Jack Colreavy

- Apr 11, 2023

- 5 min read

ABSI - De-dollarisation: Is the US Dollar's reign coming to an end?

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

In major economic news last week, China and Brazil have agreed to trade directly in their own currencies, removing the need for the US dollar to act as an intermediary. This agreement is part of a string of recent events that has some calling the start of de-dollarisation. ABSI this week looks at the signs and what de-dollarisation may mean for the global economy.

To begin, let's play a game of Who Am I?

I am a global reserve currency issued by a government with heavily increasing debt as a result of unsustainable spending. As a result, my economy is experiencing extremely high inflation, reducing my purchasing power and undermining confidence in my stability. I am experiencing a weakened economic and geopolitical position, primarily as a result of a decline in my country’s influence and the rise of new superpowers.

The answer is the Great British Pound Sterling.

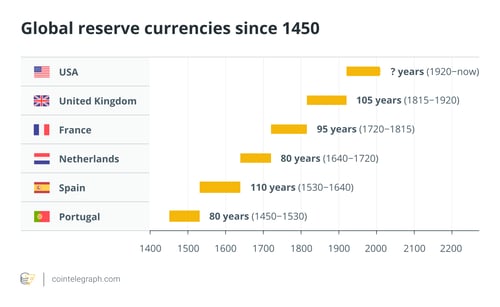

The Pound was the global reserve currency from the 19th century until the US Dollar officially assumed the role in July 1944 at the Bretton Woods conference, though the Dollar's influence had been growing since the end of WWI. Bretton Woods was a post WWII meeting of 44 Allied nations that created a new international monetary system that aimed to stabilise the world economy through the establishment of the IMF, the World Bank, and establishing the US dollar as the world’s reserve currency. Under this system, the participating countries' currencies were pegged to the US dollar, which was in turn pegged to gold at a fixed rate of US$35/oz.

Source: Cointelegraph

For those who answered the US Dollar before, you were incorrect but you could be forgiven for coming to that conclusion. Today, US debt is at ~US$31.7 trillion and rising thanks to a ~US$1.5 trillion budget deficit, and inflation is officially at 6%. Moreover, the emergence of China as a new superpower, along with others such as the EU, Russia, and India, has seen a shift in the geopolitical landscape and diluted the influence of the US. As a result, many are starting to speculate if this is the start of the demise of the US Dollar.

It is important to appreciate that it isn't baseless speculation, there are a number of global events spurring on the debate. Most recently, China and Brazil announced an agreement to facilitate their ~US$150.5 billion in bilateral trade in their own currencies. This isn’t the first such agreement, with China promoting its alternative SWIFT called CIPS (Cross-Border Interbank Payment System) which allows settlement in Yuan rather than US Dollars. In March, China completed its first trade of 65k tons of LNG imported from the UAE to Shanghai and facilitated by French giant TotalEnergies.

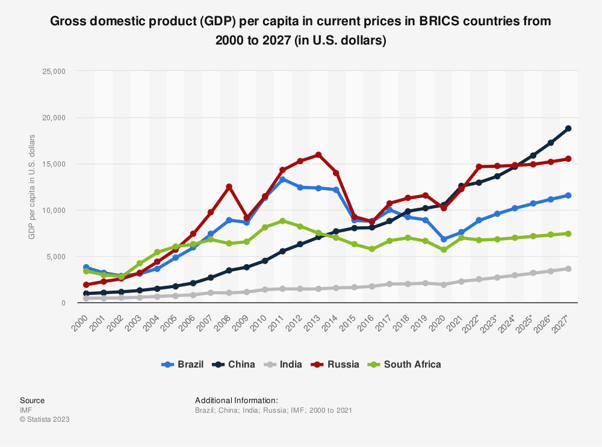

Other recent developments include the BRICS nations, who account for over 40% of the global population and almost 25% of global GDP, exploring the development of a new currency backed by gold, and Saudi Arabia becoming a dialogue partner in the Shanghai Cooperation Organisation potentially opening the door to the end of the petrodollar. Furthermore, at a March meeting of all ASEAN finance ministers and central bank governors, the top agenda item was to discuss how to reduce dependence on the US Dollar, Euro, Yen, and British Pound from financial transactions and move to settlements in local currencies.

Source: Statista

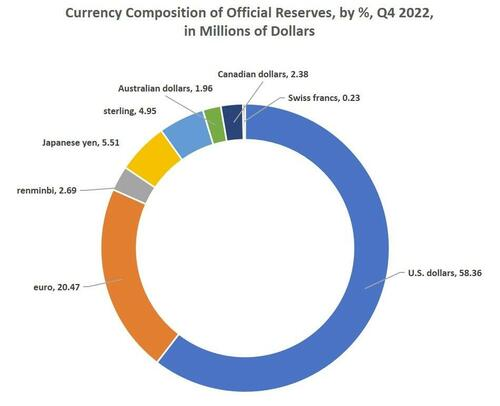

The negative trend for the US Dollar’s dominance is clear, however, these changes take time, and it certainly won’t happen overnight. This is a change that will take decades to play out.

One of the key reasons for this is the fact there are no viable alternatives to take the mantle. The Yuan is touted as the logical successor but trust in China amongst Western countries is low and it's a currency that is heavily manipulated through a “managed floating system” whereby the central bank of China, sets a daily reference rate for the yuan against the US dollar, known as the central parity rate.

Source: IMF

Nothing lasts forever and the demise of the US Dollar as the global reserve currency is an inevitability. However, the world is so reliant on the US Dollar that it will take some time for the migration to occur. Nonetheless, the first dominoes have fallen, and we now wait and see.

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link