Barclay Pearce Capital

- Aug 12, 2024

- 6 min read

My big mouth and why being calm is always the way - Market Map with James Whelan

New job, new firm but the same Free Whelan. Thank you for your continued support and keep unlocking valuable insights into the global market every week with me!

There’s an expression in markets that clients often need to “see skull”, referring to the need for people to see the face of their adviser. Truth be told what a lot of people like to see is a few grey hairs around the sides of the head, indicating you’ve been through a few tours of duty in the warzone that is financial markets.

There’s some mild salt and pepper that crept onto my head during 2008 when we were pulling 16-hour days booking out 10% of the GFC at UBS (while 15% of my colleagues were being made redundant.)

The left and right sides of my head turned a distinctive shade of white during March and April of 2020 as I was actively managing money during the COVID-19 calamity.

Last week, possibly one of the most volatile weeks of my career, I was calm as a cucumber. We detail it on the Friday podcast.

Along with my big mouth getting itself over its head to be able to play rugby in two months. Shades of last year’s challenge to compete in the National Championships for Jump Rope which won me two gold medals.

The setup we have now for clients is very much in tune with this style of not panicking. Calm, collected, invested.

For example. Here is the S&P 500 daily candle chart courtesy of TradingView. The left arrow is where the market finished on Friday 2nd August.

Source: TradingView

Then the weekend headlines started on how much of a selloff we would see on Monday it would be. Volatility spiked to levels only seen on the grey hair events listed above, the Yen unwind caused “forced derisking” (a lovely Goldman Sachs term I just heard) and everything was about to go down in a ball of fire.

Then have a look at the red arrow on the right of the above. That’s where the US market closed on Friday.

Basically, there is no change.

Except for this…this changed a lot.

Source: Radar - X

The usual transfer of wealth from retail to institutions. I won’t stand for it, it is why I’ve spent as long as I have built the offering to retail to stay largely immune to this sort of thing.

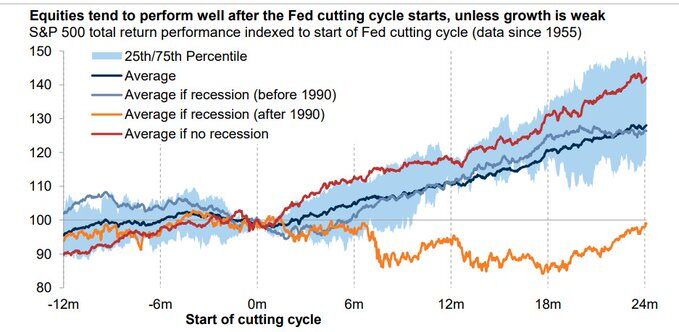

The stat I’ve mentioned a few times that markets usually have a correction as the Fed starts cutting is usually only brought to fruition because the Fed starts cutting when growth is weak. Out of necessity, growth slows, Fed cuts, markets respond to growth and then the cuts. Everything keeps spinning.

Any conversation you’ve heard on growth slowing in the US is, in my view, just that for now.

Citi produced some charts showing:

-that the US unemployment rate is rising because layoffs are rising and another;

-that people remain unemployed for longer;

- More consumers are reporting jobs as hard to get and;

- Businesses have cut back on hiring

I can’t show these charts because it’s for Citi subscribers' eyes only. They’re fairly grim, trust me.

Then you look at the market and earnings are just gone. Here’s part of a transcript from Goldman Sachs's “The Markets” podcast with John Flood, head of Americas Equities Sales Trading in Global Banking and Markets regarding US reporting as we have seen it thus far.

“Earnings. Coming into this quarter, there was fear that this nine per cent year-over-year growth hurdle for S&P 500 earnings was very high. It's the highest we have seen in years.

We're 85 per cent of the way through earnings right now, and they're coming in at 11 per cent. So this very high hurdle is still being cleared. That's why I remain optimistic.”

And so, we continue our dance. I’ll leave you with this re-market as I’ve mentioned above.

Stay the course.

Source: DataStream, Goldman Sachs Global Investment Research

Courtesy Goldman Sachs.

And congratulations to our Olympic team, doing us proud in Paris. But there have been some accusations of cheating at the velodrome…

Source: George - X

Finally, RIP one of the all-time greatest meme generators of our time. Jack Karlson, who I hope will be able to watch over us as he enjoys a meal, a succulent Chinese meal in the big restaurant above.

Source: MENAFN

All the best and stay safe,

James

A quick detour to announce the BPC NRL Tipping Competition!

Welcome to the BPC NRL Tipping Competition for 2024. The season has kicked off with a bang in the glittery lights of Las Vegas. Panthers are favorites to take the crown again but the Broncos look like a formidable opponent to take revenge from the heartbreak of 2023. BPC loves its footy and we're very excited for the season ahead. We also love to win stuff so please keep an eye out for the prizes on offer. Sign up and join the game!

Share Link

-BPC%20Desk%20Note.png?width=767&name=Castile%20Resources%20(ASX-CST-OCTQB-CLRSF)-BPC%20Desk%20Note.png)