William Smith

- Mar 28, 2024

- 5 min read

Monthly Market Wrap with William Smith - March 2024

Explore the monthly market wrap-up, a summary of the key trends, emerging players and market movements.

Key market movements that caught our attention in March:

Bank of Japan Breaks Tradition with First Rate Hike in 17 Years

In contrast to every other Central bank across the world, the Bank of Japan raised interest rates in March. It is the first time in 17 years that the BoJ has hiked rates. Interest rates in Japan have been negative since December of 2015.

Japan had been implementing negative rates as a part of its monetary policy strategy to combat deflation and stimulate economic growth. The move higher by 10 basis points was anticipated, dampening any major moves in the Yen, which has been trading in historically low ranges. The outlook for rate hikes has not helped the Yen either, as the dovish commentary from the BoJ indicates that another hike may be some time off.

Additionally, Yield Curve Control has been ditched allowing market forces to play a bigger role in bond price movements. The near-term signals supporting the case to hike again, which is not expected until later this year, will be continued Yen weakness and data on recent wage hikes which potentially could create a chance of an overshoot in inflation.

China's Property Woes Drive Iron Ore Prices Down.

Iron ore prices have fallen by approximately US$14.67/t since the start of March until today, March 28th. The decline in the resource can be attributed to a drop-off in steelmaking in China.

\China controls almost 60% of the 1.8Btpa crude steel market and consumes around four-fifths of the seaborne iron ore trade. The demand for steel has been declining in China due to domestic property issues. China's real estate sector accounts for 30-35% of steel demand in the country, so it is easy to understand why steelmakers are suffering. Locally, large iron ore miners still produce with a high margin, therefore are not threatened with levels around US$100/t. BHP, FMG, and RIO all produce their ore for approximately US$20/t. ANZ says that iron prices will likely trade between US$90-110/t for the remainder of 2024, noting that a floor exists at a level of US$100/t due to Chinese domestic supply being produced at costs higher than US$100/t.

There is no expectation of large movements in the price for the remainder of 2024, albeit China's stimulus policy might stoke the property sector, causing demand to jump.

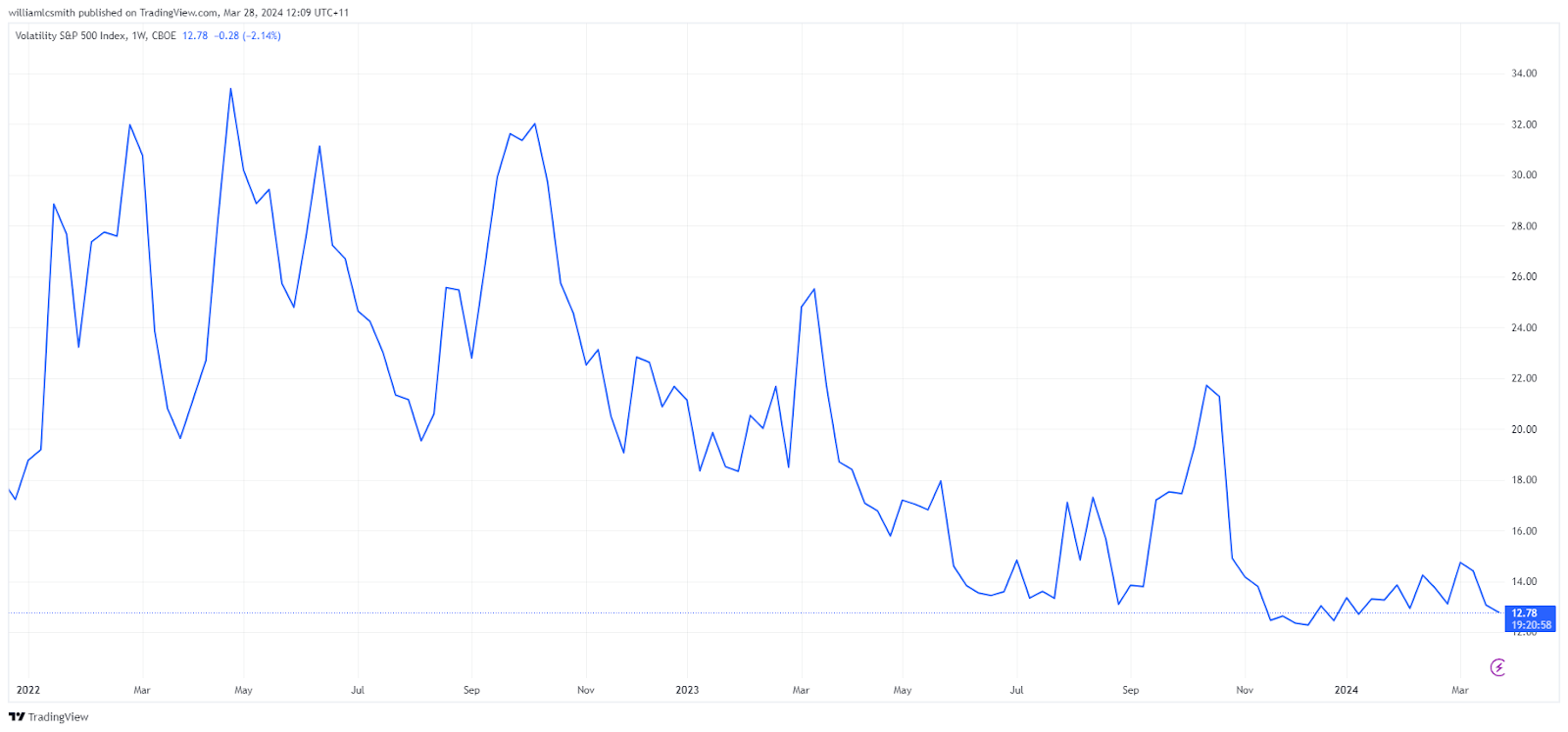

Rising Popularity of Options Investment Products Raises Concerns Amidst Low Volatility Environment

Currently, there's a surge in popularity for investment products involving the sale of options. Over the past few years, investments in these funds have tripled, exceeding US$60 billion. At the same time, the Cboe Volatility Index (VIX), which gauges market volatility, has consistently remained low, averaging 13.5 this year compared to 17 in 2023.

Researchers at the Bank for International Settlements find this persistently low VIX level puzzling, especially given the uncertain economic and geopolitical conditions. Some attribute this low volatility to substantial option selling by these investment funds, although not everyone agrees with this explanation. The significant increase in option selling has led to a decline in prices due to an oversupply.

Furthermore, if underlying asset prices move enough to necessitate adjustments in these positions, it could trigger a market correction. The sheer scale and volume of these positions may prompt a rush on market makers, compelling them to take on risk and ultimately rebalance their exposure. Since these positions are short gamma, they'll need to sell the underlying asset to manage their risk exposure when the asset's price falls, thereby increasing their risk.

Consequently, market makers will be compelled to take on these positions. To mitigate their risk, market makers won't retain these positions, resulting in them being short on the opposite side. This creates a cycle where selling persists, leading to further declines in the asset's price. Although the probability of such an event occurring is deemed low, it has previously transpired, known as "Volmageddon."

Will's March market comments:

"Building on last month's commentary, the outlook for rate cuts experienced a slight setback in March. Strong inflation figures from the US drove bond yields higher, along with the dollar. Additionally, unemployment data surpassed expectations, further bolstering market projections of no rate cuts until the June meeting.

The battle against inflation is proving more challenging than anticipated by market participants at the close of 2023. Notably, while the Fed's projection of 3 rate cuts this year was reaffirmed in the latest meeting, it may be overly optimistic given the ongoing strength of the US economy. I anticipate that bond yields have yet to reach their peak, suggesting a potential shift from equities towards higher-risk-free returns."

- William Smith, Dealers Assistant, BPC Wealth Management

Share Link