Jack Colreavy

- Oct 31, 2023

- 4 min read

ABSI - Lessons from a Failed Currency: The US Continental

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

The US House of Representatives finally has a Speaker again after 3 weeks of political dogfighting. One of the reasons for the usurpation of the previous Speaker, Kevin McCarthy, was over his willingness to work with Democrats to continue funding the Ukraine war. In the 3 weeks since, we have witnessed the Hamas terrorist attack on Israel and a subsequent Biden administration congressional request for US$100 billion in funding for Ukraine, Israel, and other security measures. With the appointment of new Speaker Mike Johnson, the House can formally review the proposal. However, with US debt spiralling out of control, it sparks the question: can the US afford to wage war? ABSI this week will seek to address this question by looking at lessons from the first currency issued by the United States; the Continental currency.

In 1776, the thirteen colonies of America made its declaration of independence from Great Britain. Unfortunately wars consume significant amounts of resources and the newly formed United States had no tax base and limited access to credit. As a result, the Continental Congress issued the Continental, a fiat currency backed by the future tax revenues of the US post war. Initially the Continental was accepted and, along with loans from France, were able to equip the Continental Army with the resources it needed.

Source: Medium

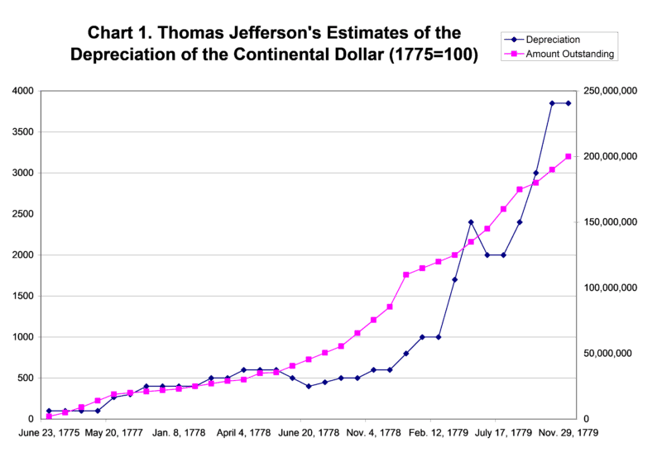

When initially issued, the Continental currency was scheduled to be redeemed in 1779, Congress hadn’t planned on a protracted war. As the war continued, further Continentals had to be issued to continue to finance the army. The result was a rapid depreciation of the currency and hyperinflation as all faith was lost in the repayment of the fiat notes. By 1781 the notes were trading at a penny on the dollar and ceased circulation. The army had to resort to seizure of required resources, providing IOUs, and help from wealthy founding father Robert Morris to continue fighting the red coats. Eventually, in 1783, the US won the war and in 1785, the US Dollar became the official currency of the United States. When the constitution was signed in 1787, the Federal government finally received the power of taxation to pay off war debts. The Continental was then able to be redeemed into US Treasuries for 1% of its face value, thus putting an end to first US fiat currency.

Source: American Institute of Economics

Almost 250 years later, the US is the world’s biggest economy and the US Dollar is the reserve currency. Importantly, for most of the Dollar’s life, it was backed by gold. It has only been 52 years since the US left the gold standard and adopted a fiat currency again. In that period, US debt has increased ~8,361% from US$398 billion to ~US$33.7 trillion today. Concerningly, the pace is accelerating at over $500 billion every 30 days thanks to a gross interest bill of US$879 billion, courtesy of rising interest rates, contributing to a US$1.7 trillion dollar federal deficit in FY23.

The perils of war are slowly spreading globally again. Already the US is supporting a war in Europe and now a war in the Middle East. And we cannot forget the tensions in Asia between China and Taiwan that need to be continually monitored. If political leaders are not careful, we could fall into World War III.

Fortunately, the macroeconomic conditions are problematic for a protracted global war. Putting all other issues aside, the cost of waging war is very expensive and usually results in inflation due to the need to print money. Most nations are already experiencing high inflation and are shouldered with huge debt loads, giving pause to the decision to rush into conflict. This is already being witnessed in the US where political leaders are starting to push back on the Ukrainian blank check at a time when interest expense, deficits, and debts are widely out of control.

Let's hope cooler heads prevail and we head towards peace rather than war.

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link