the cost of living balloons.

Australian Retail Sales MoM

Contributions to real GNI per person growth (measured in percentage points)

Source: Trading Economics

Importantly what the RBA is ultimately looking for in this data are indications that inflation is slowing. Unfortunately, this isn’t the case with the monthly CPI indicator released last week showing inflation ticking higher from 4.9% in July to 5.2% in August. The reverse in trend wasn’t a surprise to economists which pointed to persistently high oil prices and a weak Australian dollar as major contributors.

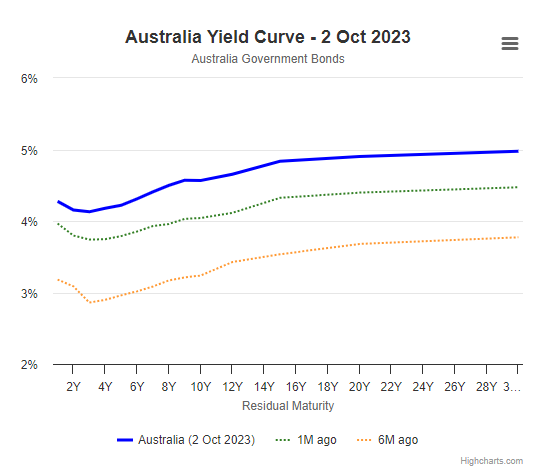

How quickly sentiment can change.

The one data point resulted in a reversal of forecasts from traders and economists. For context, the AFR’s economists survey had consensus for a rate cut by February 2024 when conducted late last year but in two subsequent surveys, the timeline has been pushed back to May 2024 and now August 2024.

Source: World Government Bonds

Turning our attention to the meeting today and the overwhelming majority don’t see Governor Bullock rocking the boat in her first meeting as Chair. But while bond traders imply a 10% chance of a hike today to 4.35%, they do ascribe a 62% chance of another hike before the end of the year.

Personally, I would like to see Governor Bullock come hard out of the gates and show her strong intentions to get inflation under control by surprising the market with a rate hike. The effects would be a shift lower in inflationary expectations and give the Australian dollar a much-needed boost.

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link