Barclay Pearce Capital

- Jul 22, 2024

- 6 min read

May you live in interesting times - Market Map with James Whelan

New job, new firm but the same Free Whelan. Thank you for your continued support and keep unlocking valuable insights into the global market every week with me!

What an eventful week it was last week.

Nothing new in the news. Biden dropped out, Max can’t drive a Formula One car sensibly, the Swans lose in a thriller, and the Tigers just don’t know how to win sometimes. Also, some computer stuff happened on Friday.

I remember reading a very concise tweet a while back that simply said “I don’t want to live in interesting times anymore” and I’m inclined to agree. There are too many things going on again and it’s reminding me of 2016…hang on.

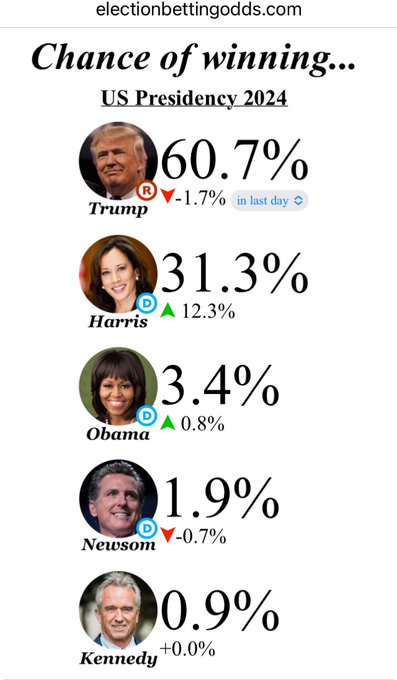

Source: electionbettingodds.com

Ah yes of course it’s that feeling again of waking up to something insane in the US that will take attention away from what you were planning to do that day.

This is why I happily stepped back from active management and am now happily a spectator of the big swinging moves that need to be captured. These I will document below.

We still have Trump as 100% the next elected president, provided he survives that long. Biden dropping out just evens the fight and means the Republicans don’t win 49/50 states.

Conspiracy

One for the tin foil hat crew about the CrowdStrike failure: a near global collapse of IT systems occurred at dawn in the US on the Friday following a very suspicious assassination attempt on the Republican presidential candidate and favourite for the job. That’s a theory that even has me taking a pause, imagining what America would look like today if that bullet had not been missed.

Long every gunmaker in the US provided markets were even open in this alternate reality.

Interesting times indeed…as covered in the new iteration of the Theory of Thing podcast along with plenty of other things.

Simple Rules

In a rising rate environment on the banks/financials, in a lowering rate environment own gold.

Source: Bloomberg

And there it is. Biggest hedge fund bullish holdings since pre-Covid. Gold reaching all-time highs.

Source: TradingView

Everyone knows I love a long-term chart so here it is going back to the 1970s. Playing golf a few years back in the comp with some of the older members at Northbridge. They all talk about their portfolios and knowing I’m involved in markets they asked me for my target on gold.

“$5000”

“ha no seriously”

Me…stopping and looking him straight in the eye, “5000 dollars US. That’s my target”

So, it’s on the way that in my lifetime I’ll be correct on that. Nothing wrong with a little gold exposure.

The rotation into small caps really took off last week with the unwinding of short positions and general rotation out of the bigger end of the market.

We cover it in the podcast but the Russell 2000 really can be pushed around relatively easily and the weight of money moving really created the perfect storm for a 5 sigma event.

Rate cuts and confidence about the years ahead in leadership in the US are a good tailwind.

Also (and you know that for the most part people should be invested, just sometimes you need to change your weight. I still think the big end of the market is overvalued and here it is evidenced by BofA.

Using long-term averages (which I love) the US market is expensive in 19 of 20 metrics, even the more dubious ones like valuing the market in gold and oil terms.

Source: FactSet/Compustat, Bloomberg, FactSet/FirstCall, BofA US Equity & Quant Strategy

Here’s something a little simpler.

Source: FactSet

Source: FactSet

The forward 12-month P/E ratio of 21.2 is above the 5-year average (19.3) and above the 10-year average (17.9)

So yes, find a way to hide in small caps, like the Van Eck small caps ETF QSML, which offers 150 of the highest quality small-cap stocks around the world (80% in the USA) and wait for the moment to properly get set in the magnificent 7 to hold forever.

Source: EPFR

Small cap fund flow though…you have to be a part of this.

If you’re after a really simple explanation of how all computers were affected at once in certain sectors than others then this tweet sums it up nicely.

Everyone pretty much has to use the same thing.

Source: Mark Atwood - X

May you live in interesting times.

PS- nothing out of the Plenum last week. Quite a letdown there. No trade for now.

All the best and stay safe,

James

A quick detour to announce the BPC NRL Tipping Competition!

Welcome to the BPC NRL Tipping Competition for 2024. The season has kicked off with a bang in the glittery lights of Las Vegas. Panthers are favorites to take the crown again but the Broncos look like a formidable opponent to take revenge from the heartbreak of 2023. BPC loves its footy and we're very excited for the season ahead. We also love to win stuff so please keep an eye out for the prizes on offer. Sign up and join the game!

Share Link